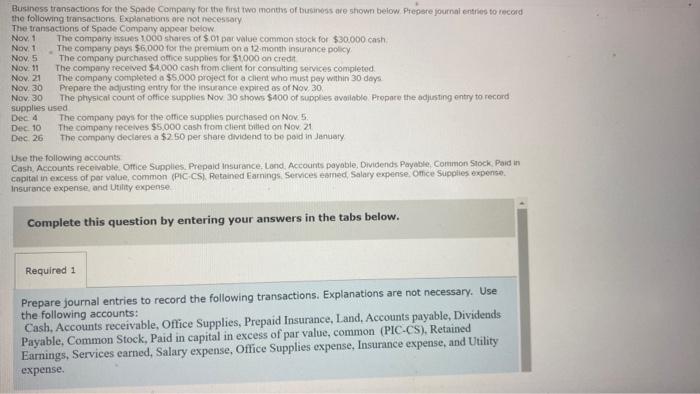

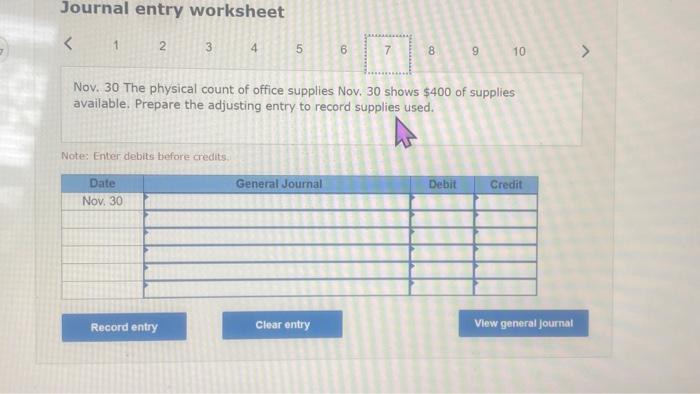

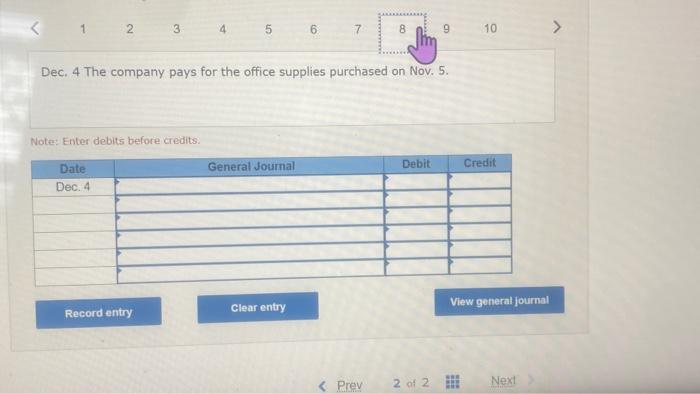

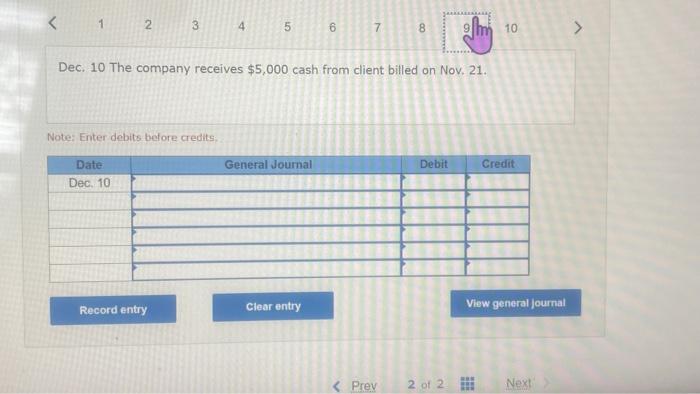

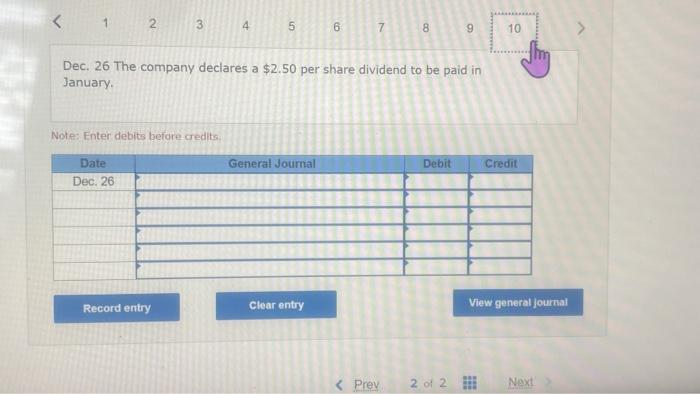

Business transoctions for the Spade Compory for the first two montiss of buganoss are shown beiow. Pregere journai entries to record the following transections. Explanations are not necessary The transactions of Spade Conpany appear below Nov, 1 The compary issues 1000 shates of $.01 par value common stock for $30.000cash Nov: 1 . The compery pays $6,000 for the premuen on a 12 month insiarance policy Noy, 5 . The company purchased otice supplies for $1,000 on credit Nov. 11 The company recelved $4,000 cash from C ilem for consulting services completed. Nov, 21 The company completed a $5,000 project fot a clent who must pey wathin 30 doys Nov 30 Prepere the adjusting entry tor the insurance expired os of Nov 30 , Nov 30 The physical count of office supplies Now 30 shows $400 of supplies available. Fropare the adjusting entry to recond supplies used Dec. A The company poys for the olfice supplies purchased on Nov 5. Dec. 10 The company recelves $5,000 cash from client billed on Nov 21 Dec 26 . The cormpary decleres a $2.50 per share dividend to bo peid in January Lhe the following occounts Cash. Accounts recewable. Ortice Supplies. Prepaid insurance. Land. Accourts payoble, Oividends Payable, Contmon Slock Paid in capital in excess of por value, common (PIC.CS. Reteined Earnings Services eamed, Salary expense, Omice Supplies expense. Insurance expense, and Utility expense Complete this question by entering your answers in the tabs below. Prepare journal entries to record the following transactions. Explanations are not necessary. Use Cash, Accounts receivable, Office Supplies, Prepaid Insurance, Land, Accounts payable, Dividends the following accounts: Payable, Common Stock, Paid in capital in excess of par value, common (PIC-CS), Retained Earnings, Services earned, Salary expense, Office Supplies expense, Insurnnce expense, and Utility expense. Journal entry worksheet 12345 9 Nov. 30 The physical count of office supplies Nov. 30 shows $400 of supplies available. Prepare the adjusting entry to record supplies used. Note: Enter debits before credits. Dec. 4 The company pays for the office supplies purchased on Nov. 5 . Note: Enter debits before credits. Dec. 10 The company receives $5,000 cash from client billed on Nov, 21 . Note: Enter debits before credits: Dec. 26 The company declares a $2.50 per share dividend to be paid in January. Note: Enter debits before credits