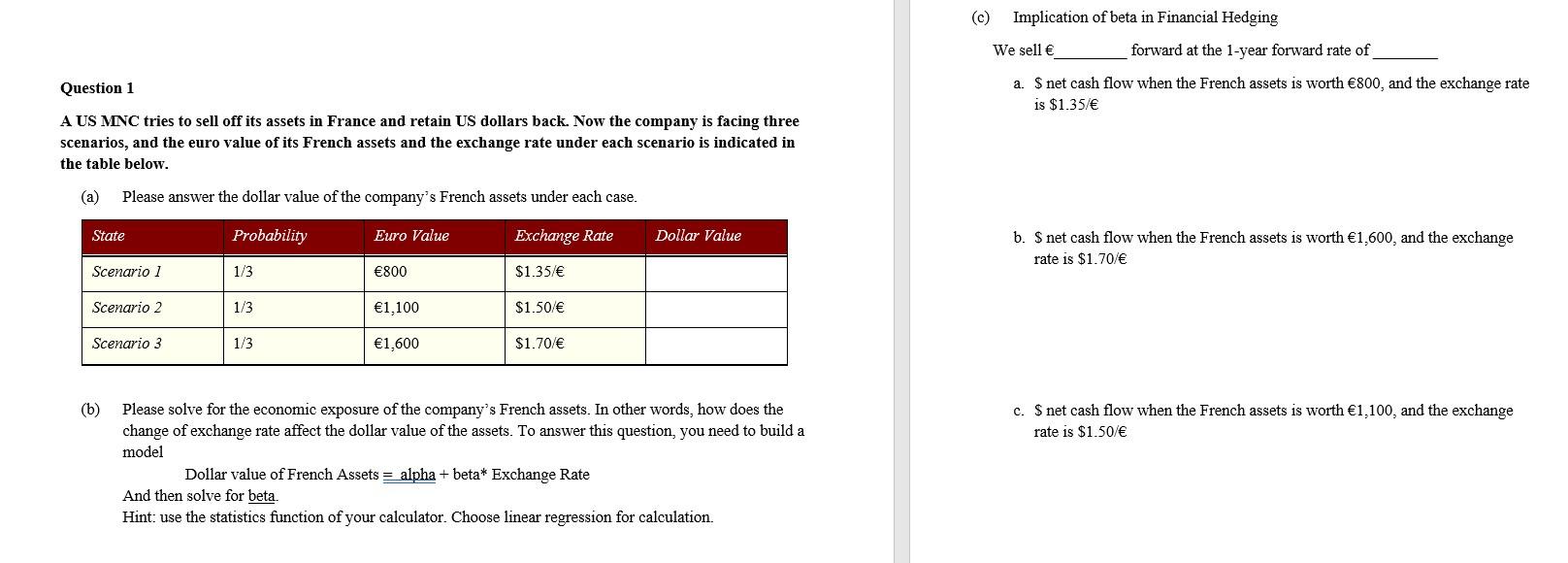

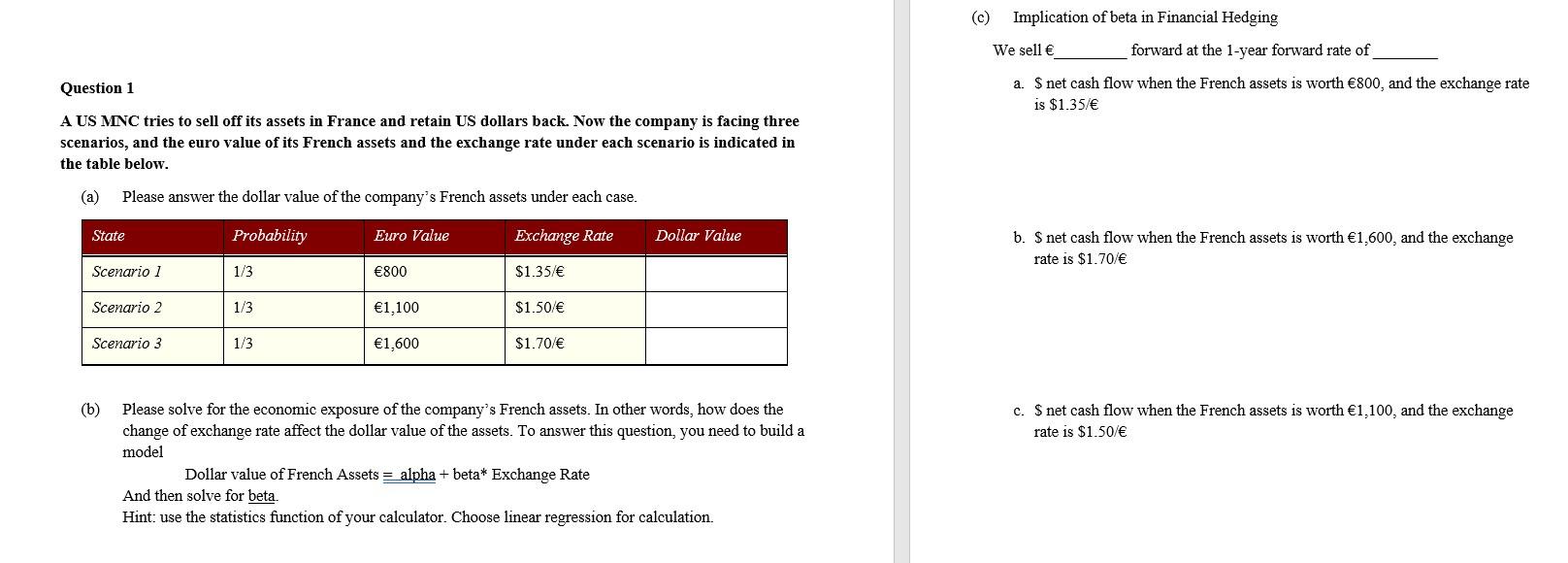

(c) Implication of beta in Financial Hedging We sell forward at the 1-year forward rate of a. S net cash flow when the French assets is worth 800, and the exchange rate is $1.35/ Question 1 A US MNC tries to sell off its assets in France and retain US dollars back. Now the company is facing three scenarios, and the euro value of its French assets and the exchange rate under each scenario is indicated in the table below. (a) Please answer the dollar value of the company's French assets under each case. State Probability Euro Value Exchange Rate Dollar Value b. S net cash flow when the French assets is worth 1,600, and the exchange rate is $1.70/ Scenario 1 1/3 800 $1.35/ Scenario 2 1/3 1,100 $1.50/ Scenario 3 1/3 1,600 $1.70/ (b) c. $ net cash flow when the French assets is worth 1,100, and the exchange rate is $1.50/ Please solve for the economic exposure of the company's French assets. In other words, how does the change of exchange rate affect the dollar value of the assets. To answer this question, you need to build a model Dollar value of French Assets = alpha + beta* Exchange Rate And then solve for beta. Hint: use the statistics function of your calculator. Choose linear regression for calculation. (c) Implication of beta in Financial Hedging We sell forward at the 1-year forward rate of a. S net cash flow when the French assets is worth 800, and the exchange rate is $1.35/ Question 1 A US MNC tries to sell off its assets in France and retain US dollars back. Now the company is facing three scenarios, and the euro value of its French assets and the exchange rate under each scenario is indicated in the table below. (a) Please answer the dollar value of the company's French assets under each case. State Probability Euro Value Exchange Rate Dollar Value b. S net cash flow when the French assets is worth 1,600, and the exchange rate is $1.70/ Scenario 1 1/3 800 $1.35/ Scenario 2 1/3 1,100 $1.50/ Scenario 3 1/3 1,600 $1.70/ (b) c. $ net cash flow when the French assets is worth 1,100, and the exchange rate is $1.50/ Please solve for the economic exposure of the company's French assets. In other words, how does the change of exchange rate affect the dollar value of the assets. To answer this question, you need to build a model Dollar value of French Assets = alpha + beta* Exchange Rate And then solve for beta. Hint: use the statistics function of your calculator. Choose linear regression for calculation