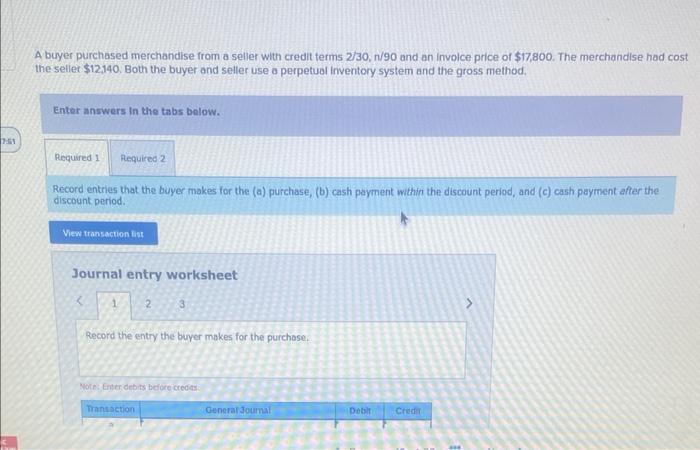

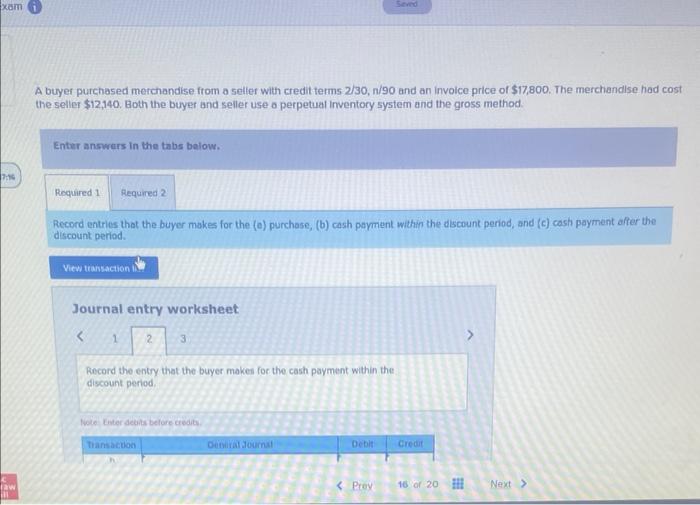

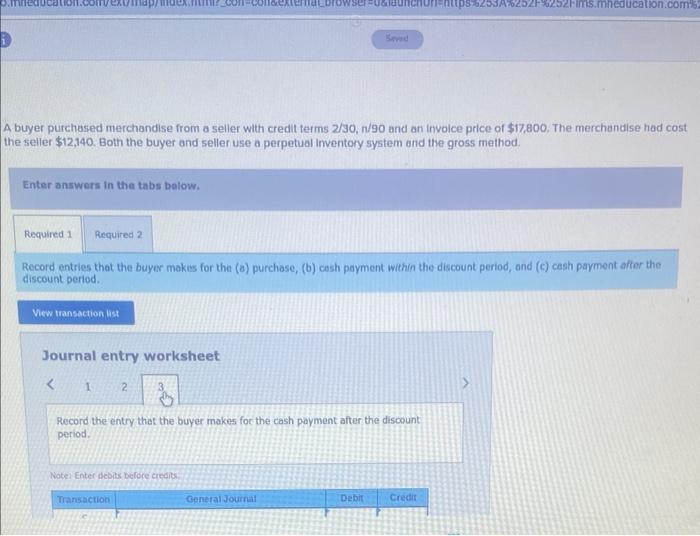

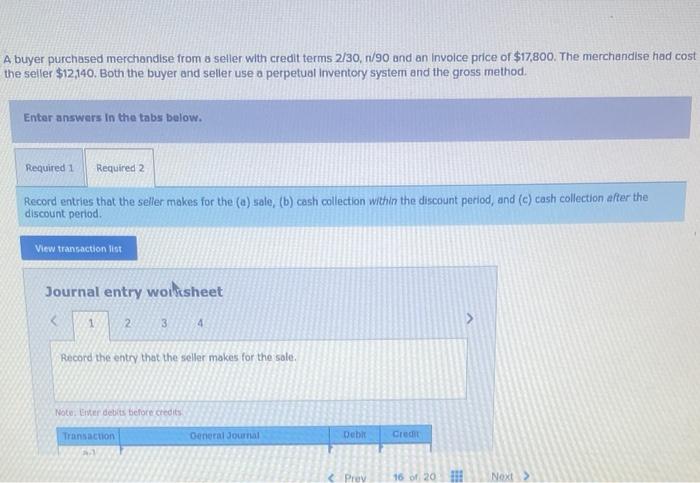

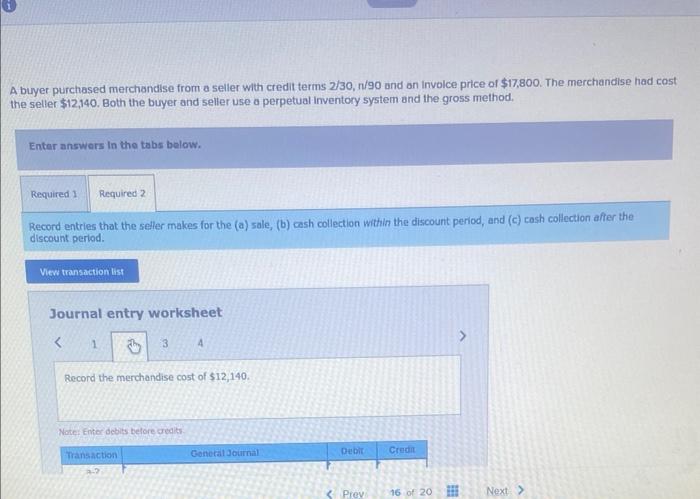

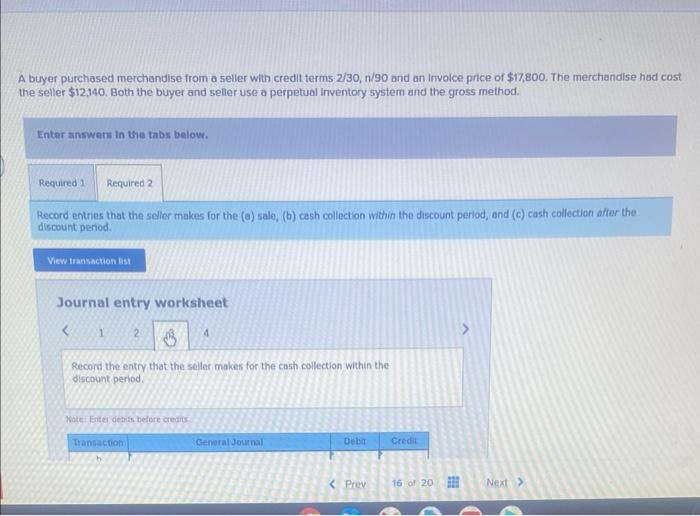

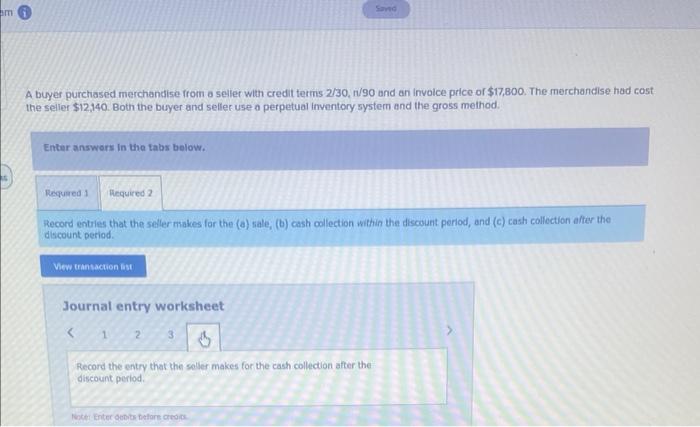

buyer purchased merchandise from a seller with credit terms 2/30,n/90 and an involce price of $17,800. The merchandise had cos he sellet $12,140. Both the buyer and seller use a perpetual inventory system and the gross method. Enter answers in the tabs below. Record entries that the buyer makes for the (a) purchase, (b) cash payment within the discount period, and (c) cash payment after the discount period. A buyer purchased merchandise from a seller with credit terms 2/30, n/90 and an invoice price of $17,800. The merchandlse had cost the seller $12,140. Both the buyer and seller use a perpetual inventory system and the gross method. Enter answers in the tabs below. Record entries that the buyer makes for the (c) purchase, (b) cash payment within the discount period, and (c) cosh payment affer the discount period. Journal entry worksheet Record the entry that the buyer makes for the cash payment within the discount period. twie timter dechis belore credits. A buyer purchased merchandise from a seller with credit terms 2/30,n/90 and an involce price of $17,800. The merchandise had cost the seller $12,140. Both the buyer and seller use a perpetual inventory system and the gross method. Enter answers in the tabs below. Record entries that the buyer makes for the (a) purchase, (b) cosh payment within the discount period, and (c) cesh payment afier the discount period. Journal entry worksheet Record the entry that the buyer makes foc the cash payment after the discount period. Notei Enter desits before creatios A buyer purchased merchandise from a seller with credit terms 2/30,n/90 and an Involce price of $17,800. The merchandise had cost the seller $12,140. Both the buyer and seller use a perpetual irventory system and the gross method. Enter answers in the tabs below. Record entries that the seller makes for the (a) sale, (b) cash collection within the discount period, and (c) cash collection after the discount period. A buyer purchased merchandise from a seller with credit terms 2/30,n/90 and on involce price of $17,800. The merchandise had cost the seller $12,140. Both the buyer and seller use a perpetual inventory system and the gross method. Enter answers in the tabs below. Record entries that the seller makes for the (a) sale, (b) cosh collection within the discount period, and (c) cosh collection affer the discount period. Journal entry worksheet Note: Enter deblts belore dedits A buyer purchased merchandise from a seller with credit terms 2/30, n/90 and an involce price of $17,800. The merchandise had cost the seller $12,140. Both the buyer and seller use a perpetual inventory system and the gross method. Enter answers in the tabs below. Record entries that the selier makes for the (a) sale, (b) cash collection within the discount period, and (c) cash collection affer the discount period. Journal entry worksheet Record the entry that the seller makes for the cash collection within the discount period. Kote Fiter ciebits before credits A buyer purchased merchandise from a seller with credit terms 2/30, r/90 and an involce price of $17,800. The merchandise had cost the seller \$12,140. Both the buyer and seller use o perpetual inventory system and the gross method. Enter answers in the tabs below. Record entries that the seller makes far the (a) sale, (b) cash collection within the discount period, and (c) cash collection after the discount period. Journal entry worksheet Record the entry that the soller makes for the cash collection after the discount period