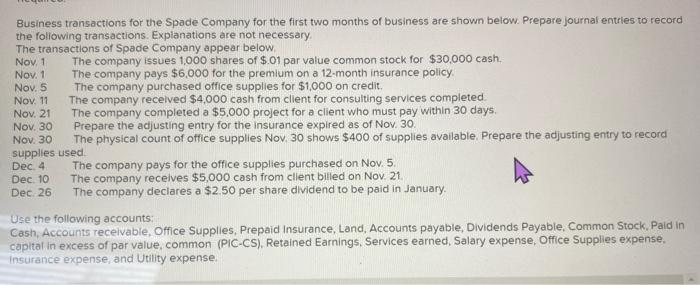

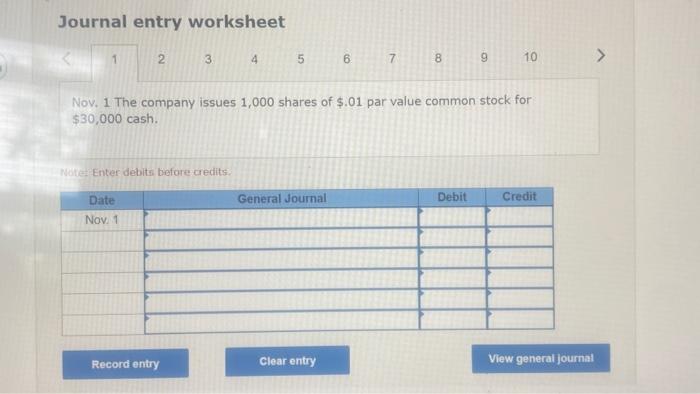

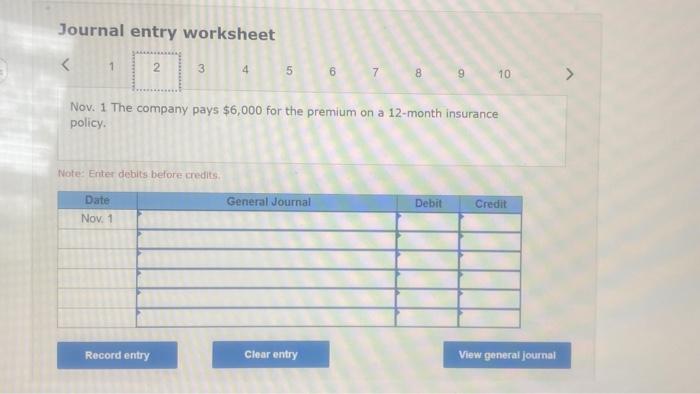

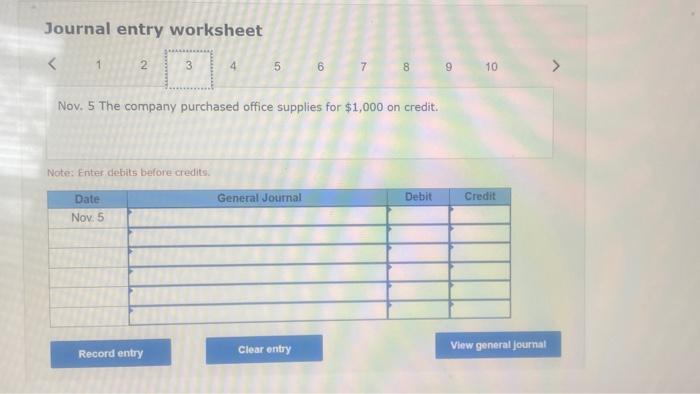

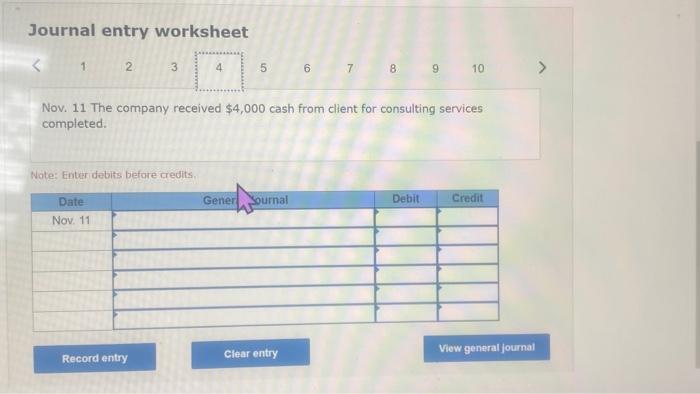

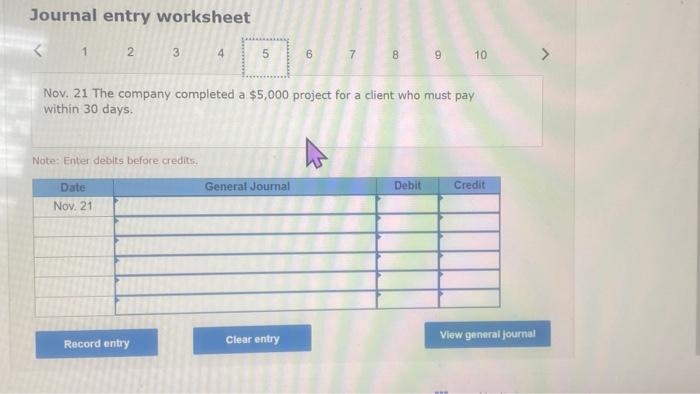

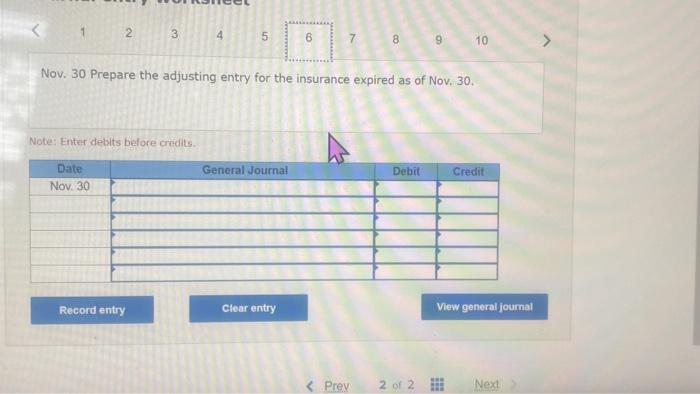

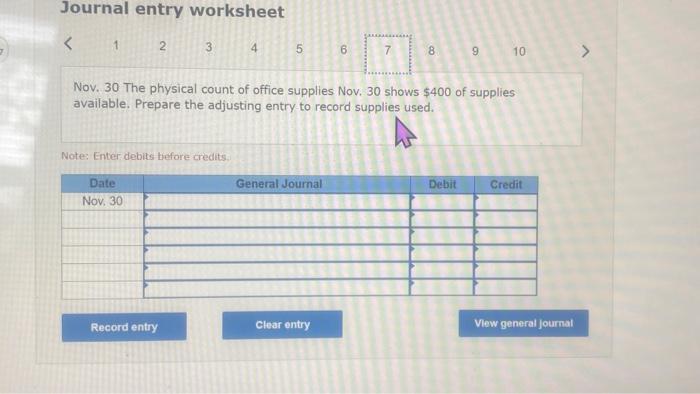

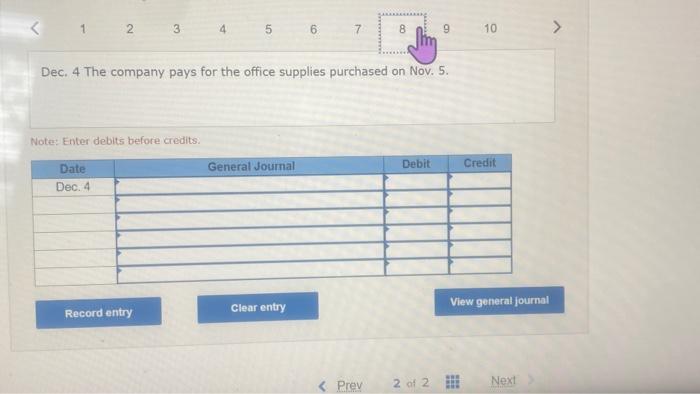

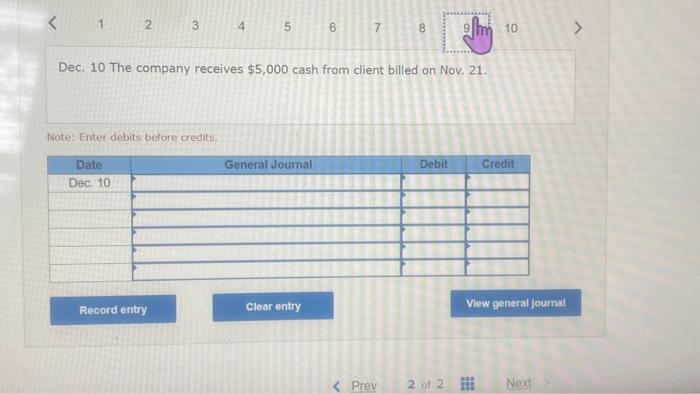

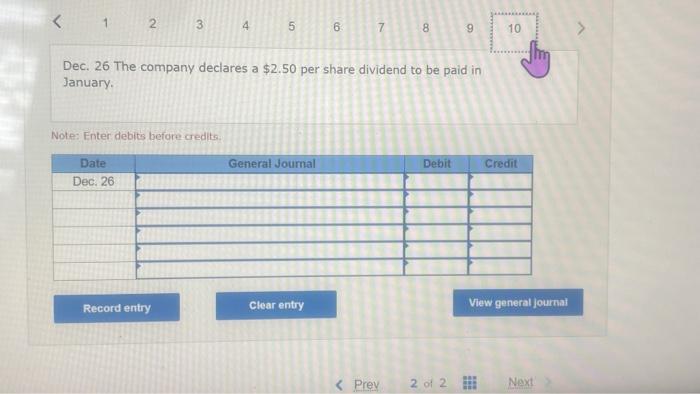

Business transactions for the Spade Company for the first two months of business are shown below. Prepare journal entrles to record the following transactions. Explanations are not necessary. The transactions of Spade Company appear below. Nov, 1 The company issues 1,000 shares of $.01 par value common stock for $30.000cash. Nov. 1 The company pays $6,000 for the premium on a 12 -month insurance policy. Nov. 5 The company purchased office supplies for $1,000 on credit. Nov, 11 The company received $4,000 cash from client for consulting services completed Nov, 21 The company completed a $5,000 project for a client who must pay within 30 days. Nov. 30 Prepare the adjusting entry for the insurance expired as of Nov. 30 Nov. 30 The physical count of office supplies Nov. 30 shows $400 of supplies avallable. Prepare the adjusting entry to record supplies used. Dec. 4 The company pays for the office supplies purchased on Nov. 5 . Dec. 10 The company receives $5,000 cash from cllent billed on Nov. 21. Dec. 26 The company declares a $2.50 per share dividend to be paid in January. Use the following accounts: Cash, Accounts recelvable, Office Supplies, Prepaid Insurance, Land, Accounts payable, Dividends Payable, Common Stock, Paid in capltal in excess of par value, common (PIC-CS), Retained Earnings, Services earned, Salary expense, Office Supplies expense. insurance expense, and Utility expense. Journal entry worksheet 3 4 5 7 8 9 10 Nov. 1 The company issues 1,000 shares of $.01 par value common stock for $30,000 cash. Wote: Enter debits bofore aredits: Journal entry worksheet 6789 Nov. 1 The company pays $6,000 for the premium on a 12 -month insurance policy. Note: Eriter debits before credits. Journal entry worksheet 5678 Nov. 5 The company purchased office supplies for $1,000 on credit. Note: Fnter drobils before credits. Journal entry worksheet 278910 Nov. 11 The company received $4,000 cash from client for consulting services completed. Wote: Entxr debits befoke credits Journal entry worksheet 1 78910 Nov. 21 The company completed a $5,000 project for a client who must pay within 30 days. Note: Enter debits before credits. Nov. 30 Prepare the adjusting entry for the insurance expired as of Nov. 30 . Note: Enter debits before credits. Journal entry worksheet 12345 9 Nov. 30 The physical count of office supplies Nov. 30 shows $400 of supplies available. Prepare the adjusting entry to record supplies used. Note: Enter debits before credits. Dec. 4 The company pays for the office supplies purchased on Nov. 5 . Note: Enter debits before credits. Dec. 10 The company receives $5,000 cash from client billed on Nov, 21 . Note: Enter debits before credits: Dec. 26 The company declares a $2.50 per share dividend to be paid in January. Note: Enter debits before credits