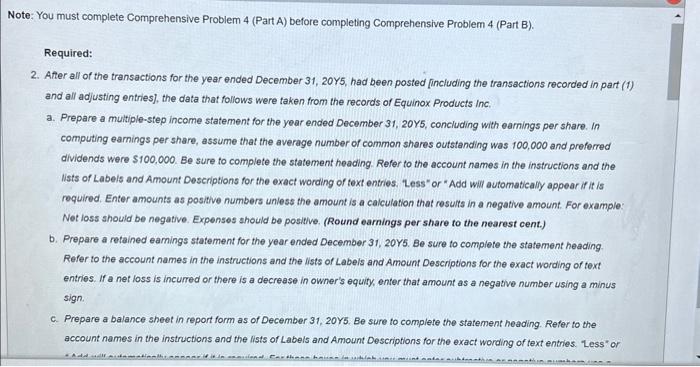

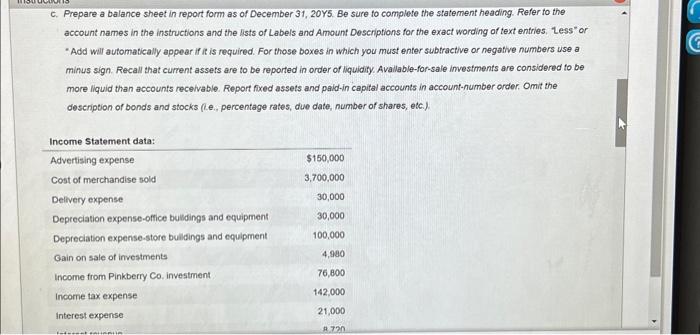

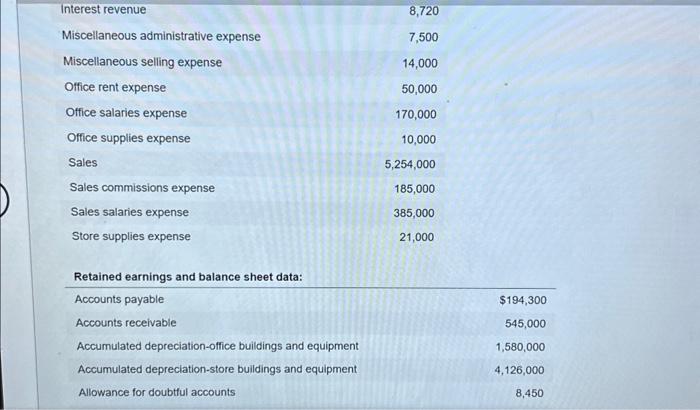

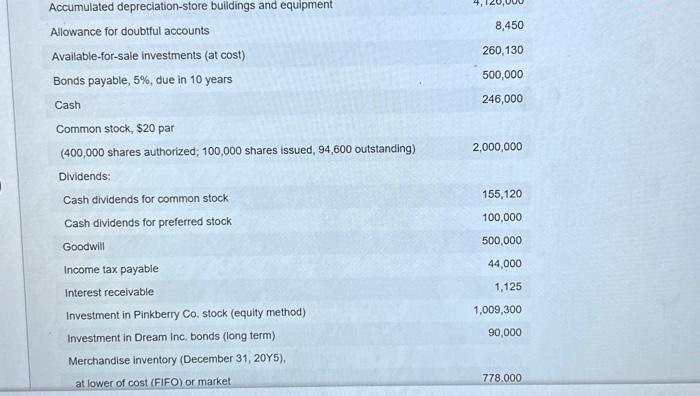

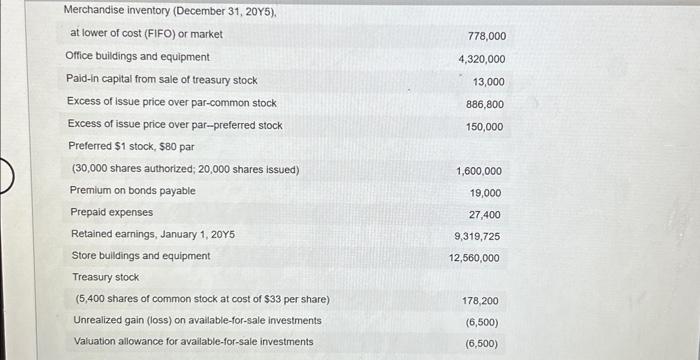

c. Prepare a balance sheet in report form as of December 31,20Y5. Be sure to complete the statement heading. Refer to the account names in the instructions and the lists of Labels and Amount Descriptions for the exact wording of text entries, Less " or - Add will automatically appear if it is required. For those boxes in which you must enter subtractive or negative numbers use a minus sign. Recall that current assets are to be reported in order of liquidity. Avallable-for-sale investments are considered to be more liquid than accounts recelvable. Report fixed assets and paid-in capital accounts in account-number order. Omit the description of bonds and stocks (Le., percentage rates, due date, number of shares, etc.). Accumulated depreciation-store buildings and equipment Allowance for doubtful accounts Available-for-sale investments (at cost) Bonds payable, 5%, due in 10 years Cash 8,450 260,130 500,000 246,000 Common stock, \$20 par (400,000 shares authorized; 100,000 shares issued, 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory (December 31, 20Y5), at lower of cost (FIFO) or market 778.000 ote: You must complete Comprehensive Problem 4 (Part A) before completing Comprehensive Problem 4 (Part B). Required: 2. After all of the transactions for the year ended December 31,20 Y, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products inc. a. Prepare a multiple-step income statement for the year ended December 31,20 Y5, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were $100,000. Be sure to complete the statement heading. Refer to the account names in the instructions and the lists of Labels and Amount Descriptions for the exact wording of text entries. Less" or "Add will automatically appear if it is required. Enter amounts as positive numbers unless the amount is a calculation that resurts in a negative amount. For example: Net loss should be negative. Expenses should be positive. (Round earnings per share to the nearest cent.) b. Prepare a retained eamings statement for the year ended December 31,20Y5. Be sure to complete the statement heading. Refer to the account names in the instructions and the lists of Labels and Amount Descriptions for the exact wording of text entries. If a net loss is incurred or there is a decrease in owner's equity, enter that amount as a negative number using a minus sign. c. Prepare a balance sheet in report form as of December 31,20Y5. Be sure to complete the statement heading. Refer to the account names in the instructions and the lists or Labels and Amount Descriptions for the exact wording of text entries. Less " or Interest revenue Miscellaneous administrative expense Miscellaneous selling expense Office rent expense Office salaries expense Office supplies expense Sales Sales commissions expense Sales salaries expense Store supplies expense 8,720 7,500 14,000 50,000 170,000 10,000 5,254,000 185,000 385,000 21,000 Retained earnings and balance sheet data: Accounts payable $194,300 Accounts receivable 545,000 Accumulated depreciation-office buildings and equipment 1,580,000 Accumulated depreciation-store buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Merchandise inventory (December 31, 20Y5), at lower of cost (FIFO) or market Office buildings and equipment Paid-in capital from sale of treasury stock Excess of issue price over par-common stock Excess of issue price over par-preferred stock Preferred \$1 stock, $80 par (30,000 shares authorized; 20,000 shares issued) Premium on bonds payable Prepaid expenses Retained earnings, January 1,20Y5 Store bulldings and equipment Treasury stock (5,400 shares of common stock at cost of $33 per share) Unrealized gain (loss) on available-for-sale investments Valuation allowance for available-for-sale investments 778,000 4,320,000 13,000 886,800 150,000 1,600,000 19,000 27,400 9,319,725 12,560,000 178,200 (6,500) (6,500)