Answered step by step

Verified Expert Solution

Question

1 Approved Answer

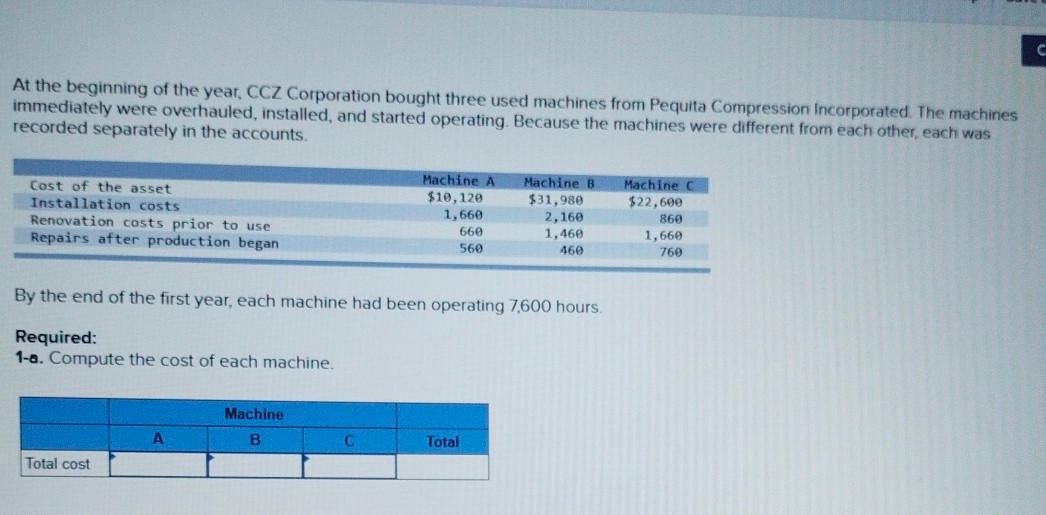

c At the beginning of the year, CCZ Corporation bought three used machines from Pequita Compression Incorporated. The machines immediately were overhauled, installed, and started

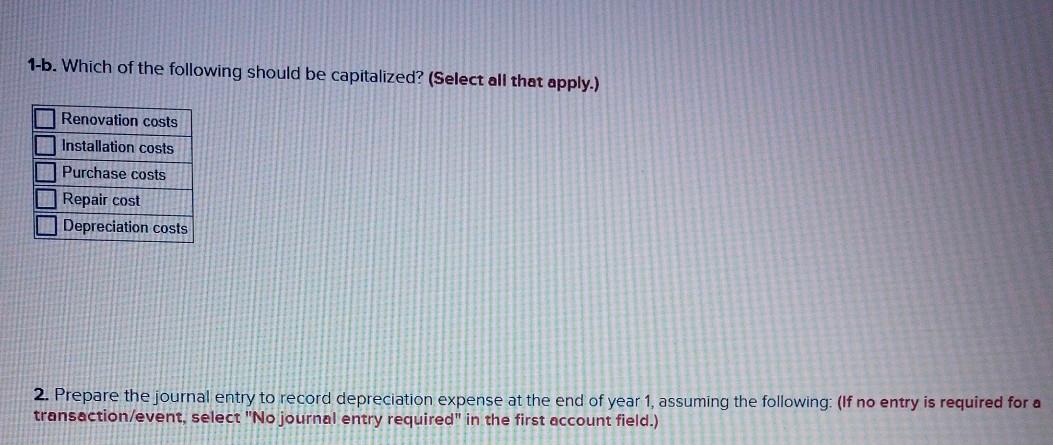

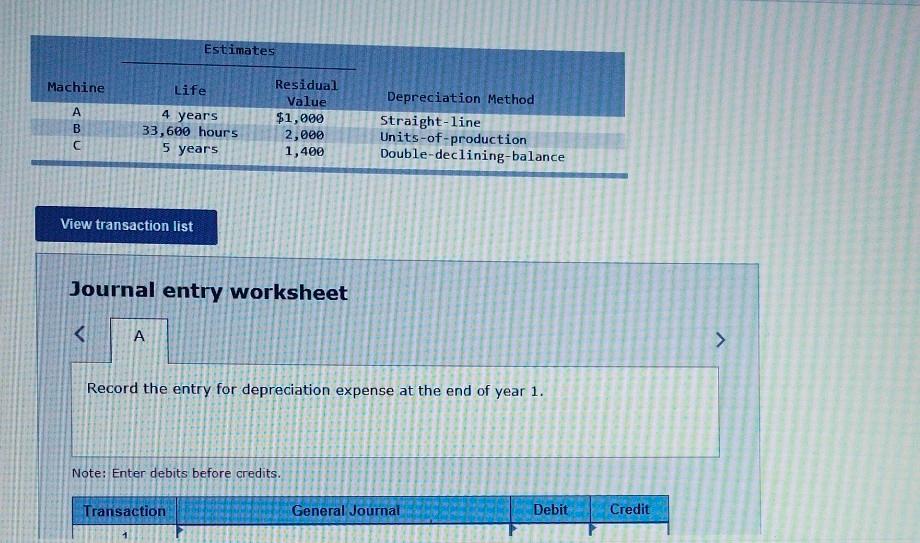

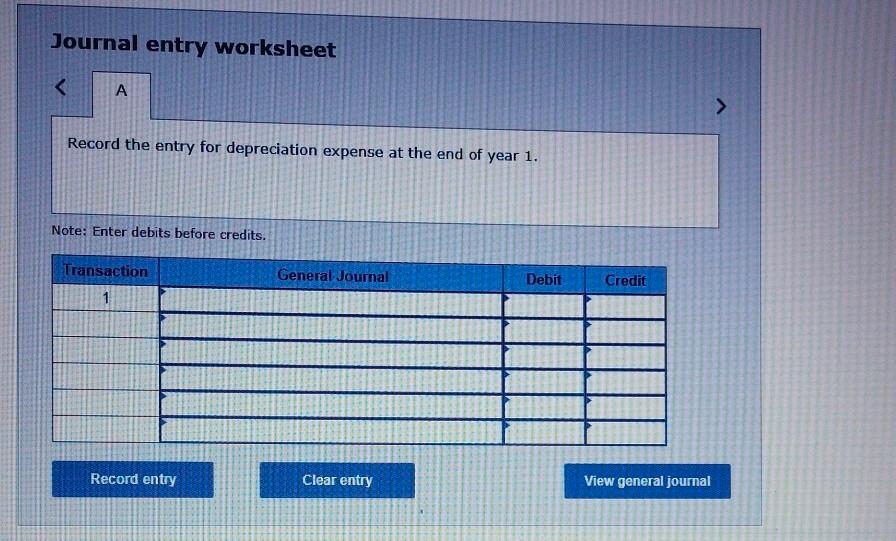

c At the beginning of the year, CCZ Corporation bought three used machines from Pequita Compression Incorporated. The machines immediately were overhauled, installed, and started operating. Because the machines were different from each other, each was recorded separately in the accounts. Cost of the asset Installation costs Renovation costs prior to use Repairs after production began Machine A $10,120 1,660 660 560 Machine B $31,989 2,160 1,460 460 Machine c $22,600 860 1,660 769 By the end of the first year, each machine had been operating 7.600 hours. Required: 1-a. Compute the cost of each machine. Machine A B Total Total cost 1-b. Which of the following should be capitalized? (Select all that apply.) Renovation costs Installation costs Purchase costs Repair cost Depreciation costs 2. Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Estimates Machine Life 4 B 4 years 33,600 hours 5 years Residual Value $1,000 2,000 1,400 Depreciation Method Straight-line Units-of-production Double-declining-balance View transaction list Journal entry worksheet A > Record the entry for depreciation expense at the end of year 1. Note: Enter debits before credits. Transaction General Journal Debit Credit Journal entry worksheet Record the entry for depreciation expense at the end of year 1. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started