Answered step by step

Verified Expert Solution

Question

1 Approved Answer

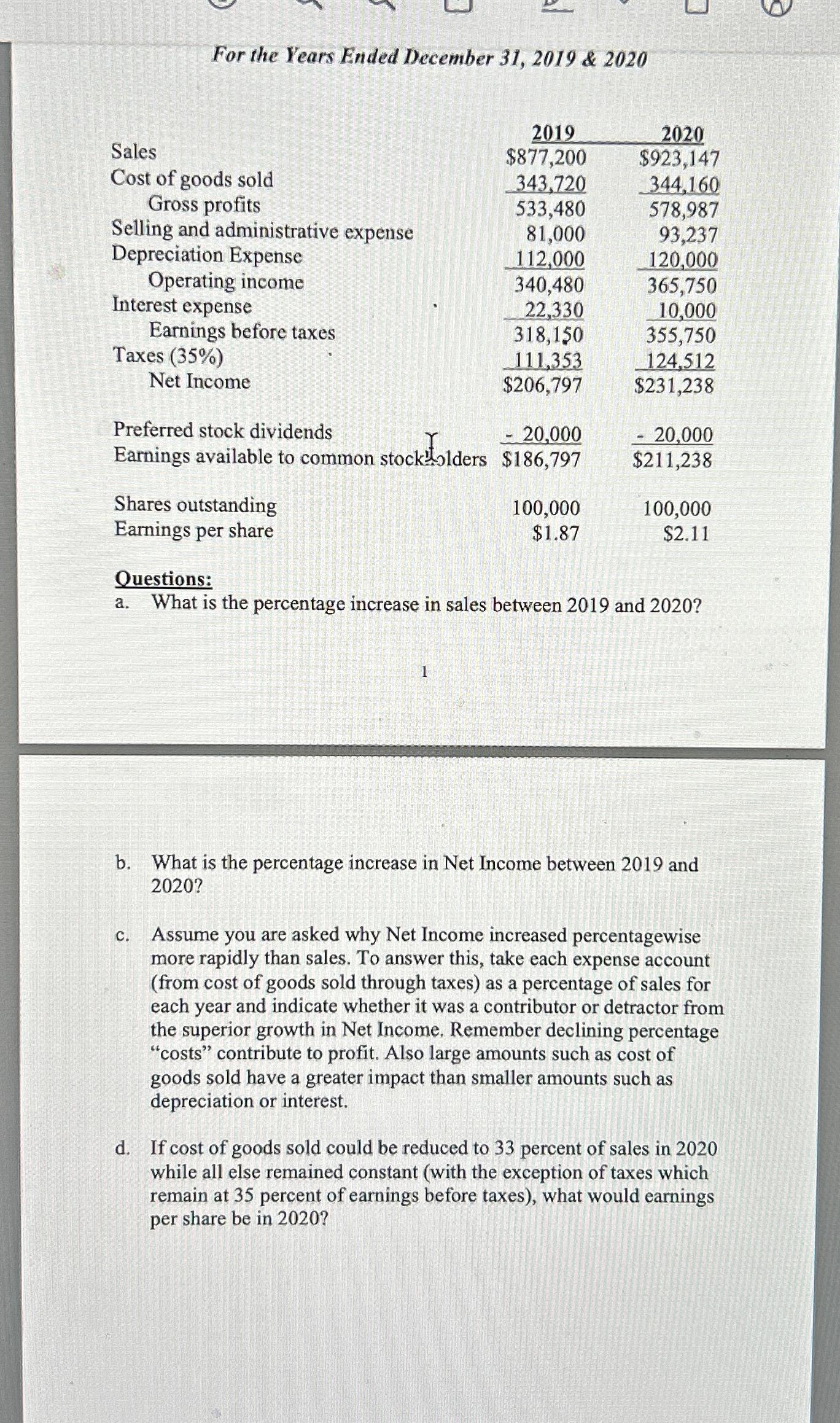

C For the Years Ended December 31, 2019 & 2020 2019 2020 Sales $877,200 $923,147 Cost of goods sold 343,720 344,160 Gross profits 533,480

C For the Years Ended December 31, 2019 & 2020 2019 2020 Sales $877,200 $923,147 Cost of goods sold 343,720 344,160 Gross profits 533,480 578,987 Selling and administrative expense 81,000 93,237 Depreciation Expense 112,000 120,000 Operating income 340,480 365,750 Interest expense 22,330 10,000 Earnings before taxes 318,150 355,750 Taxes (35%) 111,353 124,512 Net Income $206,797 $231,238 Preferred stock dividends - 20,000 - 20,000 Earnings available to common stockholders $186,797 stock!olders $211,238 Shares outstanding Earnings per share Questions: 100,000 100,000 $1.87 $2.11 a. What is the percentage increase in sales between 2019 and 2020? 1 b. What is the percentage increase in Net Income between 2019 and 2020? C. Assume you are asked why Net Income increased percentagewise more rapidly than sales. To answer this, take each expense account (from cost of goods sold through taxes) as a percentage of sales for each year and indicate whether it was a contributor or detractor from the superior growth in Net Income. Remember declining percentage "costs" contribute to profit. Also large amounts such as cost of goods sold have a greater impact than smaller amounts such as depreciation or interest. d. If cost of goods sold could be reduced to 33 percent of sales in 2020 while all else remained constant (with the exception of taxes which remain at 35 percent of earnings before taxes), what would earnings per share be in 2020?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Percentage increase in sales between 2019 and 2020 Sales increase 2020 Sales 2019 Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started