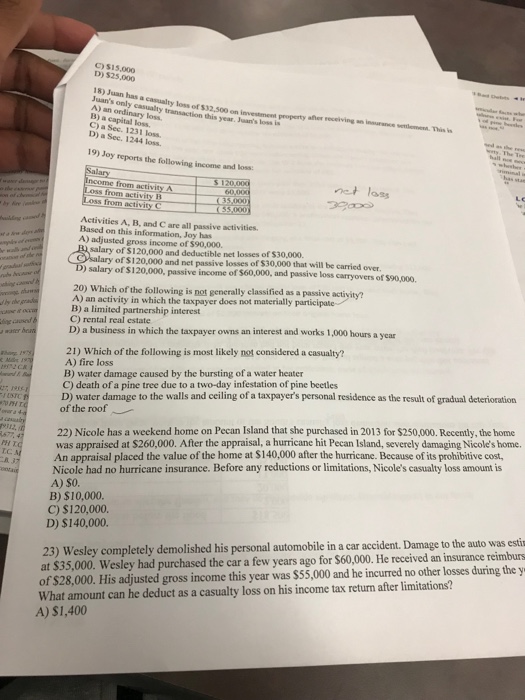

C) S15,000 D) $25,000 18) Juan has a a canualty loss of $32,500 on invessment property afer receiving an inurance settomena. This casualty transaction this year. Juan's los is Juan's only ) an ordinary loss. B) a capital loss. C) a Sec. 1231 loss D) a Sec. 1244 loss. 19) Joy reports the following income and loss: Income from activity A 60,00 oss from activity B Loss from activity C Activities A, B, and C are all passive activities Based on this information, Joy has A) adjusted gross income of $90,000. salary of $120,000 and deductible net losses of S30,000. of $120,000 and net passive losses of $30,000 that will be carried over. )salary of $120,000, passive income of $60,000, and passive loss carryovers of $90,000. 20 Which of the following is not generaly clasifed as a rasive actiyity? A) an activity in which the taxpayer does not materially participate B) a limited partnership interest C) rental real estate D) a business in which the taxpayer owns an interest and works 1,000 hours a yean 21) Which of the following is most likely not considered a casualty? A) fire loss B) water damage caused by the bursting of a water heater C) death of a pine tree due to a two-day infestation of pine beetles D) water damage to the walls and ceiling of a taxpayer's personal residence as the result of gradual deterioration of the roof 22) Nicole has a weekend home on Pecan Island that she purchased in 2013 for $250,000. Recently, the home was appraised at $260,000. After the appraisal, a hurricane hit Pecan Island, severely damaging Nicole's home. An appraisal placed the value of the home at S140,000 after the hurricane. Because of its prohibitive cost, Nicole had no hurricane insurance. Before any reductions or limitations, Nicole's casualty loss amount is tC A)$0. B) $10,000. C) $120,000. D) $140,000. 23) Wesley completely demolished his personal automobile in a car acident. Damageto the auto was esti at $35,000. Wesley had purchased the car a few years ago for $60,000. He received an insurance reimburs of $28,000. His adjusted gross income this year was $55,000 and he incurred no other losses during the y What amount can he deduct as a casualty loss on his income tax return after limitations? A) $1,400