Answered step by step

Verified Expert Solution

Question

1 Approved Answer

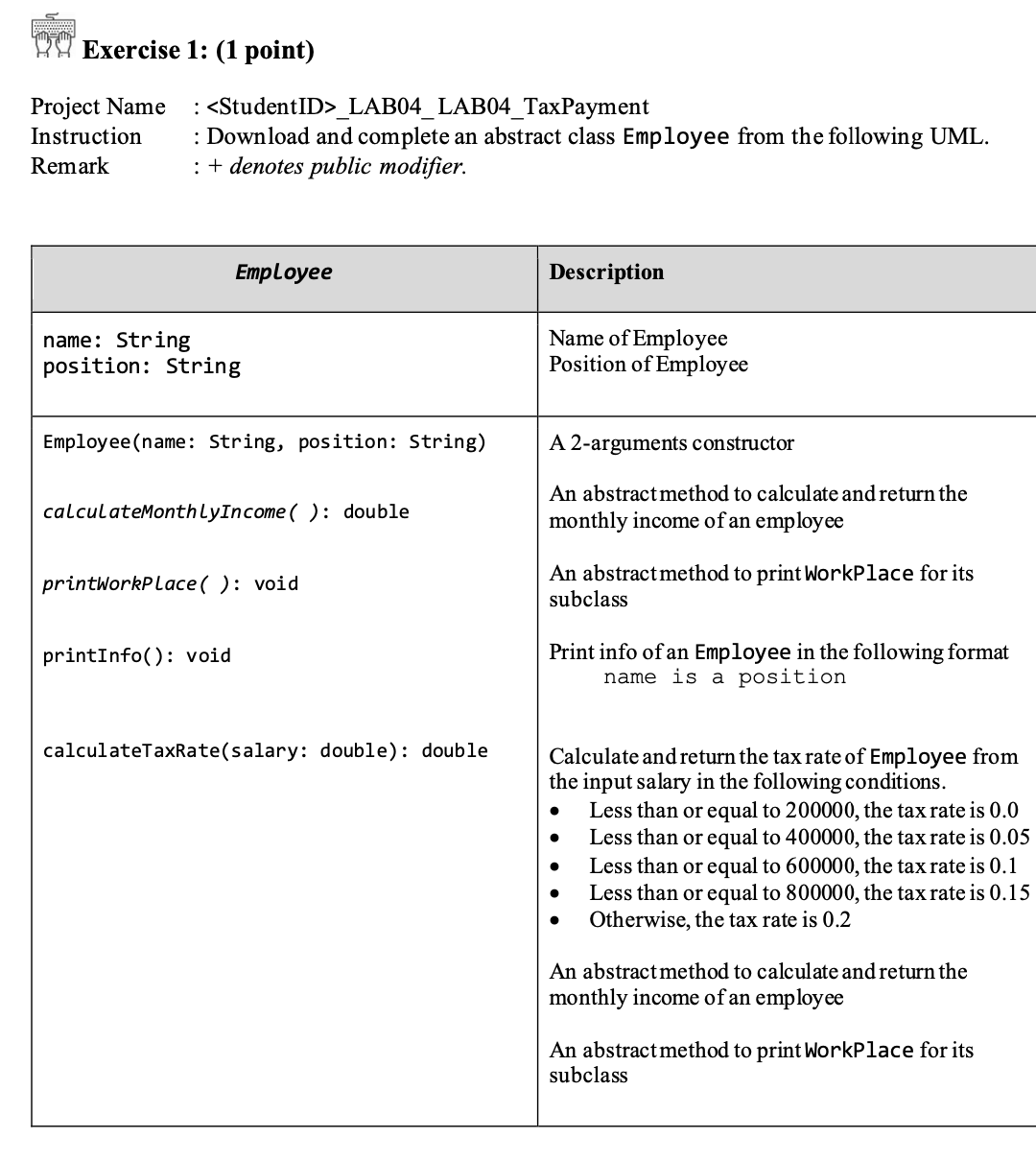

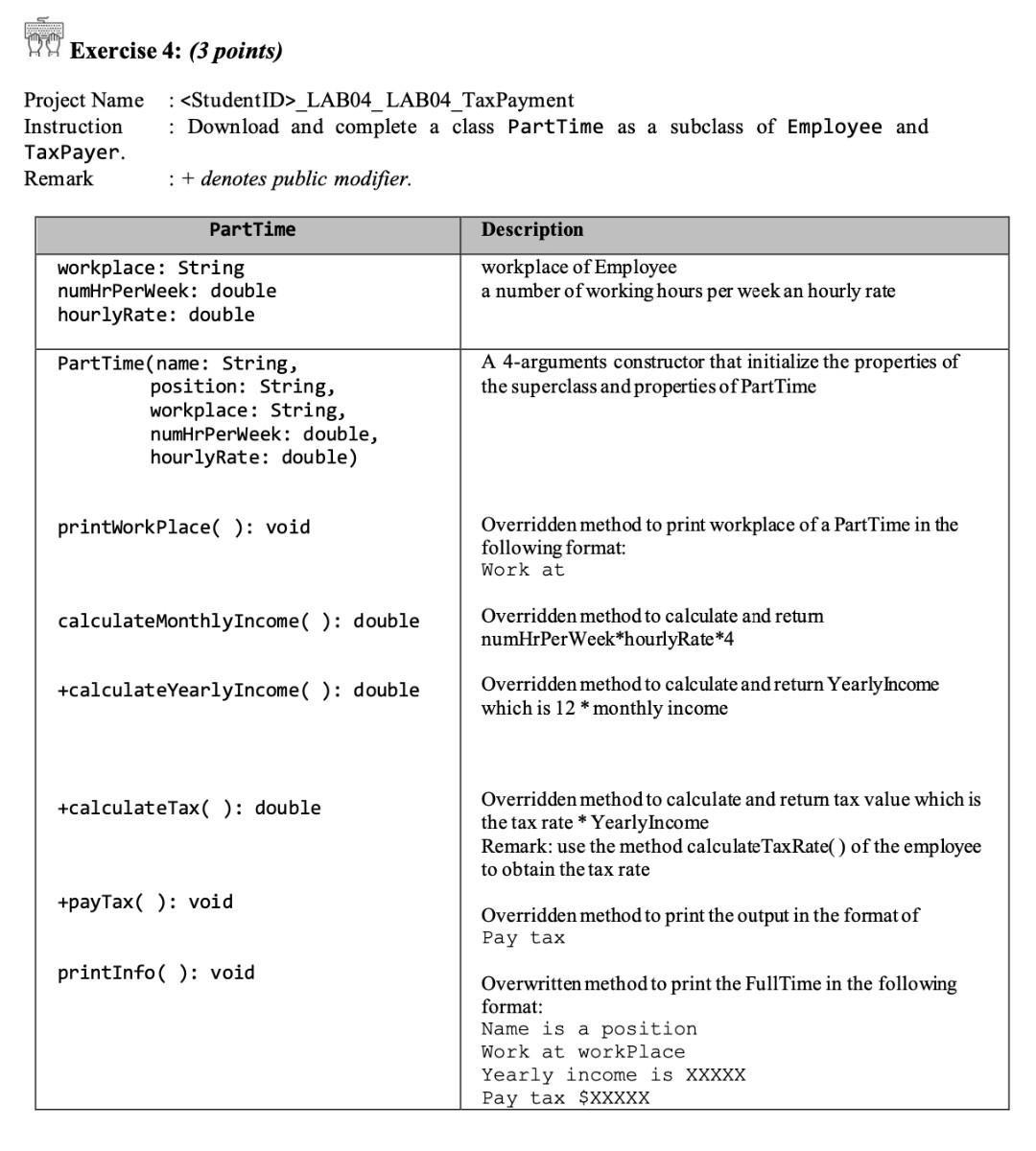

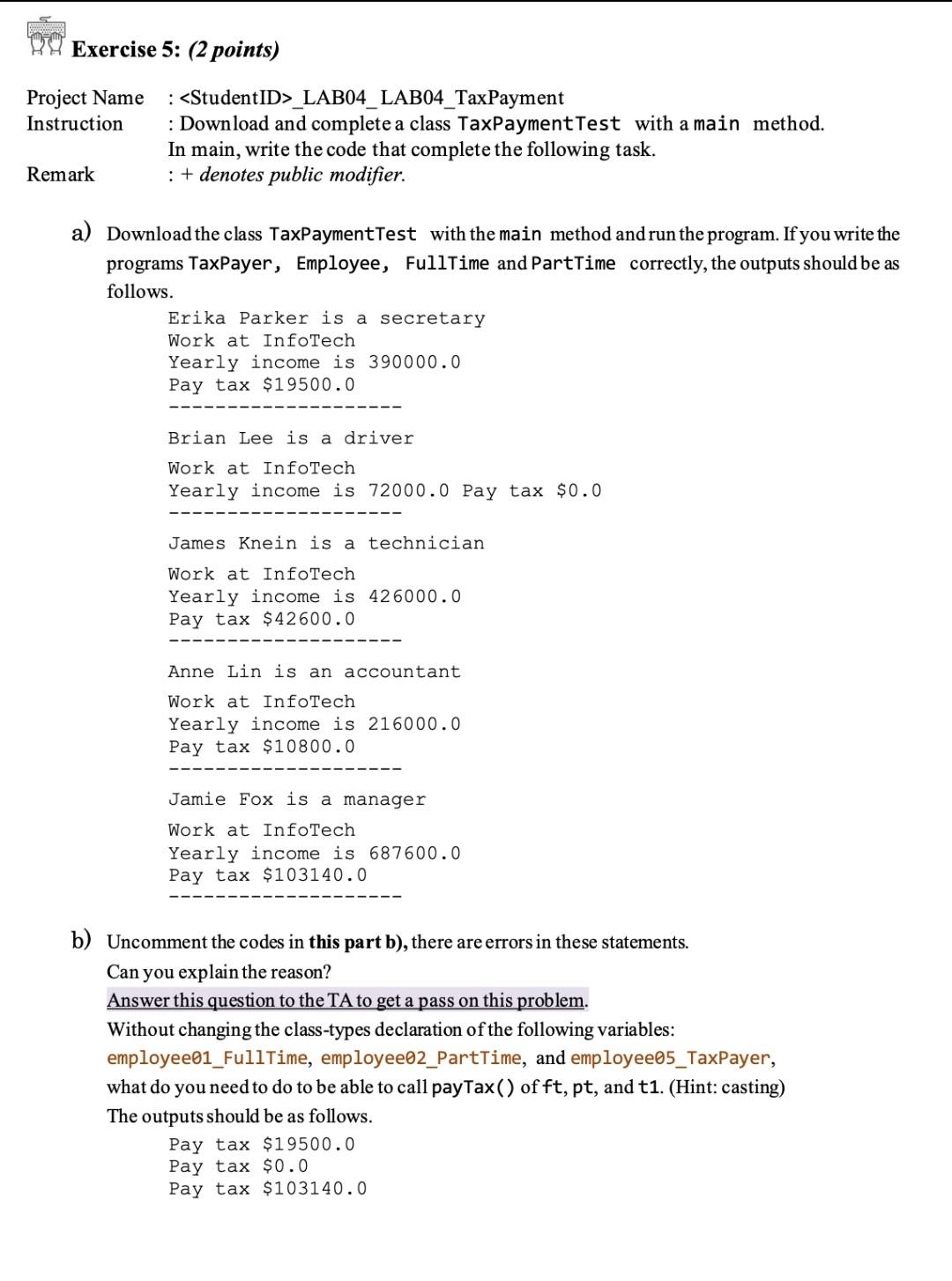

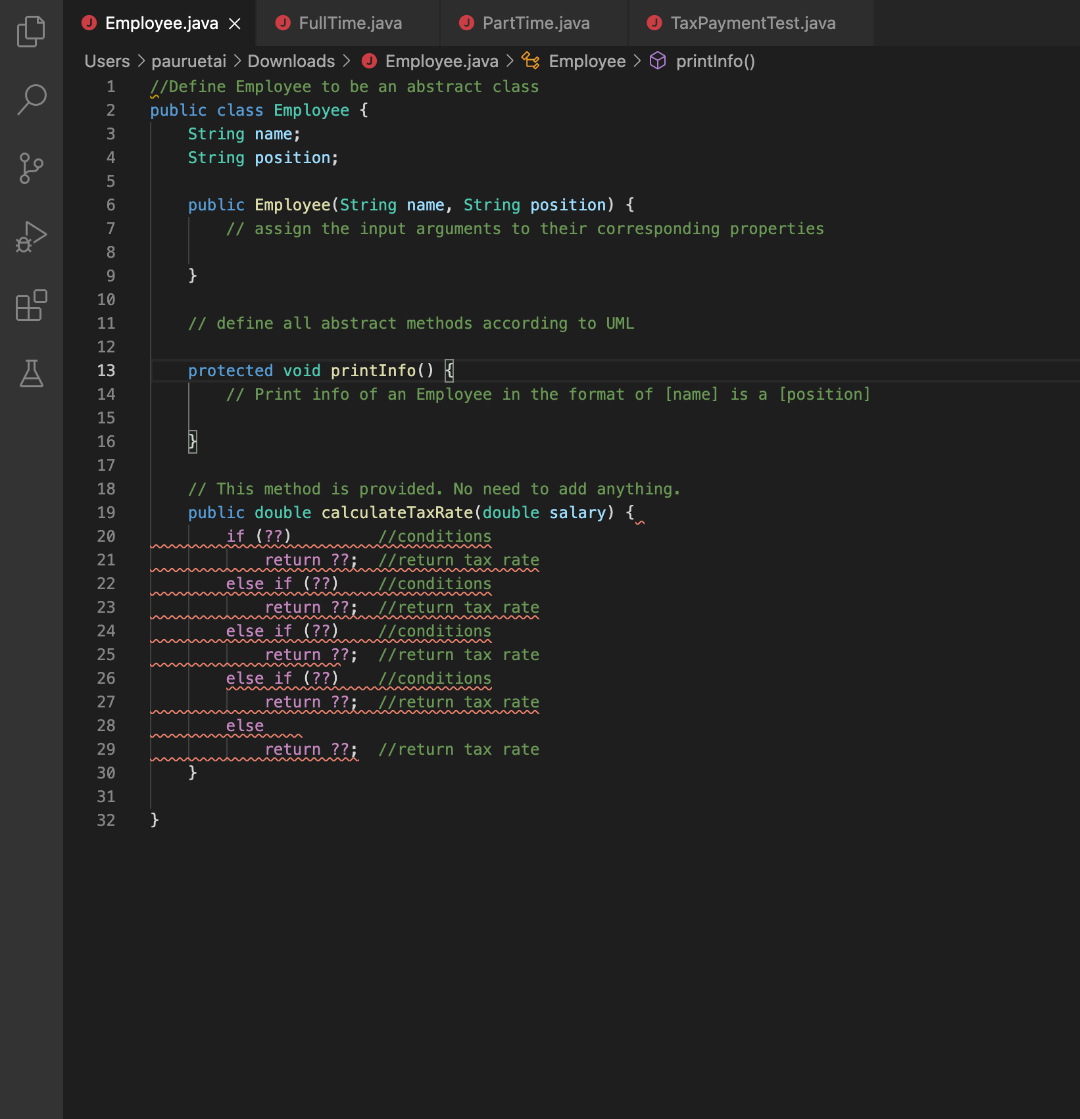

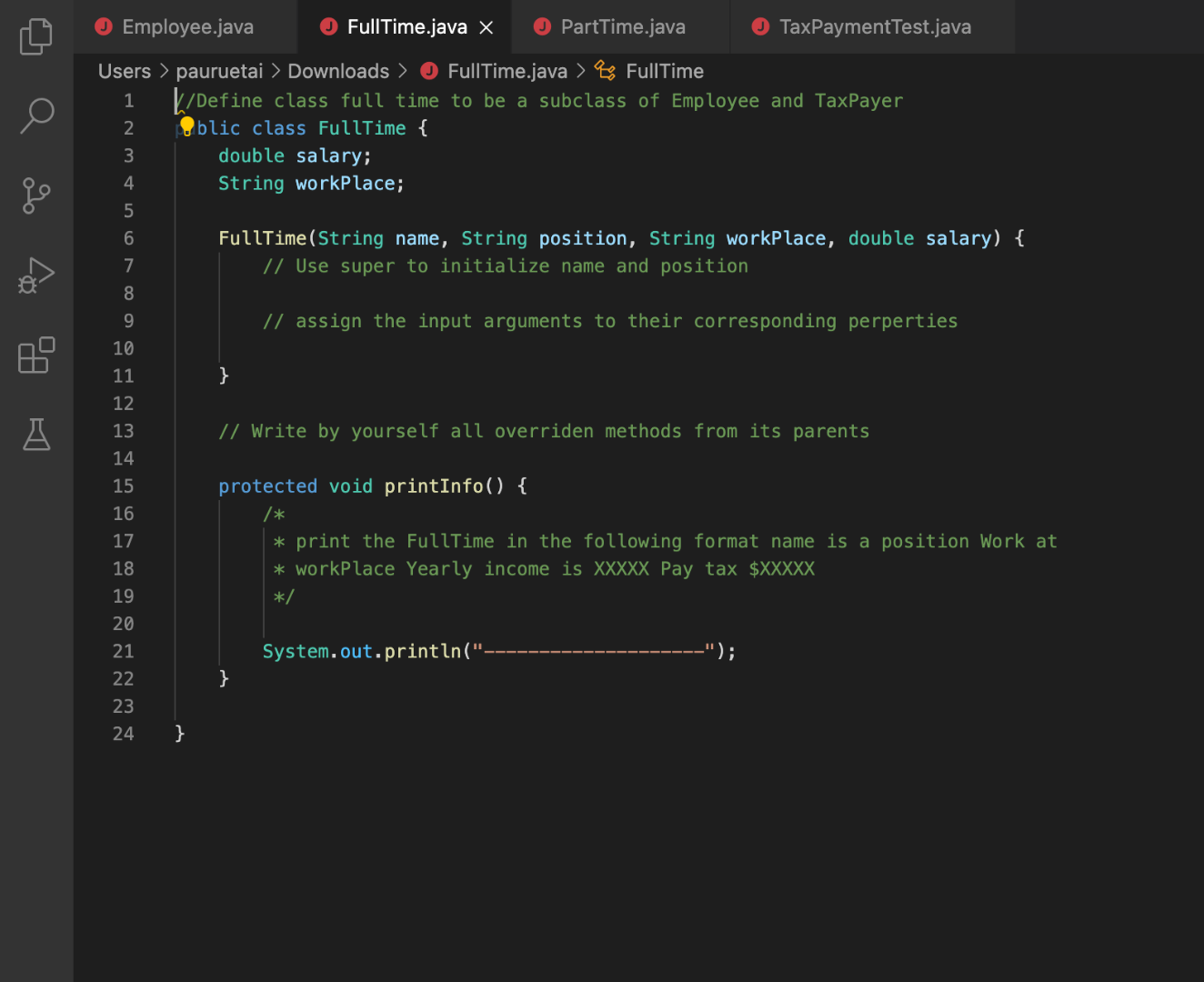

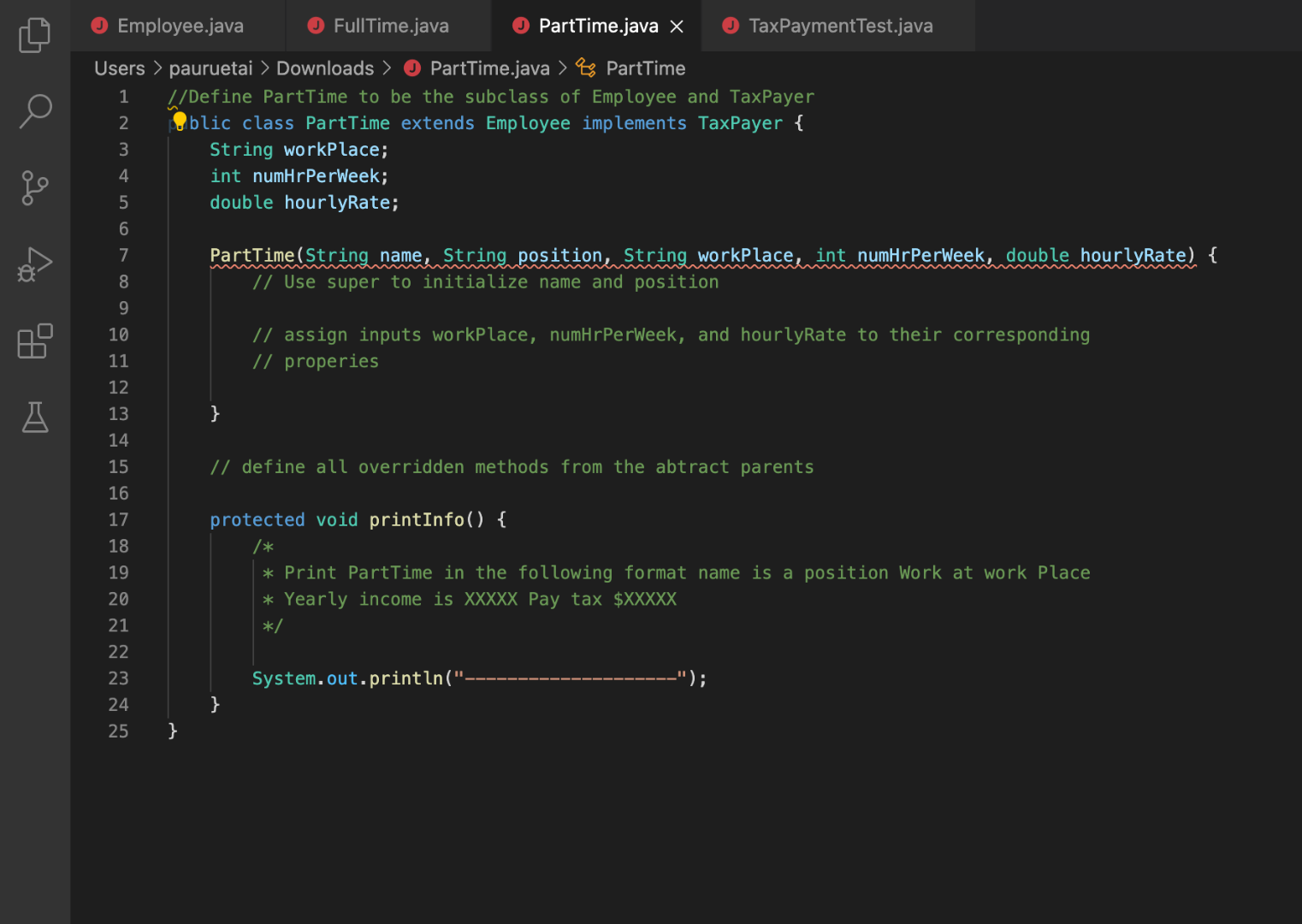

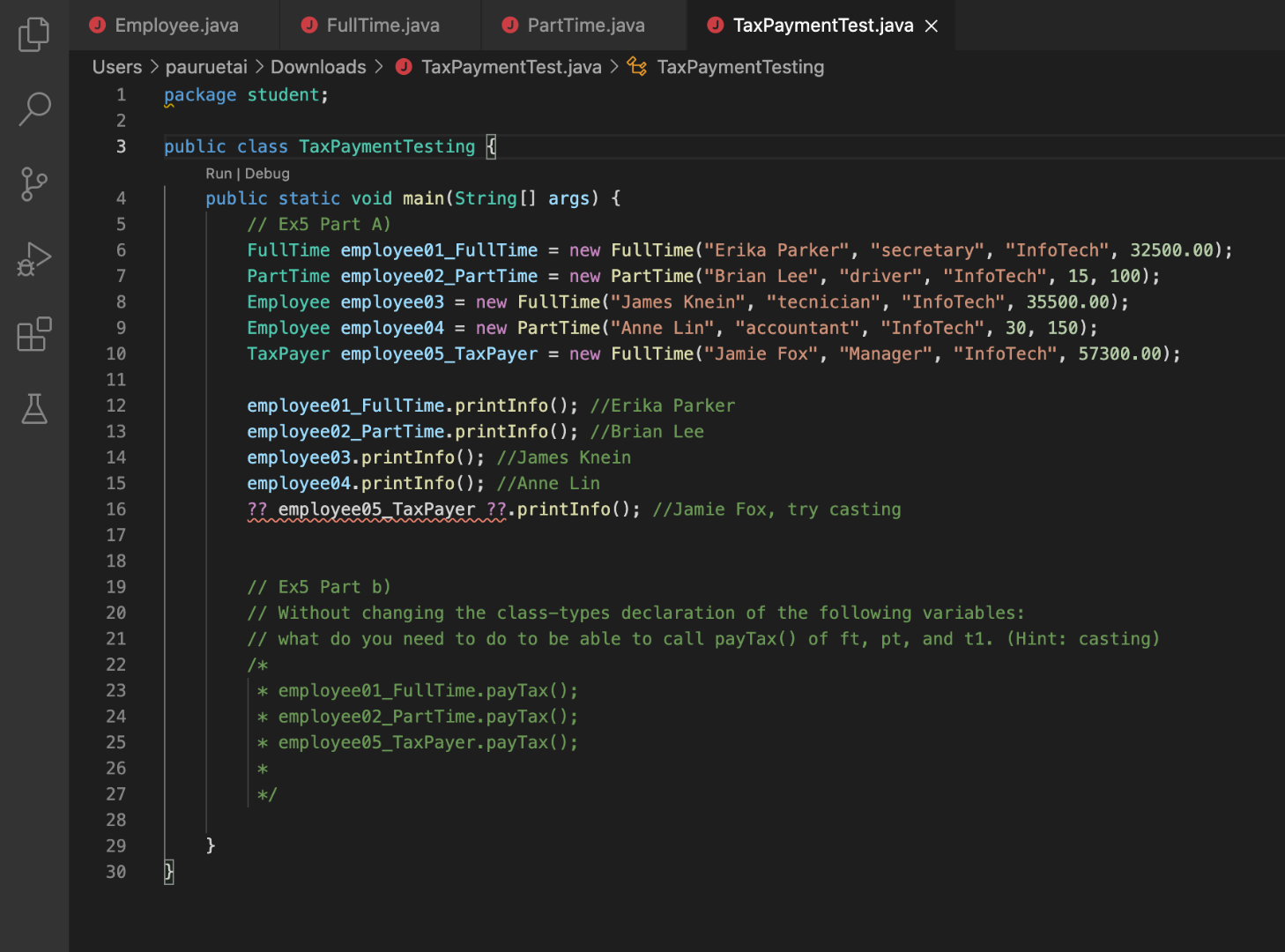

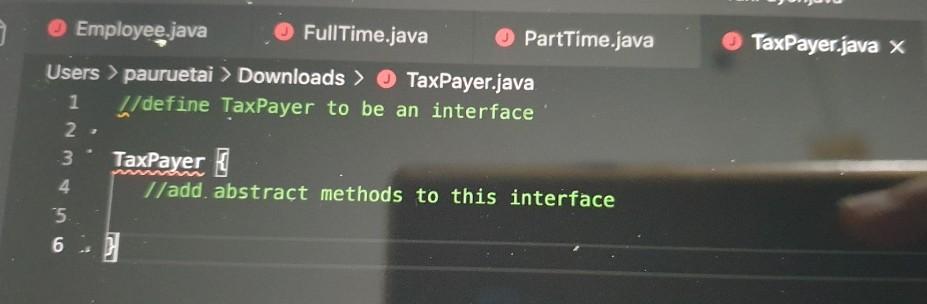

by basic java Exercise 1: (1 point) Project Name Instruction Remark : _LAB04_LAB04_TaxPayment : Download and complete an abstract class Employee from the following UML.

by basic java

Exercise 1: (1 point) Project Name Instruction Remark :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started