Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Businesses can be classified into the following forms: sole proprietorship, partnership, corporation, limited liability company (LLC), and limited liability partnership (LLP). Different forms of businesses

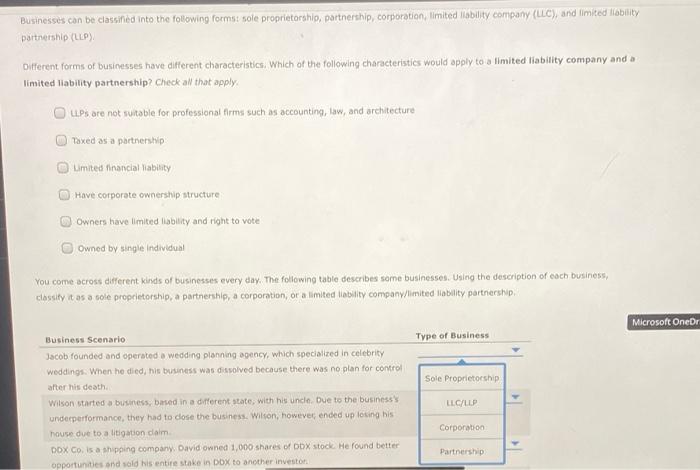

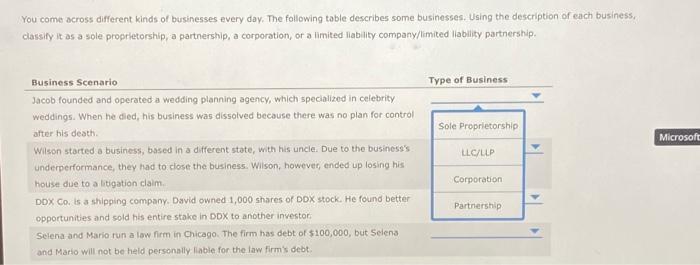

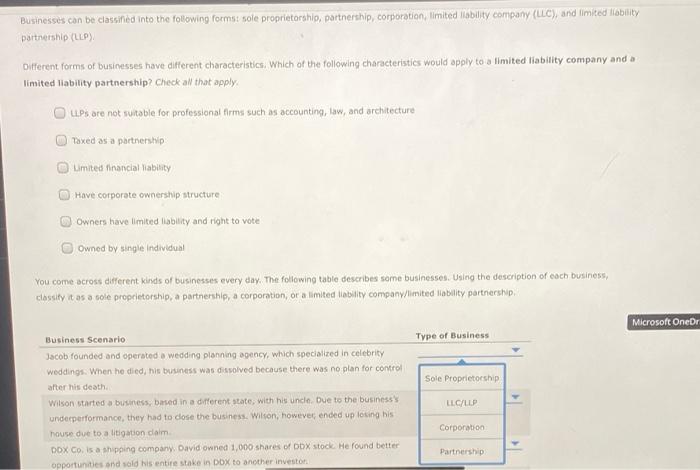

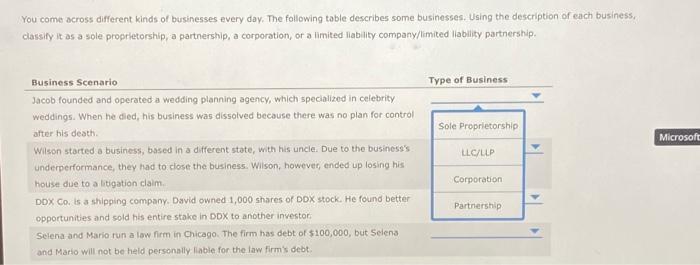

Businesses can be classified into the following forms: sole proprietorship, partnership, corporation, limited liability company (LLC), and limited liability partnership (LLP). Different forms of businesses have different characteristics. Which of the following characteristics would apply to a limited liability company and a limited liability partnership? Check all that apply. LLPs are not suitable for professional firms such as accounting, law, and architecture Taxed as a partnership Limited financial liability Have corporate ownership structure Owners have limited liability and right to vote Owned by single individual You come across different kinds of businesses every day. The following table describes some businesses. Using the description of each business, classify it as a sole proprietorship, a partnership, a corporation, or a limited liability company/limited liability partnership. Business Scenario Jacob founded and operated a wedding planning agency, which specialized in celebrity weddings. When he died, his business was dissolved because there was no plan for control after his death. Wilson started a business, based in a different state, with his uncle. Due to the business's underperformance, they had to close the business. Wilson, however, ended up losing his house due to a litigation claim.. DOX Co. is a shipping company. David owned 1,000 shares of DDX stock. He found better opportunities and sold his entire stake in DDX to another investor. Type of Business Sole Proprietorship LLC/LLP Corporation Partnership: Microsoft OneDr You come across different kinds of businesses every day. The following table describes some businesses. Using the description of each business, classify it as a sole proprietorship, a partnership, a corporation, or a limited liability company/limited liability partnership. Business Scenario Jacob founded and operated a wedding planning agency, which specialized in celebrity weddings. When he died, his business was dissolved because there was no plan for control after his death. Wilson started a business, based in a different state, with his uncle. Due to the business's underperformance, they had to close the business. Wilson, however, ended up losing his house due to a litigation claim... DDX Co. is a shipping company. David owned 1,000 shares of DDX stock. He found better opportunities and sold his entire stake in DDX to another investor Selena and Mario run a law firm in Chicago. The firm has debt of $100,000, but Selena and Mario will not be held personally liable for the law firm's debt. Type of Business Sole Proprietorship LLC/LLP Corporation Partnership Microsoft

Businesses can be classified into the following forms: sole proprietorship, partnership, corporation, limited liability company (LLC), and limited liability partnership (LLP). Different forms of businesses have different characteristics. Which of the following characteristics would apply to a limited liability company and a limited liability partnership? Check all that apply. LLPs are not suitable for professional firms such as accounting, law, and architecture Taxed as a partnership Limited financial liability Have corporate ownership structure Owners have limited liability and right to vote Owned by single individual You come across different kinds of businesses every day. The following table describes some businesses. Using the description of each business, classify it as a sole proprietorship, a partnership, a corporation, or a limited liability company/limited liability partnership. Business Scenario Jacob founded and operated a wedding planning agency, which specialized in celebrity weddings. When he died, his business was dissolved because there was no plan for control after his death. Wilson started a business, based in a different state, with his uncle. Due to the business's underperformance, they had to close the business. Wilson, however, ended up losing his house due to a litigation claim.. DOX Co. is a shipping company. David owned 1,000 shares of DDX stock. He found better opportunities and sold his entire stake in DDX to another investor. Type of Business Sole Proprietorship LLC/LLP Corporation Partnership: Microsoft OneDr You come across different kinds of businesses every day. The following table describes some businesses. Using the description of each business, classify it as a sole proprietorship, a partnership, a corporation, or a limited liability company/limited liability partnership. Business Scenario Jacob founded and operated a wedding planning agency, which specialized in celebrity weddings. When he died, his business was dissolved because there was no plan for control after his death. Wilson started a business, based in a different state, with his uncle. Due to the business's underperformance, they had to close the business. Wilson, however, ended up losing his house due to a litigation claim... DDX Co. is a shipping company. David owned 1,000 shares of DDX stock. He found better opportunities and sold his entire stake in DDX to another investor Selena and Mario run a law firm in Chicago. The firm has debt of $100,000, but Selena and Mario will not be held personally liable for the law firm's debt. Type of Business Sole Proprietorship LLC/LLP Corporation Partnership Microsoft

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started