Question

business management class homework: choose a company of your choosing and do a business portfolio analysis using the G.E. model on that company. your model

business management class homework:

choose a company of your choosing and do a business portfolio analysis using the G.E. model on that company. your model must consist of atleast 4 business units.

List of tasks that must be done:

1. pick a company which has some sort of production or gives some sorf of service.

2. analyze what makes said company attractable and its points of strength which makes it unique in its trade.

3. measurement of its attractablity and strengths in 5 levels:

i. picking the points of strengths and attractability of the company into seperate factors.

ii. determine the weights of each factor compared to the other factors

iii. determine the favorable and unfavorable states of each factor in the future ( unfavorable: 0 average: 0.5 favorable: 1)

iv. determine the combination of the degree and weight of each factor and determine the extent(score) of the attractiveness of each factor.

v. determine the overall(overall the factors) attractiveness and strength.

4.maintenance and strengthening of the units and factors in the company which are attractive and are the companies strengths.

5. determination of growth strategies(exploring opportunities to grow the market penetration).

please keep your answers readable. the report must be thorough. DO NOT COPY FROM THE INTERNET!!

Thanks

here is an answer that i copied from the internet with 2 business units:

Step 1

To use the GE McKinsey matrix, first select a popular company which has 2 or 3 business units. Let us pick a global brand Apple with its 2 business units being Mac (desktop, laptop) and iOS devices (IPhone, iPad, etc)

Step 2

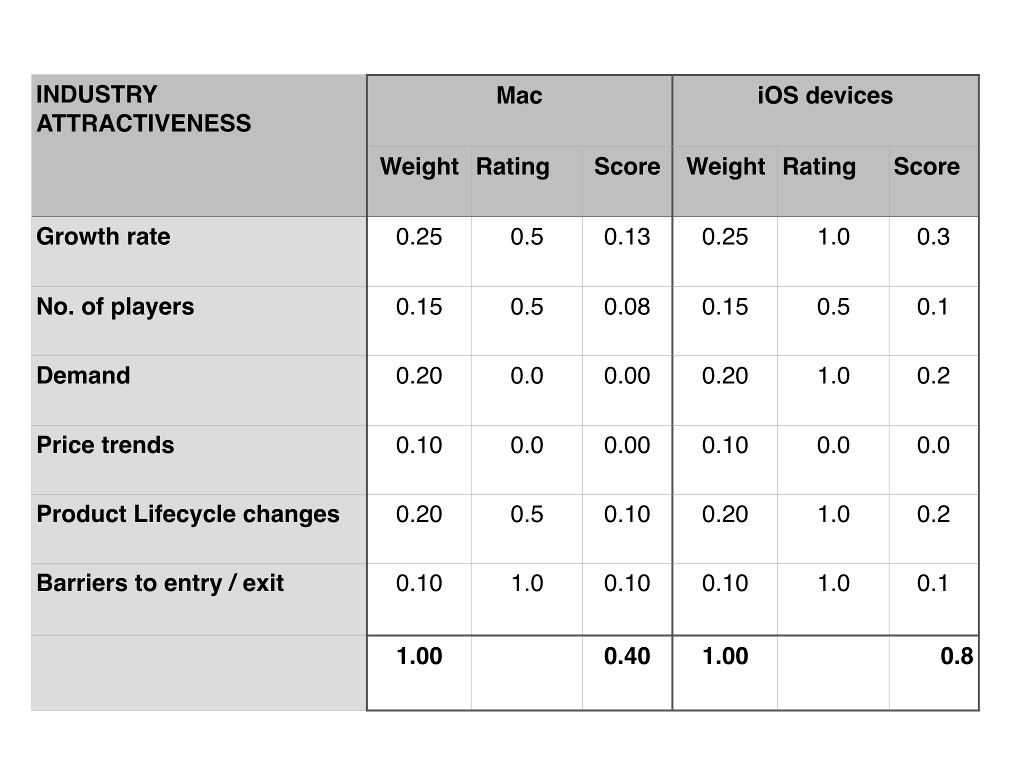

List of factors contributing to industry attractiveness.

Growth rate

Number of players

Demand

Price trends

Product lifecycle changes

Barriers to entry/exit

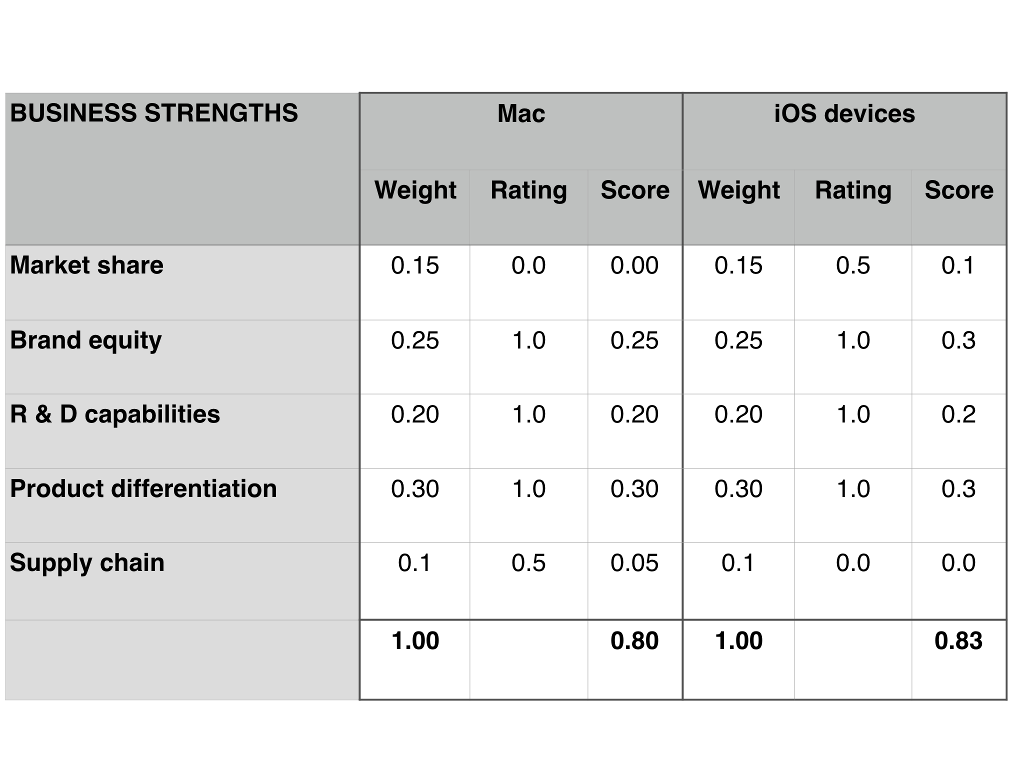

List of factors contributing to strength of Apple's business

Market share

Brand equity

R&D capability

Product differentiation

Supply chain

Step 3

Let us plot these factors in a table, giving it weight (percent), favourabilty ratings (0, 0.5, 1) and scores (weight x rating)

Step 4

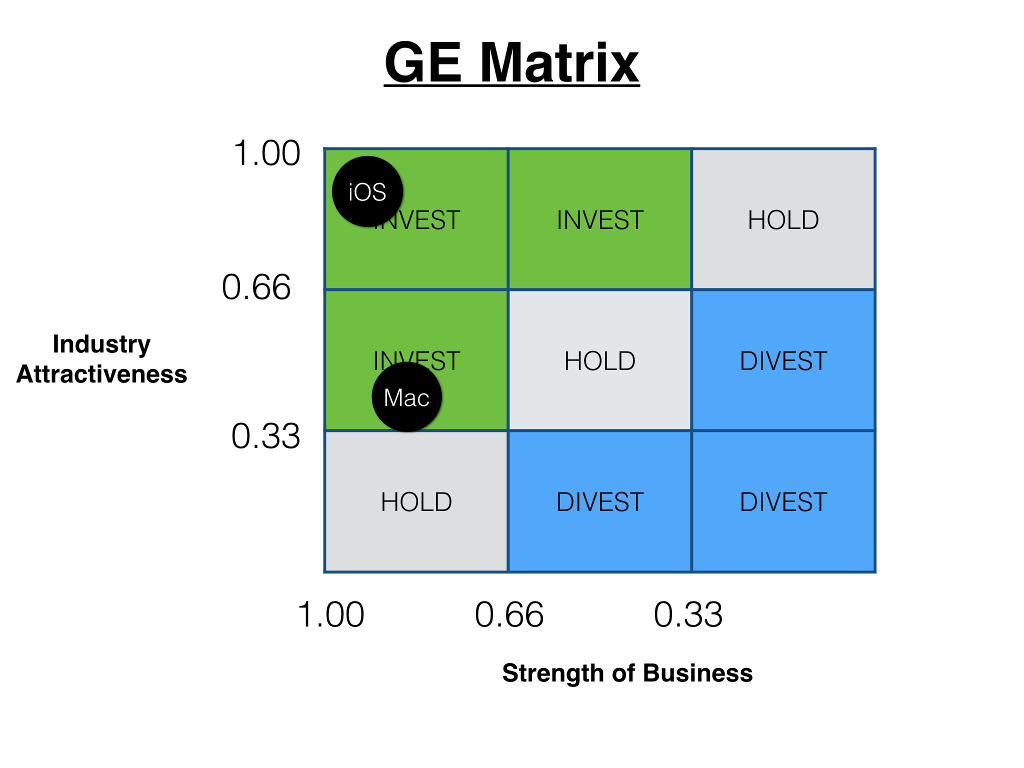

Based on the scores above, we can now plot the strategic positioning for Mac and iOS with respect to industry attractiveness on the Y-axis and business strengths on the X-axis as shown below:

While both the business units of Apple are plotted on the INVEST cells of the GE model, the Mac unit is placed lower than the iOS mainly due to the lower inudstry attractiveness.

Step 5

The final step is to determine the strategy for the future.

For Mac, it is a build strategy to make investments in the most attractive market segments only, maybe in emerging markets where high quality desktop/laptop penetration is low. The focus of this strategy will be on increasing productivity and cutting costs.

For iOS devices, the strategy will be to primarily protect the high competitive position. Investment must continue to be targeted at marketing and releasing new versions of existing products to beat the competitors.

INDUSTRY iOS devices Mac ATTRACTIVENESS Weight Rating Score Weight Rating Score 0.25 0.5 0.3 1.0 Growth rate 0.13 0.25 0.15 0.5 0.5 0.1 No. of players 0.08 0.15 0.0 0.2 0.20 1.0 Demand 0.00 0.20 0.10 0.0 0.0 Price trends 0.0 0.00 0.10 1.0 Product Lifecycle changes 0.20 0.5 0.10 0.20 0.2 0.10 1.0 Barriers to entry exit 1.0 0.1 0 0.10 0.1 1.00 0.8 0.40 1.00 INDUSTRY iOS devices Mac ATTRACTIVENESS Weight Rating Score Weight Rating Score 0.25 0.5 0.3 1.0 Growth rate 0.13 0.25 0.15 0.5 0.5 0.1 No. of players 0.08 0.15 0.0 0.2 0.20 1.0 Demand 0.00 0.20 0.10 0.0 0.0 Price trends 0.0 0.00 0.10 1.0 Product Lifecycle changes 0.20 0.5 0.10 0.20 0.2 0.10 1.0 Barriers to entry exit 1.0 0.1 0 0.10 0.1 1.00 0.8 0.40 1.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started