Answered step by step

Verified Expert Solution

Question

1 Approved Answer

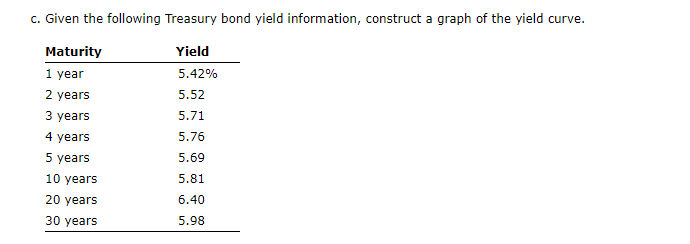

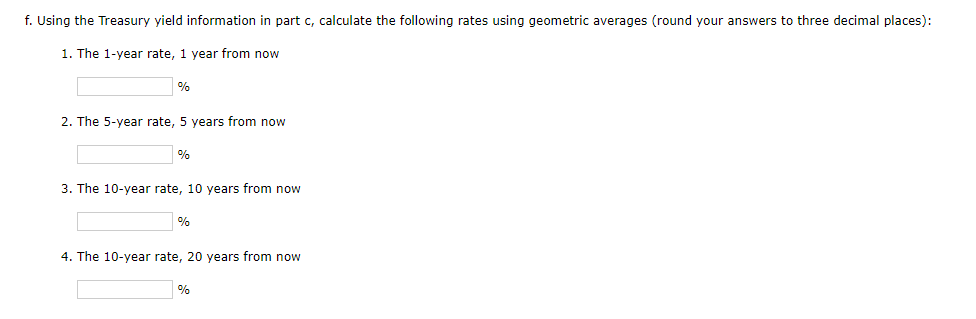

c. Given the following Treasury bond yield information, construct a graph of the yield curve. f. Using the Treasury yield information in part c, calculate

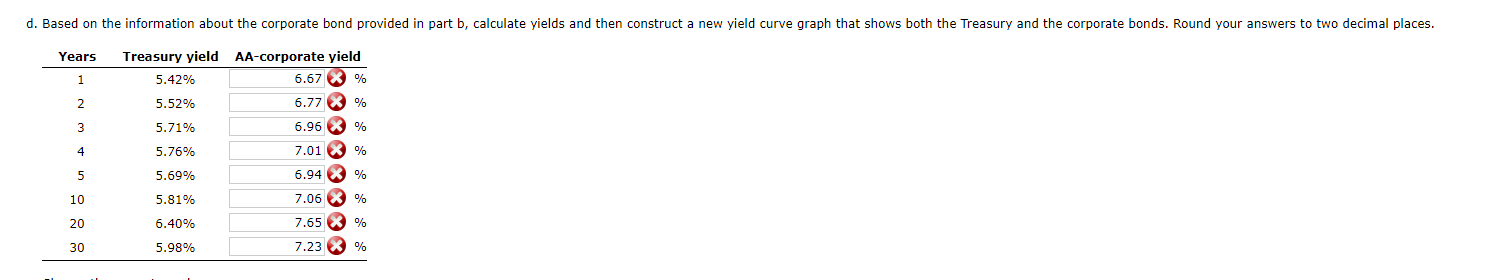

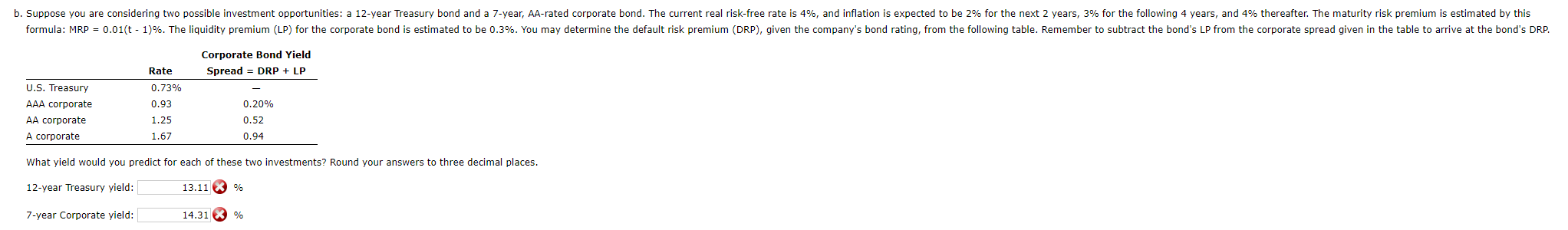

c. Given the following Treasury bond yield information, construct a graph of the yield curve. f. Using the Treasury yield information in part c, calculate the following rates using geometric averages (round your answers to three decimal places): 1. The 1 -year rate, 1 year from now % 2. The 5-year rate, 5 years from now % 3. The 10 -year rate, 10 years from now % 4. The 10 -year rate, 20 years from now % \begin{tabular}{|c|c|c|} \hline Years & Treasury yield & AA-corporate yield \\ \hline 1 & 5.42% & 6.67% \\ \hline 2 & 5.52% & 6.77 \\ \hline 3 & 5.71% & 6.96 \\ \hline 4 & 5.76% & 7.01 \\ \hline 5 & 5.69% & 6.94% \\ \hline 10 & 5.81% & 7.06% \\ \hline 20 & 6.40% & 7.65% \\ \hline 30 & 5.98% & 7.23% \\ \hline \end{tabular} What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 7-year Corporate yield: 3% (3)

c. Given the following Treasury bond yield information, construct a graph of the yield curve. f. Using the Treasury yield information in part c, calculate the following rates using geometric averages (round your answers to three decimal places): 1. The 1 -year rate, 1 year from now % 2. The 5-year rate, 5 years from now % 3. The 10 -year rate, 10 years from now % 4. The 10 -year rate, 20 years from now % \begin{tabular}{|c|c|c|} \hline Years & Treasury yield & AA-corporate yield \\ \hline 1 & 5.42% & 6.67% \\ \hline 2 & 5.52% & 6.77 \\ \hline 3 & 5.71% & 6.96 \\ \hline 4 & 5.76% & 7.01 \\ \hline 5 & 5.69% & 6.94% \\ \hline 10 & 5.81% & 7.06% \\ \hline 20 & 6.40% & 7.65% \\ \hline 30 & 5.98% & 7.23% \\ \hline \end{tabular} What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 7-year Corporate yield: 3% (3) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started