Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(c) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the gross profit if

| (c) | Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the gross profit if the inventory is valued at FIFO? |

| (d) | Why is it stated that LIFO usually produces a lower gross profit than FIFO? |

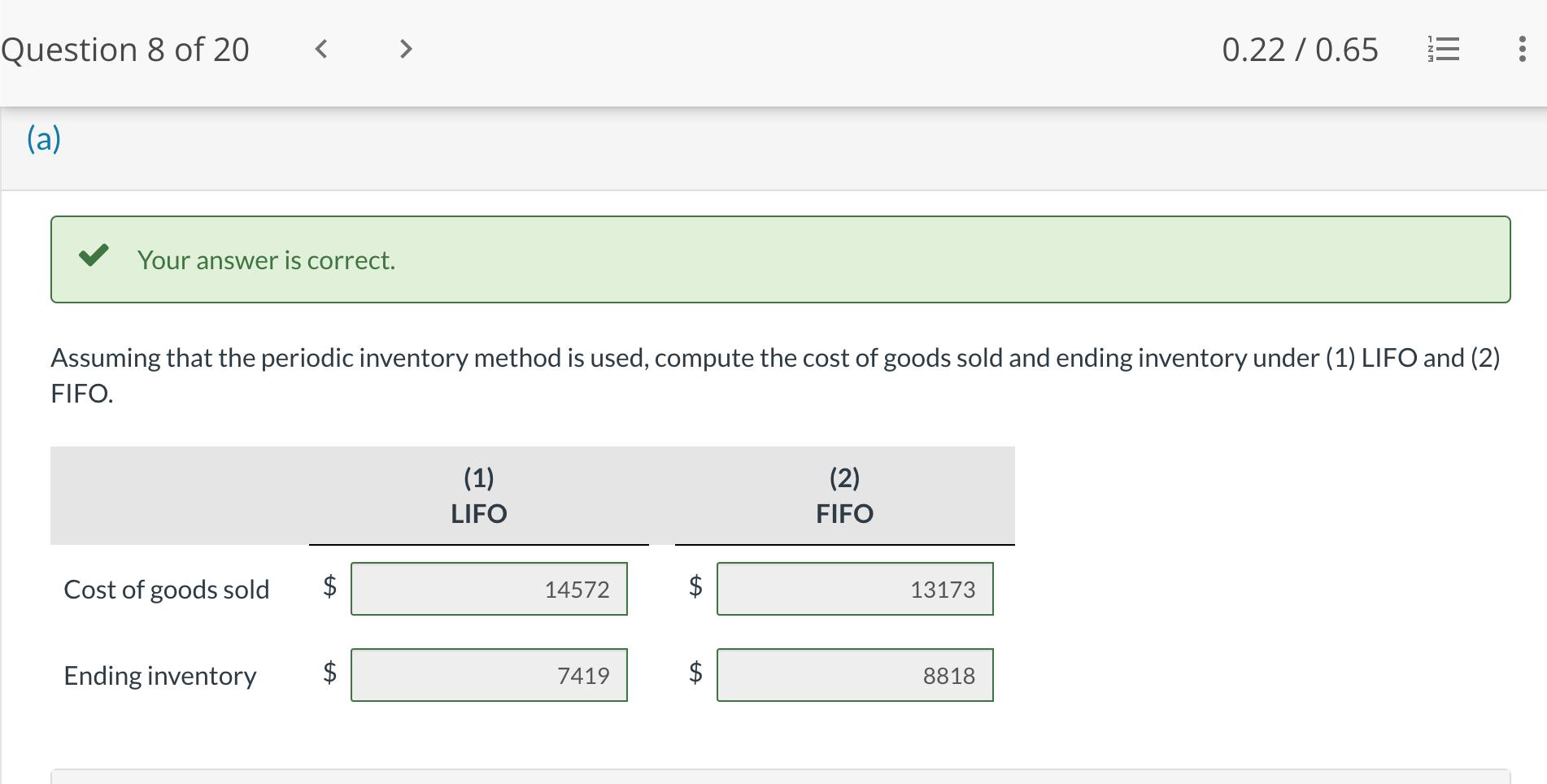

Inventory information for Part 311 of Concord Corp. discloses the following information for the month of June. June 1 (a) 11 20 Balance Purchased Purchased 299 units @ $11 798 units @ $14 502 units @ $15 Your answer is correct. June 10 15 27 Sold Sold Sold 197 units @ $27 503 units @ $29 305 units @ $31 Assuming that the periodic inventory method is used, compute the cost of goods sold and ending inventory under (1) LIFO and (2) FIFO.

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

2 Perpetual LIFO Ending inventory 102 x 11 295 14 19...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started