Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(c) Using your answers from Parts (a) and (b) calculate the covariance between the two funds, and the correlation coefficient. [6 Points] (d) Using the

(c) Using your answers from Parts (a) and (b) calculate the covariance between the two funds, and the correlation coefficient. [6 Points]

(d) Using the formulas for the expected return and risk of a portfolio, calculate the expected return and standard deviation of a portfolio that is weighted40% in the stock equity fund and 60% in the bond fund. Show your work.[6Points]

please show work

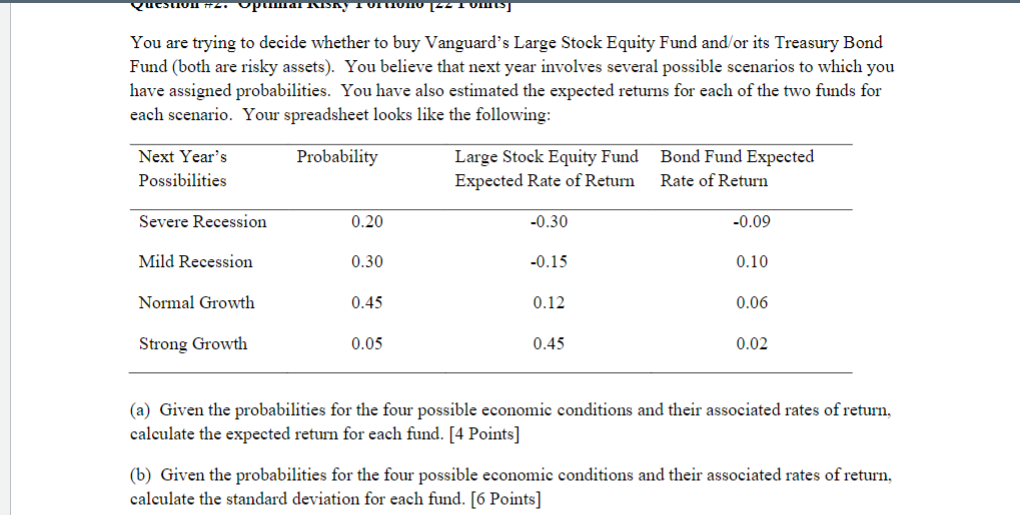

Quesnon 72 puma y Turnomo -2 Tommy You are trying to decide whether to buy Vanguard's Large Stock Equity Fund and/or its Treasury Bond Fund (both are risky assets). You believe that next year involves several possible scenarios to which you have assigned probabilities. You have also estimated the expected returns for each of the two funds for each scenario. Your spreadsheet looks like the following: Next Year's Possibilities Probability Large Stock Equity Fund Expected Rate of Return Bond Fund Expected Rate of Return Severe Recession 0.20 -0.30 -0.09 Mild Recession 0.30 -0.15 0.10 Normal Growth 0.45 0.12 0.06 Strong Growth 0.05 0.45 0.02 (a) Given the probabilities for the four possible economic conditions and their associated rates of return, calculate the expected return for each fund. [4 Points] (b) Given the probabilities for the four possible economic conditions and their associated rates of return, calculate the standard deviation for each fund. [6 Points]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started