Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C A 0 O v Chapter 05 Resc X n Not secure Draw Type here to search Expert Chat: Wo X CORPORATE FIN X

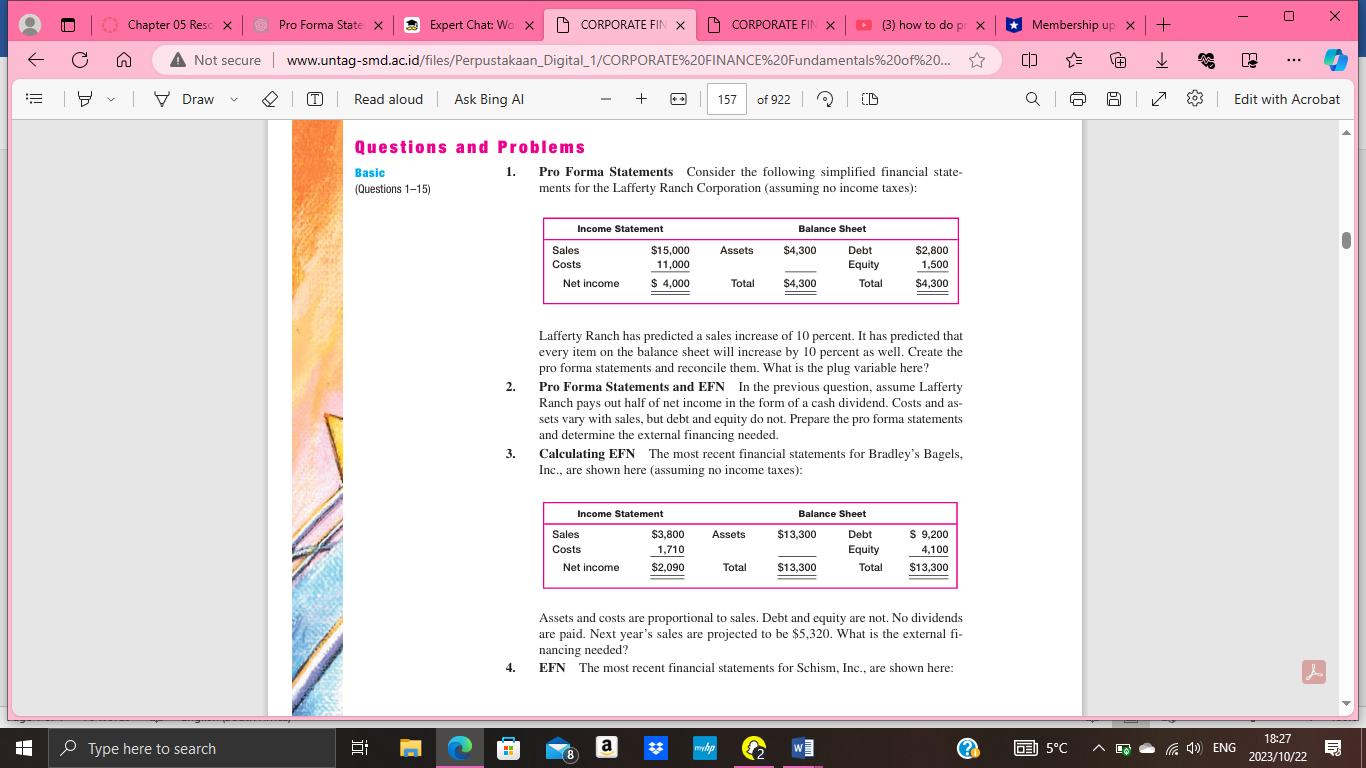

C A 0 O v Chapter 05 Resc X n Not secure Draw Type here to search Expert Chat: Wo X CORPORATE FIN X CORPORATE FIN X | (3) how to do prx www.untag-smd.ac.id/files/Perpustakaan_Digital_1/CORPORATE%20FINANCE %20Fundamentals %20of%20... 1 T | Read aloud | Ask Bing Al Pro Forma State X Questions and Problems Basic (Questions 1-15) 1. 2. 3. 4. I Sales Costs Pro Forma Statements Consider the following simplified financial state- ments for the Lafferty Ranch Corporation (assuming no income taxes): Income Statement Net income + Sales Costs Net income 8 $15,000 11,000 $ 4,000 Income Statement a 157 of 922 Assets $2,090 Total Lafferty Ranch has predicted a sales increase of 10 percent. It has predicted that every item on the balance sheet will increase by 10 percent as well. Create the pro forma statements and reconcile them. What is the plug variable here? Pro Forma Statements and EFN In the previous question, assume Lafferty Ranch pays out half of net income in the form of a cash dividend. Costs and as- sets vary with sales, but debt and equity do not. Prepare the pro forma statements and determine the external financing needed. $3,800 Assets 1,710 www.hp Calculating EFN The most recent financial statements for Bradley's Bagels, Inc., are shown here (assuming no income taxes): Total Balance Sheet Debt $4,300 $4.300 2 | 0:0 $13,300 Equity $13,300 = Total Balance Sheet W Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $5,320. What is the external fi- nancing needed? EFN The most recent financial statements for Schism, Inc., are shown here: $2,800 1,500 $4,300 Debt Equity Total $ 9,200 4,100 $13,300 ? Membership up x + CA (1) QI GE 5C L + I 503 I (4) ENG n ... Edit with Acrobat A X 18:27 2023/10/22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started