Question

Buy-and-hold investors expect that the value of their investments will decrease or increase along with the growth of the economy. Buy-and-hold investors should or should

Buy-and-hold investors expect that the value of their investments will decrease or increase along with the growth of the economy. Buy-and-hold investors should or should not react emotionally to the short-term fluctuations in the market. Selling high-quality investments in a market downturn (called a bear market) usually is or is not a good strategy.

Buy-and-hold investors expect that the value of their investments will decrease or increase along with the growth of the economy. Buy-and-hold investors should or should not react emotionally to the short-term fluctuations in the market. Selling high-quality investments in a market downturn (called a bear market) usually is or is not a good strategy.

Although it may seem counterintuitive, a buy-and-hold investor should consider buying no, fewer, more shares of an investment when the market is down. This is because he or she will be able to buy a greater number of shares for the same amount of money while the market is down and investment prices are lower.

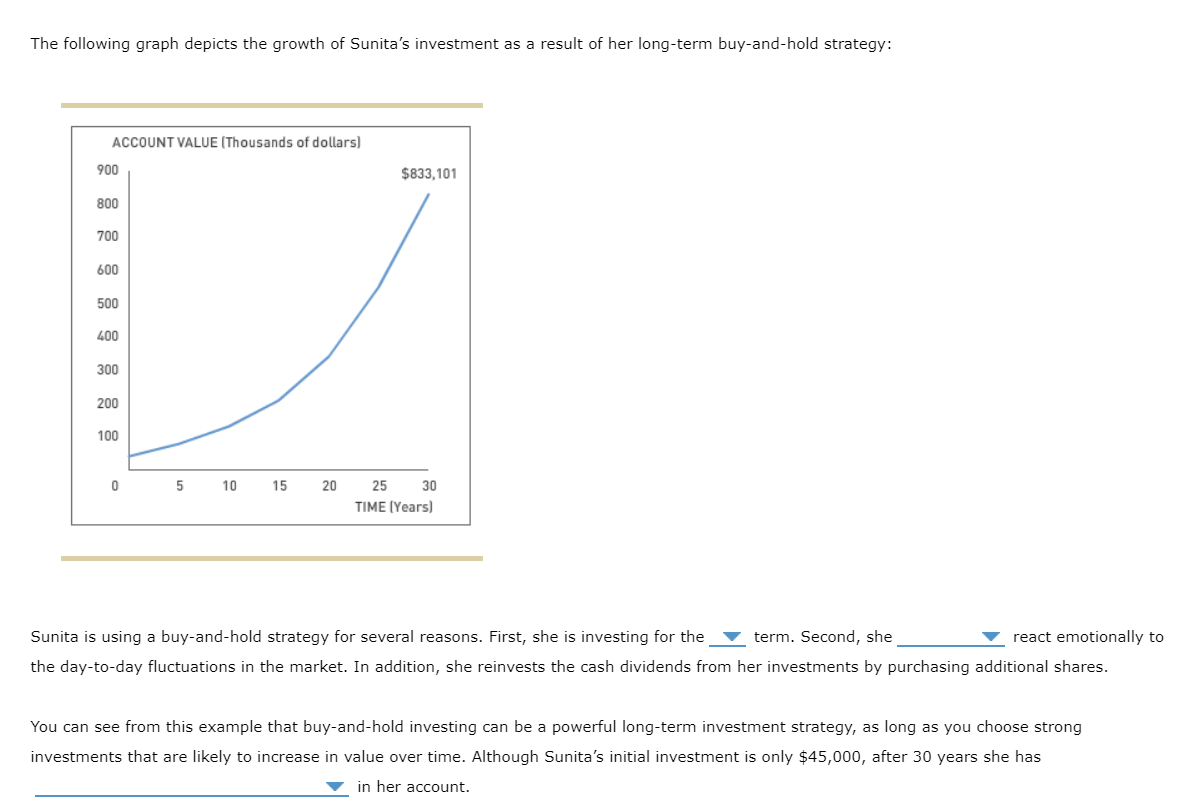

Sunita is using a buy-and-hold strategy for several reasons. First, she is investing for the short or long term. Second, she does or does not react emotionally to the day-to-day fluctuations in the market. In addition, she reinvests the cash dividends from her investments by purchasing additional shares.

You can see from this example that buy-and-hold investing can be a powerful long-term investment strategy, as long as you choose strong investments that are likely to increase in value over time. Although Sunitas initial investment is only $45,000, after 30 years she has between $800,000 and $899,999, between $500,000 and $599,999, between $400,000 and $499,999, between $0 and $99,999, between $200,000 and $299,999 in her account.

One popular long-term investment strategy is buy and hold (also called buy to hold). Buy-and-hold investors usually buy a widely diversified set of stocks or mutual funds that they plan to hold on to for a long period of time, often 20 years or longer. Buy and hold investors often reinvest the dividends from their investments, which means that they purchase additional shares of their investments with the dividend payments. You can usually set up your investment account to automatically reinvest your dividend payments for you. Buy-and-hold investors expect that the value of their investments will along with the growth of the economy. Buy-and-hold investors react emotionally to the short-term fluctuations in the market. Selling high-quality investments in a market downturn (called a bear market) usually a good strategy. Although it may seem counterintuitive, a buy-and-hold investor should consider buying shares of an investment when the market is down. This is because he or she will be able to buy a greater number of shares for the same amount of money while the market is down and investment prices are lower. Consider the following example of buy-and-hold investing: Sunita inherits $45,000 from a distant relative. She decides to invest her inheritance in a diversified, dividend-paying mutual fund. At the time of her initial investment, she purchases 1,500 shares at a price of $30 per share. Over the next 30 years, the mutual fund increases in value at an average rate of 9% per year. In addition, the fund pays an annual cash dividend of 3% per year. Because Sunita understands that reinvesting her dividends can make a big difference to her total long-term returns, she reinvests her dividends every year in order to purchase additional shares of the fund. The following graph depicts the growth of Sunita's investment as a result of her long-term buy-and-hold strategy: Sunita is using a buy-and-hold strategy for several reasons. First, she is investing for the term. Second, she emotionally to the day-to-day fluctuations in the market. In addition, she reinvests the cash dividends from her investments by purchasing additional shares. You can see from this example that buy-and-hold investing can be a powerful long-term investment strategy, as long as you choose strong investments that are likely to increase in value over time. Although Sunita's initial investment is only $45,000, after 30 years she has in her account. One popular long-term investment strategy is buy and hold (also called buy to hold). Buy-and-hold investors usually buy a widely diversified set of stocks or mutual funds that they plan to hold on to for a long period of time, often 20 years or longer. Buy and hold investors often reinvest the dividends from their investments, which means that they purchase additional shares of their investments with the dividend payments. You can usually set up your investment account to automatically reinvest your dividend payments for you. Buy-and-hold investors expect that the value of their investments will along with the growth of the economy. Buy-and-hold investors react emotionally to the short-term fluctuations in the market. Selling high-quality investments in a market downturn (called a bear market) usually a good strategy. Although it may seem counterintuitive, a buy-and-hold investor should consider buying shares of an investment when the market is down. This is because he or she will be able to buy a greater number of shares for the same amount of money while the market is down and investment prices are lower. Consider the following example of buy-and-hold investing: Sunita inherits $45,000 from a distant relative. She decides to invest her inheritance in a diversified, dividend-paying mutual fund. At the time of her initial investment, she purchases 1,500 shares at a price of $30 per share. Over the next 30 years, the mutual fund increases in value at an average rate of 9% per year. In addition, the fund pays an annual cash dividend of 3% per year. Because Sunita understands that reinvesting her dividends can make a big difference to her total long-term returns, she reinvests her dividends every year in order to purchase additional shares of the fund. The following graph depicts the growth of Sunita's investment as a result of her long-term buy-and-hold strategy: Sunita is using a buy-and-hold strategy for several reasons. First, she is investing for the term. Second, she emotionally to the day-to-day fluctuations in the market. In addition, she reinvests the cash dividends from her investments by purchasing additional shares. You can see from this example that buy-and-hold investing can be a powerful long-term investment strategy, as long as you choose strong investments that are likely to increase in value over time. Although Sunita's initial investment is only $45,000, after 30 years she has in her accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started