Business Statistics

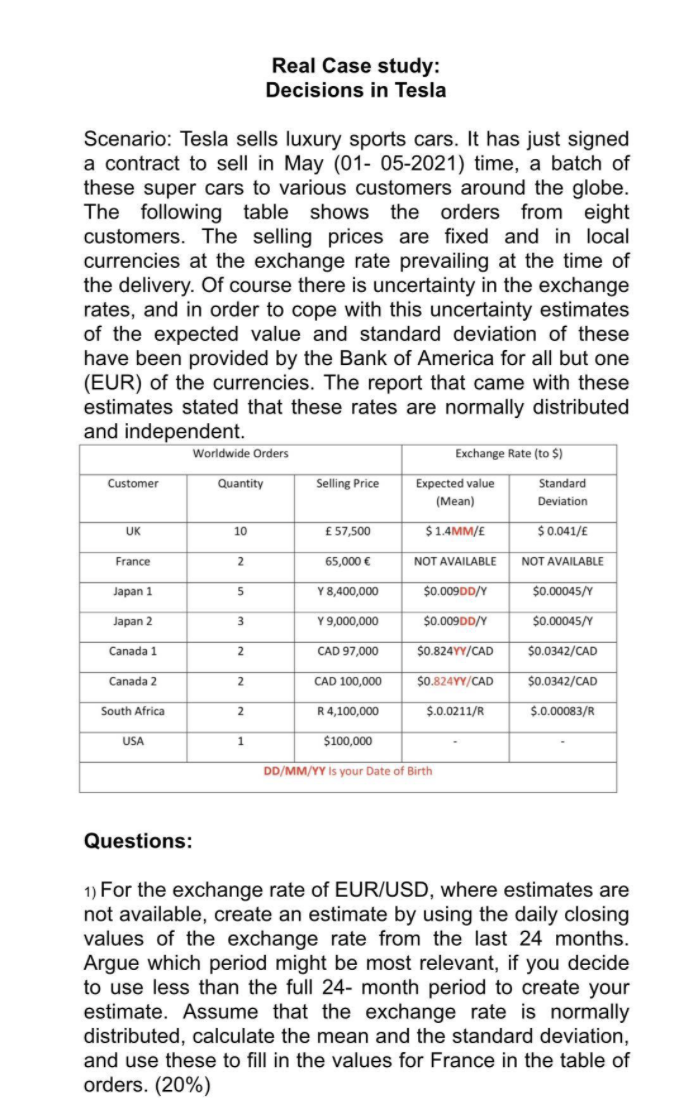

Real Case study: Decisions in Tesla Scenario: Tesla sells luxury sports cars. It has just signed a contract to sell in May (01- 05-2021) time, a batch of these super cars to various customers around the globe. The following table shows the orders from eight customers. The selling prices are fixed and in local currencies at the exchange rate prevailing at the time of the delivery. Of course there is uncertainty in the exchange rates, and in order to cope with this uncertainty estimates of the expected value and standard deviation of these have been provided by the Bank of America for all but one (EUR) of the currencies. The report that came with these estimates stated that these rates are normally distributed and independent. Worldwide Orders Exchange Rate (to $) Customer Quantity Selling Price Expected value Standard (Mean) Deviation UK 10 E 57,500 $ 1.4MM/E $ 0.041/E France 2 65,000 E NOT AVAILABLE NOT AVAILABLE Japan 1 5 Y 8,400,000 $0.009DD/Y $0.00045/Y Japan 2 3 Y 9,000,000 $0.009DD/Y $0.00045/Y Canada 1 2 CAD 97,000 $0.824YY/CAD $0.0342/CAD Canada 2 2 CAD 100,000 $0.824YY/CAD $0.0342/CAD South Africa 2 R 4,100,000 $.0.0211/R $.0.00083/R USA 1 $100,000 DD/MM/YY Is your Date of Birth Questions: 1) For the exchange rate of EUR/USD, where estimates are not available, create an estimate by using the daily closing values of the exchange rate from the last 24 months. Argue which period might be most relevant, if you decide to use less than the full 24- month period to create your estimate. Assume that the exchange rate is normally distributed, calculate the mean and the standard deviation, and use these to fill in the values for France in the table of orders. (20%)2) Specify the distribution and report the mean and the standard deviation of total revenue in $. (20%) a) a. What is the probability that this revenue will exceed $ 2,280,000? (10%) b. What is the probability that this revenue will be less than $ 2,160,000? (10%) 4) H830 offers to pay a certain sum of $2,150,000. in return for the uncertain revenue in local currencies. Give an opinion as to whether this is a good offer for Tesla or not? (20%) 5} In Tesla. the Sales manager is willing to accept HSBC's offer. but the CEO is not. Who is more risk-averse? (20%) a} What other risks is the bank taking, apart from the uncertainty in the exchange rates? (Bonus point)