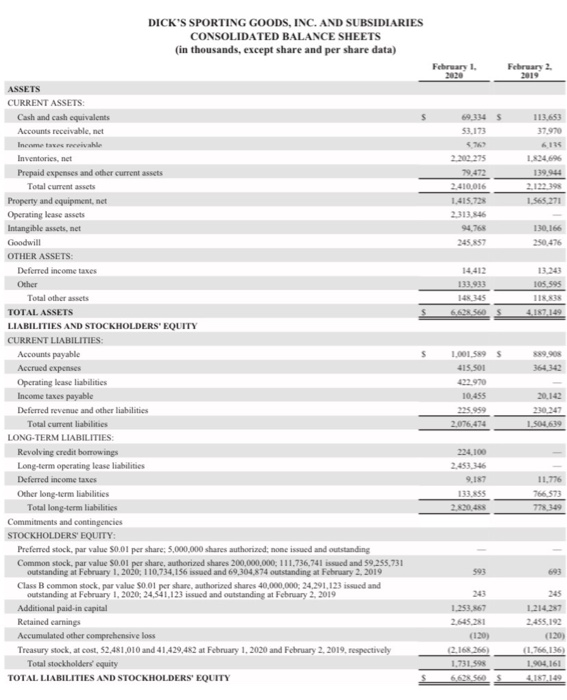

c. Ratios that evaluate the ability to pay long-term debt i. Debt Ratio ii. Debt to Equity Ratio iii. Times-Interest-Earned Ratio DICK'S SPORTING GOODS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share data) February 1. 2020 February 2 2019 113.653 37.970 69,334 5 53.173 576 2.202.275 79.472 2.410 016 1.415.728 2.313.846 94.768 245.857 1.824.696 139944 2.122398 1.565.271 130,166 250.476 14,412 133.933 13.243 105.595 118.838 4.187.149 1345 6628560 $ ASSETS CURRENT ASSETS: Cash and cash equivalents Accounts receivable, net Income taxes revival Inventories, net Prepaid expenses and other current assets Total current assets Property and equipment, net Operating lease assets Intangible assets, net Goodwill OTHER ASSETS: Deferred income taxes Other Total other assets TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable Accrued expenses Operating lease liabilities Income taxes payable Deferred revenue and other liabilities Total current liabilities LONG-TERM LIABILITIES: Revolving credit borrowings Long-term operating lease liabilities Deferred income taxes Other long-term liabilities Total long-term liabilities Commitments and contingencies STOCKHOLDERS' EQUITY: Preferred stock, par value $0.01 per share: 5.000.000 shares authorized: none issued and outstanding Common stock, par value 0.01 per share, authorized shares 200,000,000; 111,736,741 issued and 59.255,731 outstanding at February 1, 2020: 110,734,156 issued and 69,304,874 outstanding at February 2, 2019 Class B common stock par value $0.01 per share, authorized shares 40,000,000; 24.291.123 issued and outstanding at February 1, 2020:24,541.123 issued and outstanding at February 2, 2019 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 52,481,010 and 41,429,482 at February 1, 2020 and February 2, 2019, respectively Total stockholders' equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 1.001.5895 415.501 422.970 10.455 225.959 2,076,474 20.142 230-247 1,504.639 224.100 2.453.346 9.187 133.SS 2.820.45 11.776 766 573 778 349 593 693 1.253.867 2.645.281 (120) 2.168.266 1.731.59 1.214287 2,455,192 (120) (1.766, 136) 1.904.161 4.187.149