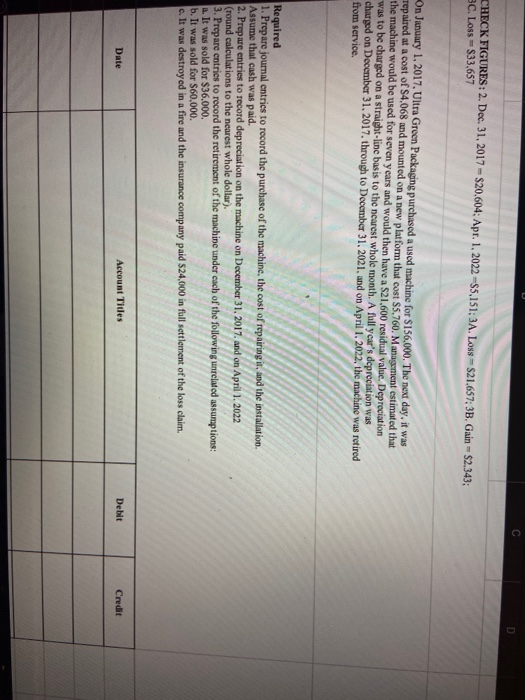

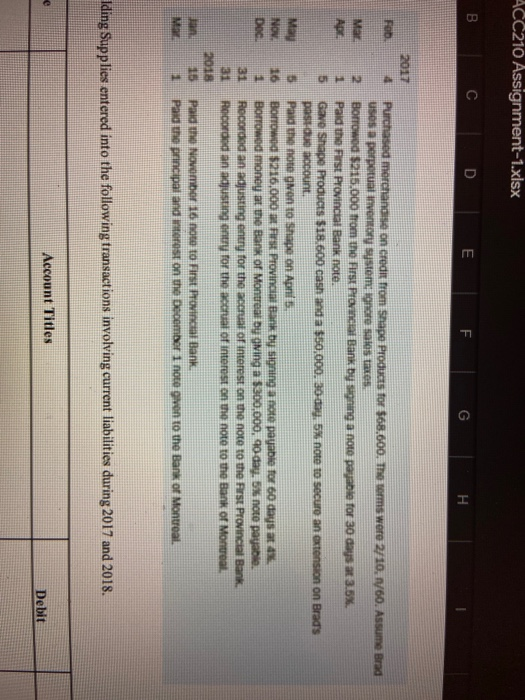

C D CHECK FIGURES: 2. Dec 31, 2017 - $20.604: Apr. 1, 2022-55,151: 3A. Loss - S21.657; 3B. Gain = $2.343; BC. Loss = $33.657 On January 1, 2017. Ultra Green Packaging purchased a used machine for $156,000. The next day, it was repaired at a cost of $4.068 and mounted on a new platform that cost $5.760. Management estimated that the machine would be used for seven years and would then have a $21.600 residual value. Depreciation was to be charged on a straight-line basis to the nearest whole month. A full year's depreciation was charged on December 31, 2017, through to December 31, 2021, and on April 1, 2022, the machine was retired from service. Required 1. Prepare journal entries to record the purchase of the machine, the cost of repairing it, and the installation. Assume that cash was paid. 2. Prepare entries to record depreciation on the machine on December 31, 2017, and on April 1, 2022 (round calculations to the nearest whole dollar). 3. Prepare entries to record the retirement of the machine under each of the following unrelated assumptions: a. It was sold for $36.000. b. It was sold for S60.000. c. It was destroyed in a fire and the insurance company paid $24,000 in full settlement of the loss claim. Date Account Titles Debit Credit ACC210 Assignment-1.xlsx B C D E F. 2017 FOD Mar Apr 2 1 5 Purchased merchandise on credir from Shape Products for $68.600. The terms were 2/10.1/60. Assume Brad Usos perpetual inventory system: ignore sales taxes. Borrowed $215.000 from the First Provincial Bank by signing a noto payable for 30 days at 3.5% Paid the First Provincial Bank note. Gave Shape Products $18.600 cash and a $50,000. 30 day, 5% not to secure an extension on Brad's pastu account. Paid the note gvon to Shape on Apni 5. Borrowed $216.000 m First Provincial Bank by signing a note payable for 60 days at 47 Borrowed money at the Bank of Montreal by aving a $300,000, 90 day, 5 noto payable Recorded an adjusting entry for the accruat of interest on the note to the First Provincial Bank Recorded an adjusting entry for the accruat of interest on the note to the Bank of Montreal May NOV. DOC 5 16 31 31 2018 15 Paide NOVOmor 16 not to First Provincia Bank Paid the principal and interest on the December 1 note given to the Bank of Montreal M 1 Iding Supplies entered into the following transactions involving current liabilities during 2017 and 2018. Account Titles Debit