Answered step by step

Verified Expert Solution

Question

1 Approved Answer

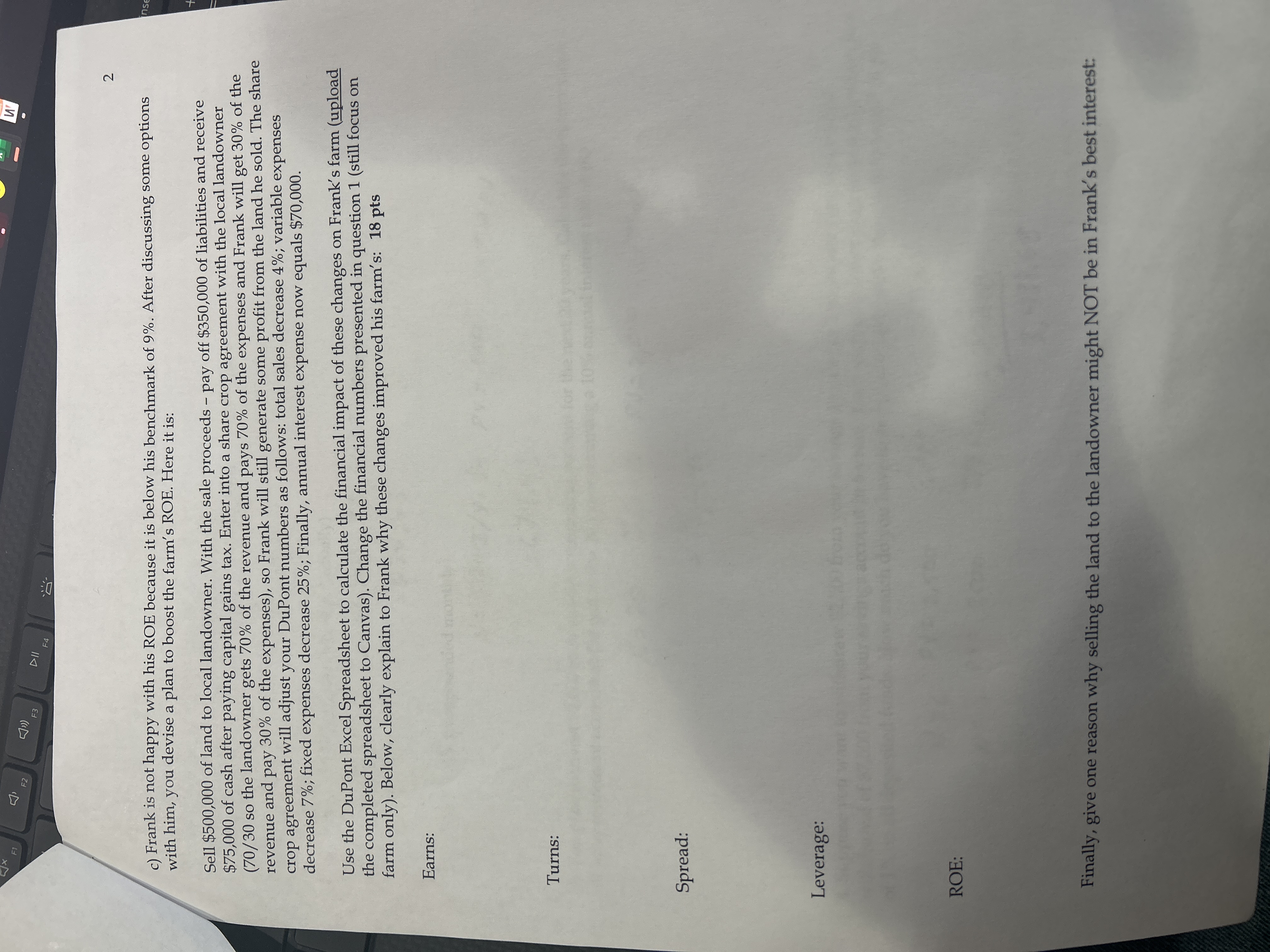

c ) Frank is not happy with his ROE because it is below his benchmark of 9 % . After discussing some options with him,

c Frank is not happy with his ROE because it is below his benchmark of After discussing some options

with him, you devise a plan to boost the farm's ROE. Here it is:

Sell $ of land to local landowner. With the sale proceeds pay off $ of liabilities and receive

$ of cash after paying capital gains tax. Enter into a share crop agreement with the local landowner

so the landowner gets of the revenue and pays of the expenses and Frank will get of the

revenue and pay of the expenses so Frank will still generate some profit from the land he sold. The share

crop agreement will adjust your DuPont numbers as follows: total sales decrease ; variable expenses

decrease ; fixed expenses decrease ; Finally, annual interest expense now equals $

Use the DuPont Excel Spreadsheet to calculate the financial impact of these changes on Frank's farm upload

the completed spreadsheet to Canvas Change the financial numbers presented in question still focus on

farm only Below, clearly explain to Frank why these changes improved his farm's: pts

Earns:

Turns:

Spread:

Leverage:

ROE:

Finally, give one reason why selling the land to the landowner might NOT be in Frank's best interest:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started