c

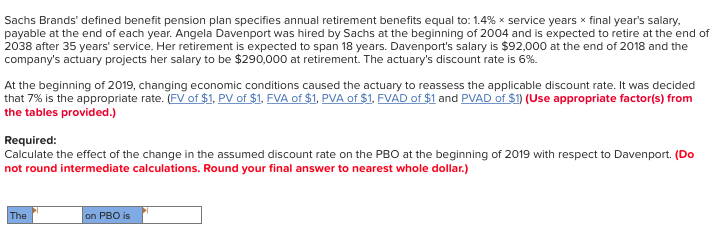

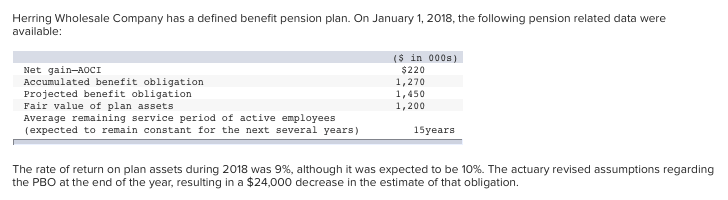

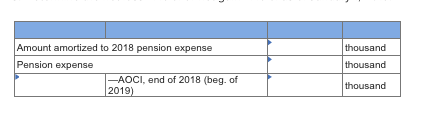

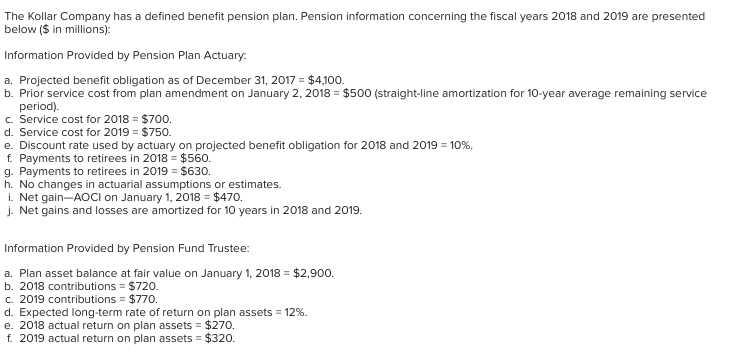

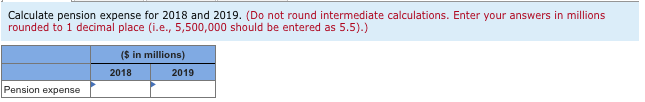

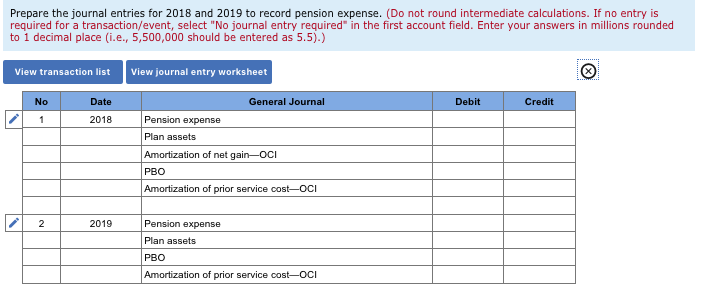

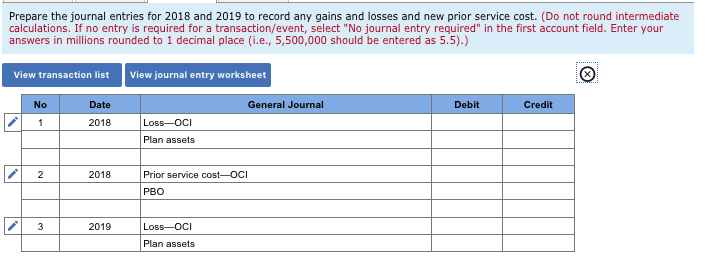

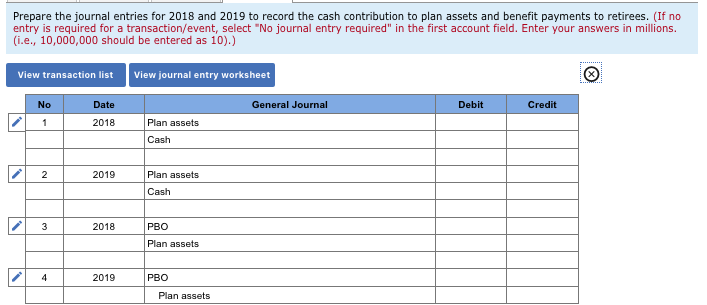

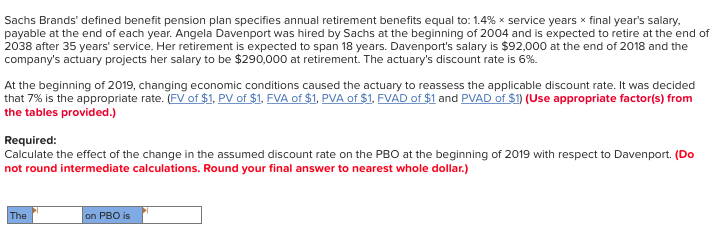

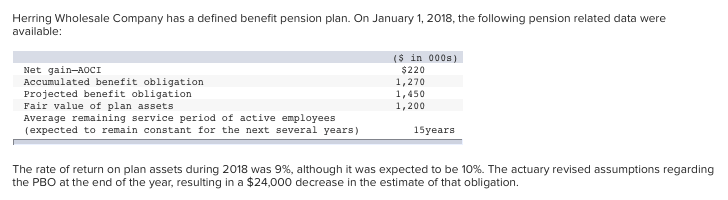

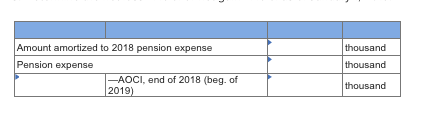

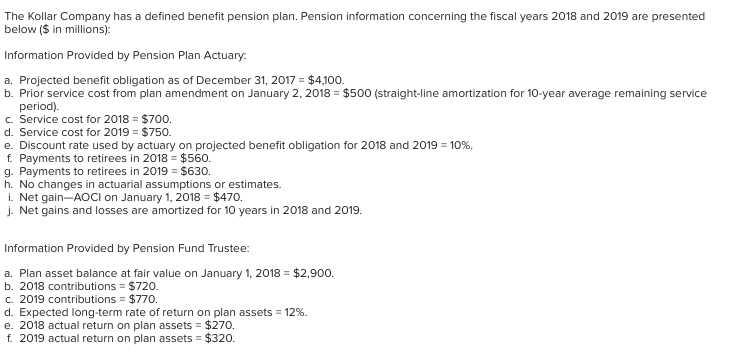

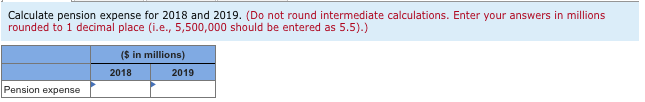

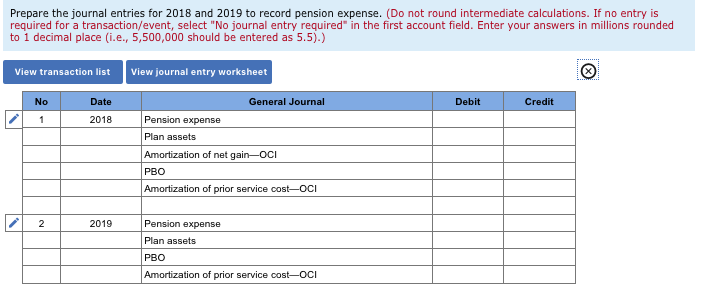

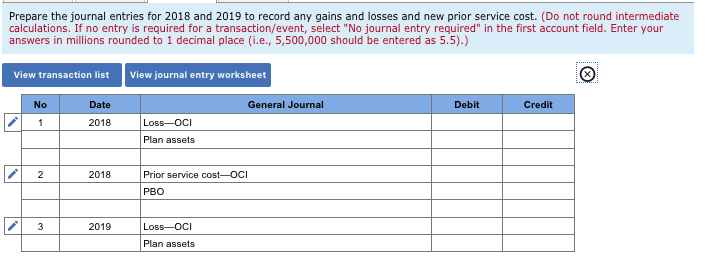

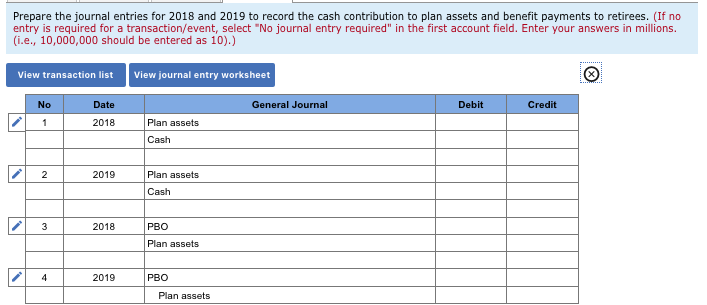

Herring Wholesale Company has a defined benefit pension plan. On January 1, 2018, the following pension related data were available: ($ in 000s) Net qain-AOCI Accumulated benefit obligation Projected benefit obliqation Fair value of plan assets Average remaining service period of active employees (expected to remain constant for the next several years) $220 1,270 1,450 1,200 15years The rate of return on plan assets during 2018 was 9%, although it was expected to be 10%. The actuary revised assumptions regarding the PBO at the end of the year, resulting in a $24,000 decrease in the estimate of that obligation Amount amortized to 2018 pension expense Pension expense thousand thousand -AOCI, end of 2018 (beg. of 2019) thousand The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2018 and 2019 are presented below ($in millions): Information Provided by Pension Plan Actuary a. Projected benefit obligation as of December 31, 2017 $4,100. b. Prior service cost from plan amendment on January 2, 2018 $500 (straight-line amortization for 10-year average remaining service period) c. Service cost for 2018 $700 d. Service cost for 2019 $750 e. Discount rate used by actuary on projected benefit obligation for 2018 and 2019 10 % f. Payments to retirees in 2018 $560 g. Payments to retirees in 2019 $630 h. No changes in actuarial assumptions or estimates. i. Net gain-AOCI on January 1, 2018 $470 j Net gains and losses are amortized for 10 years in 2018 and 2019 Information Provided by Pension Fund Trustee a. Plan asset balance at fair value on January 1, 2018 $2,900. b. 2018 contributions $720. c. 2019 contributions $770. d. Expected long-term rate of return on plan assets 12 % e. 2018 actual return on plan assets $270. f. 2019 actual return on plan assets $320. Calculate pension expense for 2018 and 2019. (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) (S in millions) 2018 2019 Pension expense Prepare the journal entries for 2018 and 2019 to record pension expense. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View journal entry works heet View transaction list No Date General Journal Debit Credit 1 Pension expense 2018 Plan assets Amortization of net gain-OCI PBO Amortization of prior service cost-OCI Pension expense 2019 Plan assets PBO Amortization of prior service cost-OCI Prepare the journal entries for 2018 and 2019 to record any gains and losses and new prior service cost. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list View journal entry worksheet General Journal No Date Debit Credit 1 2018 Loss-OCI Plan assets Prior service cost-OCI 2 2018 PBO 3 2019 Loss-OCI Plan assets Prepare the journal entries for 2018 and 2019 to record the cash contribution to plan assets and benefit payments to retirees. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) View transaction list View journal entry worksheet General Journal No Date Debit Credit 2018 Plan assets Cash Plan assets 2 2019 Cash 2018 O Plan assets 4 2019 PRO Plan assets