Question

C++ PLEASE!! ---- You will develop an application that allows users to see how their investments will grow over time. Airgead Banking has provided you

C++ PLEASE!! ----

You will develop an application that allows users to see how their investments will grow over time. Airgead Banking has provided you with a list of functional requirements that describe what they need their application to do.

Directions

- Review the Airgead Banking App Functional Requirements, located in the Supporting Materials section. Create pseudocode or a flowchart to plan your coding project. Outline your code step-by-step so that you can use it as a guide when coding. This will be submitted along with your zipped application.

- Do not write code yet. You will do that in Step 3. For this step, write your thoughts in English of what the program should do.

- Dont be concerned with syntax, just list statements, each describing a single action.

- List all steps.

- Use proper naming conventions.

- Keep it simpleuse only one statement per line.

- Develop an object-oriented programming (OOP) application using secure and efficient C++ code. Make sure that your application:

- Meets all specifications listed in the Airgead Banking App Functional Requirements

- Follows best practices described in the Airgead Banking Standards document

- Includes in-line comments

- When your solution is finished, zip your project including all components (CPP, H, and any other files used).

- Upload your zipped project file and pseudocode or flowchart to the project submission area.

Airgead Banking App Functional Requirements

1. Airgead Banking wants a screen to display with the following information:

Initial Investment Amount: The starting amount of your investment (a positive real number)

Monthly Deposit: The amount you plan to contribute to the growth of your investment each month (a positive real number)

Annual Interest (Compounded): Interest that is added to the principal sum of your investment and its previously accumulated interest (interest on interest and principal)

Number of Years: The number of years your investment has to grow

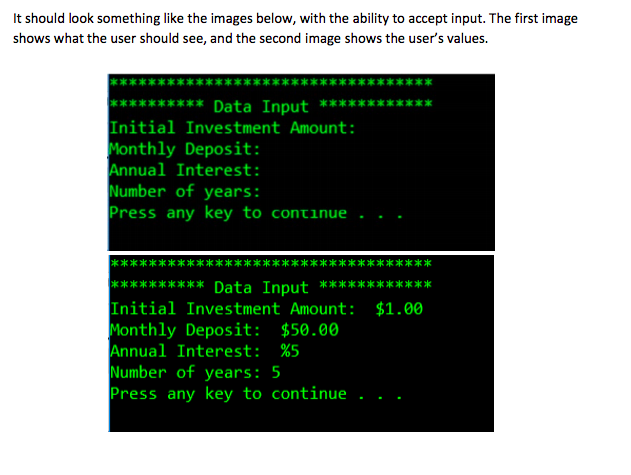

A way to see the data (for example: Press any key to continue) It should look something like the images below, with the ability to accept input. The first image shows what the user should see, and the second image shows the users values.

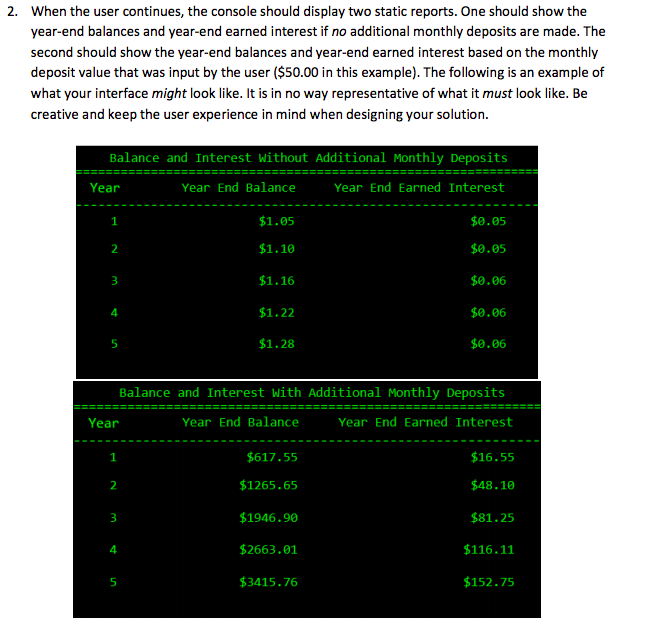

3. The user should be able to test different monthly deposit amounts, interest rates, and lengths of time to see how increases and decreases impact their investment growth.

4. Your code will need to account for the following:

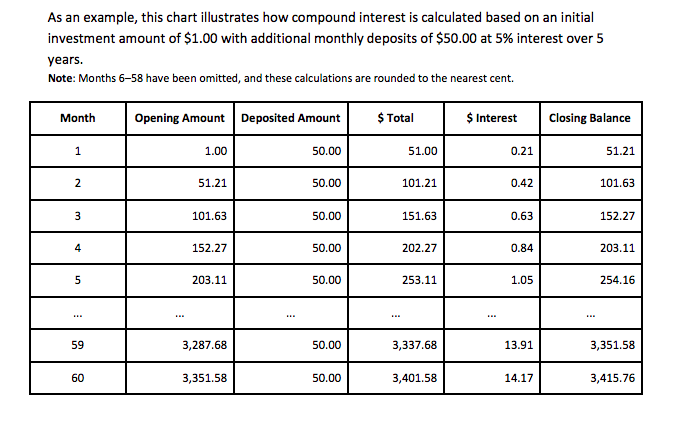

a. Month: The number of months based on user input in the Number of Years field

b. Opening Amount: The initial investment amount as well as the opening balance each month, which includes interest

c. Deposited Amount: The dollar amount the user plans to deposit each month. This value will be the same every month for the duration of the investment.

d. Total: The sum of the opening and deposited amounts

e. Interest: Money earned based on the annual interest rate input by the user. The interest based on an opening amount of $1 and a deposited amount of $50 with an interest rate of 5% compounded monthly is: (Opening Amount + Deposited Amount) * ((Interest Rate/100)/12) OR (1 + 50) * ((5/100)/12)

Note: Dividing by 100 converts the interest rate percentage to a decimal.

Note: 12 is the number of months in a year. Dividing the yearly amount by twelve gives monthly compounded interest.

f. Closing Balance: The sum of the total and interest amounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started