Answered step by step

Verified Expert Solution

Question

1 Approved Answer

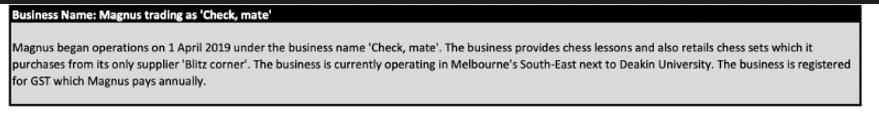

Business Name: Magnus trading as 'Check, mate' Magnus began operations on 1 April 2019 under the business name 'Check, mate'. The business provides chess

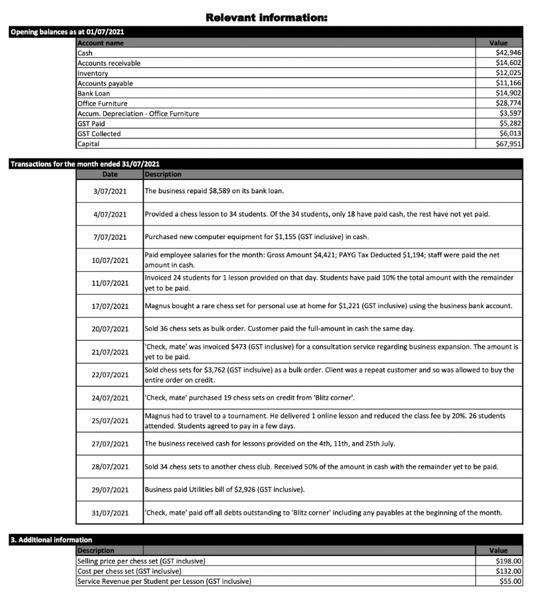

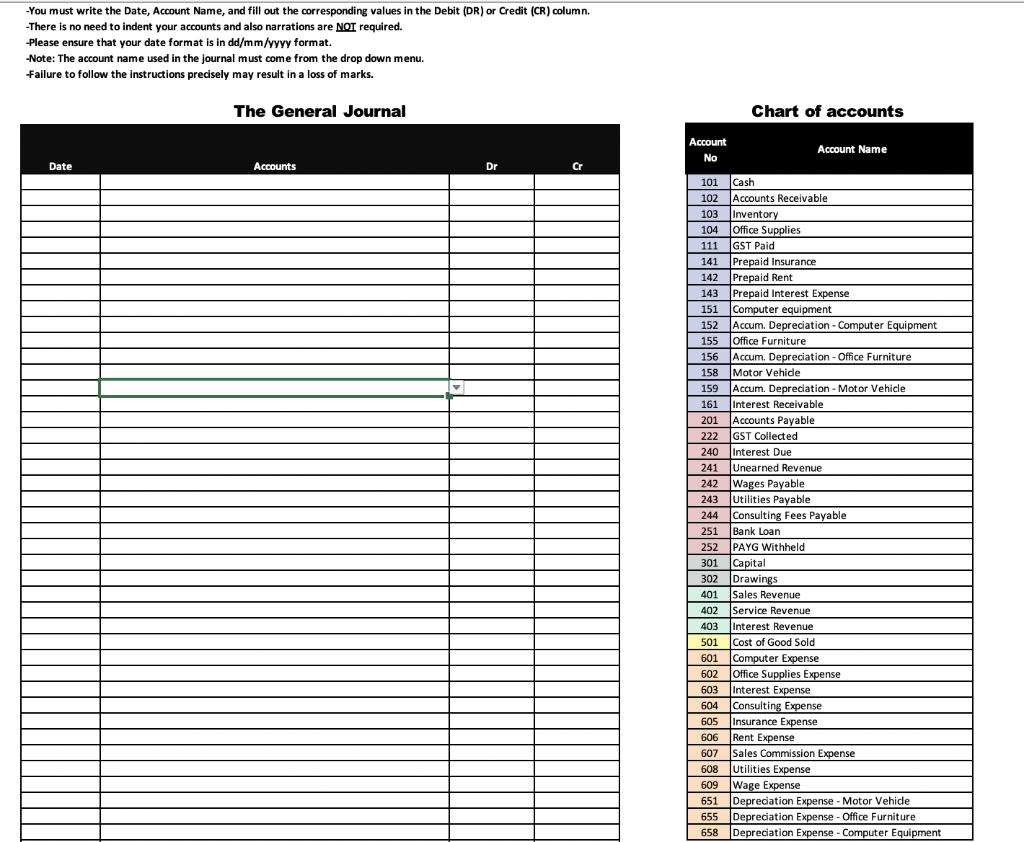

Business Name: Magnus trading as 'Check, mate' Magnus began operations on 1 April 2019 under the business name 'Check, mate'. The business provides chess lessons and also retails chess sets which it purchases from its only supplier 'Blitz corner". The business is currently operating in Melbourne's South-East next to Deakin University. The business is registered for GST which Magnus pays annually. Opening balances as at 01/07/2021 Account name Cash Accounts receivable Inventory Accounts payable Bank Loan Office Furniture Accum. Depreciation Office Furniture GST Paid GST Collected Capital Transactions for the month ended 31/07/2021 Date 3/07/2021 4/07/2021 7/07/2021 10/07/2021 11/07/2021 21/07/2021 22/07/2021 24/07/2021 25/07/2021 27/07/2021 28/07/2021 Invoiced 24 students for 1 lesson provided on that day. Students have paid 10% the total amount with the remainder yet to be paid. 17/07/2021 Magnus bought a rare chess set for personal use at home for $1,221 (GST inclusive) using the business bank account. 20/07/2021 29/07/2021 3. Additional information 31/07/2021 Description Relevant information: The business repaid $8,589 on its bank loan. Provided a chess lesson to 34 students. Of the 34 students, only 18 have paid cash, the rest have not yet paid. Purchased new computer equipment for $1,155 (GST inclusive) in cash. Paid employee salaries for the month: Gross Amount $4,421; PAYG Tax Deducted $1,194; staff were paid the net amount in cash Value $42,946 $14,602 $12,025 $11,166 $14,902 $28,774 $3,597 $5,282 $6,013 $67,951 Sold 36 chess sets as bulk order. Customer paid the full-amount in cash the same day. Check, mate' was invoiced $473 (GST inclusive) for a consultation service regarding business expansion. The amount is yet to be paid. Sold chess sets for $3,762 (GST inclsuive) as a bulk order. Client was a repeat customer and so was allowed to buy the entire order on credit. Check, mate' purchased 19 chess sets on credit from 'Blitz corner. Magnus had to travel to a tournament. He delivered 1 online lesson and reduced the class fee by 20%. 26 students attended. Students agreed to pay in a few days. The business received cash for lessons provided on the 4th, 11th, and 25th July. Sold 34 chess sets to another chess club. Received 50% of the amount in cash with the remainder yet to be paid. Business paid Utilities bill of $2,926 (GST inclusive) Check, mate' paid off all debts outstanding to "Blitz corner" including any payables at the beginning of the month. Description Selling price per chess set (GST inclusive) Cost per chess set (GST inclusive) Service Revenue per Student per Lesson (GST inclusive) Value $198.00 $132.00 $55.00 -You must write the Date, Account Name, and fill out the corresponding values in the Debit (DR) or Credit (CR) column. -There is no need to indent your accounts and also narrations are NOT required. -Please ensure that your date format is in dd/mm/yyyy format. -Note: The account name used in the journal must come from the drop down menu. -Failure to follow the instructions precisely may result in a loss of marks. The General Journal Date Accounts Dr Cr Account No 101 102 103 104 = 111 = 141 - 142 - 143 - 151 155 = 156 = 158 = 159 - 161 201 222 240 241 AYA Computer equipment pompa egan 152 Accum. Depreciation - Computer Equipment - expreom Office Furniture 242 - 243 2 244 2 251 201 234 252 391 301 302 - 401 - 402 - 403 - 501 ve 601 LOVE 602 2 603 - 604 - 605 - Chart of accounts 606 607 608 609 Cash Accounts Receivable Inventory Office Supplies Lemo GST Paid Prepaid Insurance Prepaid Rent Depand Prepaid Interest Expense prepaid intere Accum. Depreciation - Office Furniture accom Motor Vehicle Account Name Accum. Depreciation - Motor Vehicle power and proce Interest Receivable Accounts Payable GST Collected Interest Due Unearned Revenue Wages Payable Utilities Payable Consulting Fees Payable condicing Bank Loan PAYG Withheld DATO Capital Capital Larawings Sales Revenue - Service Revenue Interest Revenue Cost of Good Sold con of Computer Expense computer Exper Office Supplies Expense Interest Expense companion Consulting Expense andening Insurance Expense Maca orice Rent Expense Sales Commission Expense Utilities Expense Wage Expense 651 Depreciation Expense - Motor Vehicle 655 Depreciation Expense - Office Furniture 658 Depreciation Expense - Computer Equipment

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started