Answered step by step

Verified Expert Solution

Question

1 Approved Answer

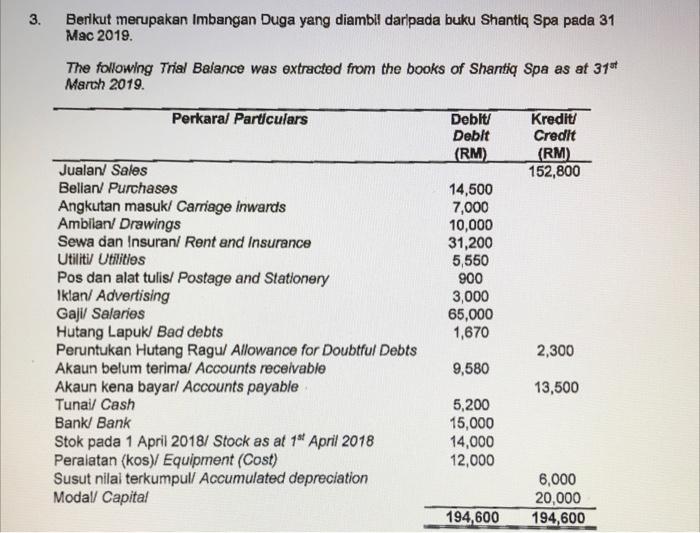

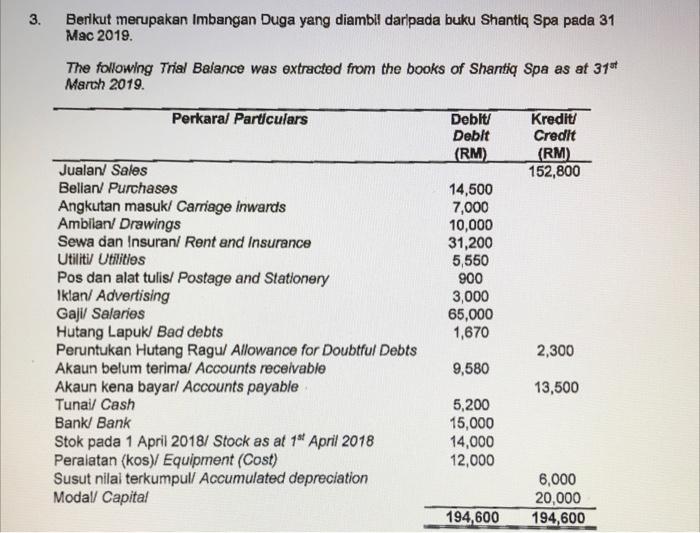

c 3. Berikut merupakan Imbangan Duga yang diambil daripada buku Shanti Spa pada 31 Mac 2019. The following Trial Balance was extracted from the books

c

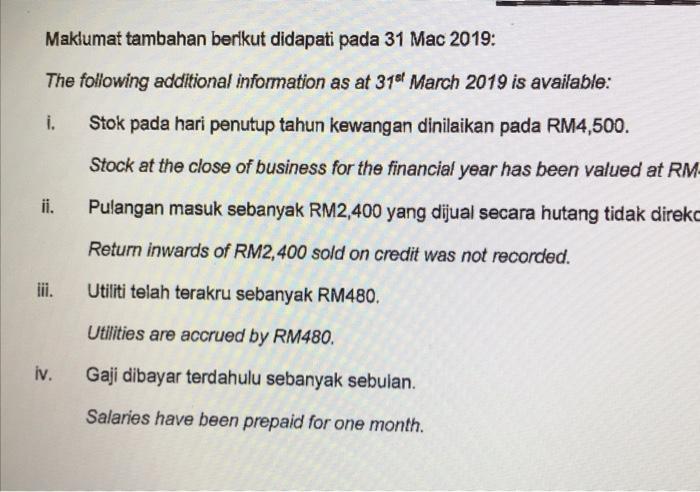

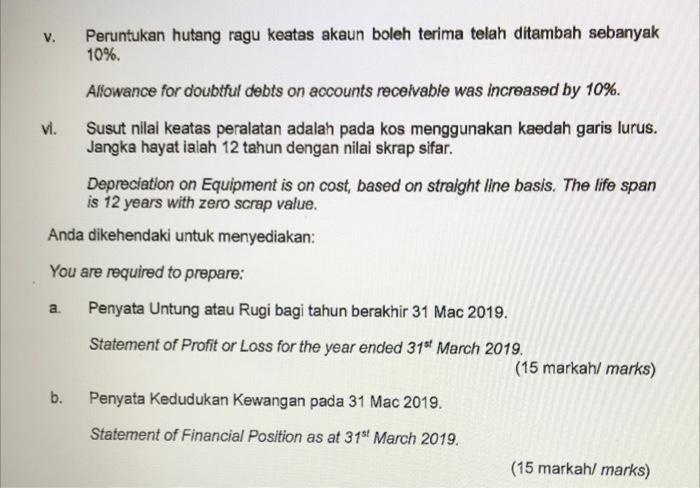

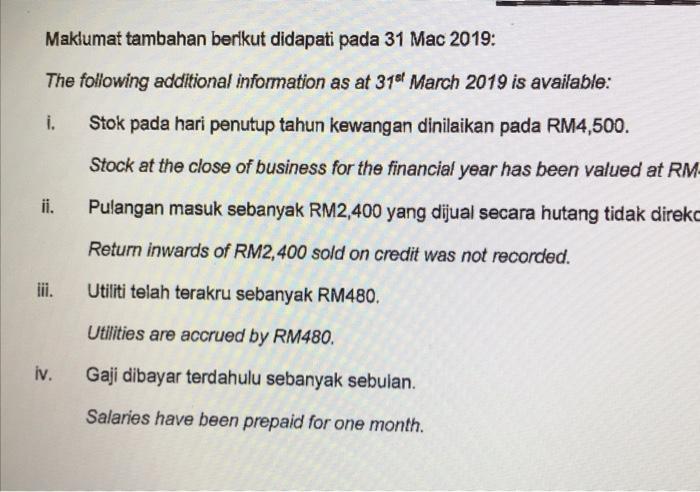

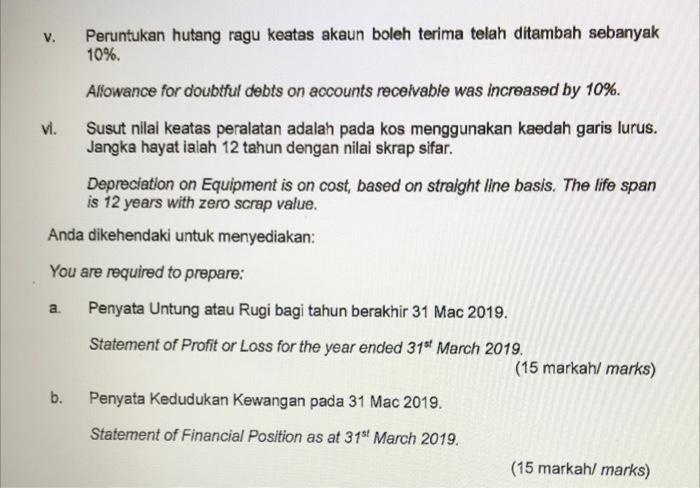

3. Berikut merupakan Imbangan Duga yang diambil daripada buku Shanti Spa pada 31 Mac 2019. The following Trial Balance was extracted from the books of Shanti Spa as at 390 March 2019. Perkaral Particulars Debit Debit (RM) Kredit Credit (RM) 152,800 Jualan/ Sales Belian Purchases Angkutan masuk/ Carriage inwards Ambilan/ Drawings Sewa dan Insuran/ Rent and Insurance Utiliti Utilities Pos dan alat tulis/Postage and Stationery Iklan/ Advertising Gaji Salaries Hutang Lapuk Bad debts Peruntukan Hutang Ragul Allowance for Doubtful Debts Akaun belum terimal Accounts receivable Akaun kena bayarl Accounts payable Tunail Cash Bank/ Bank Stok pada 1 April 2018/ Stock as at 10 April 2018 Peralatan (kos) Equipment (Cost) Susut nilal terkumpul/ Accumulated depreciation Modal Capital 14,500 7,000 10,000 31,200 5,560 900 3,000 65,000 1,670 2,300 9,580 13,500 5,200 15,000 14,000 12,000 6,000 20,000 194,600 194,600 Maklumat tambahan berikut didapati pada 31 Mac 2019: The following additional information as at 31 March 2019 is available: i. Stok pada hari penutup tahun kewangan dinilaikan pada RM4,500. Stock at the close of business for the financial year has been valued at RM- ii. Pulangan masuk sebanyak RM2,400 yang dijual secara hutang tidak direkc Return inwards of RM2,400 sold on credit was not recorded. lii. Utiliti telah terakru sebanyak RM480. Utilities are accrued by RM480. iv. Gaji dibayar terdahulu sebanyak sebulan. Salaries have been prepaid for one month. vi. v. Peruntukan hutang ragu keatas akaun boleh terima telah ditambah sebanyak 10%. Allowance for doubtful debts on accounts receivable was increased by 10%. Susut nilai keatas peralatan adalah pada kos menggunakan kaedah garis lurus. Jangka hayat ialah 12 tahun dengan nilai skrap sifar. Depreciation on Equipment is on cost, based on straight line basis. The life span is 12 years with zero scrap value. Anda dikehendaki untuk menyediakan: You are required to prepare: Penyata Untung atau Rugi bagi tahun berakhir 31 Mac 2019. Statement of Profit or Loss for the year ended 310 March 2019, (15 markah/ marks) b. Penyata Kedudukan Kewangan pada 31 Mac 2019. Statement of Financial Position as at 31st March 2019. (15 markah/ marks) a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started