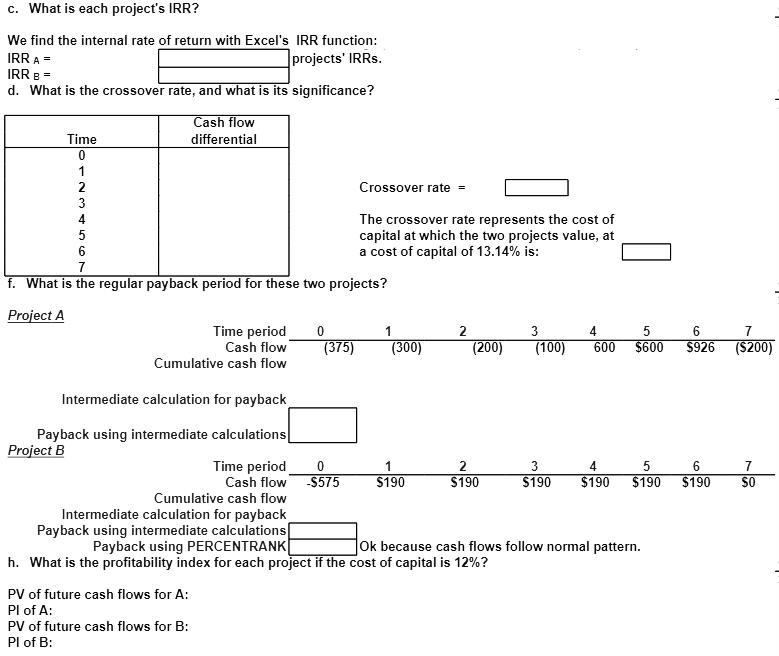

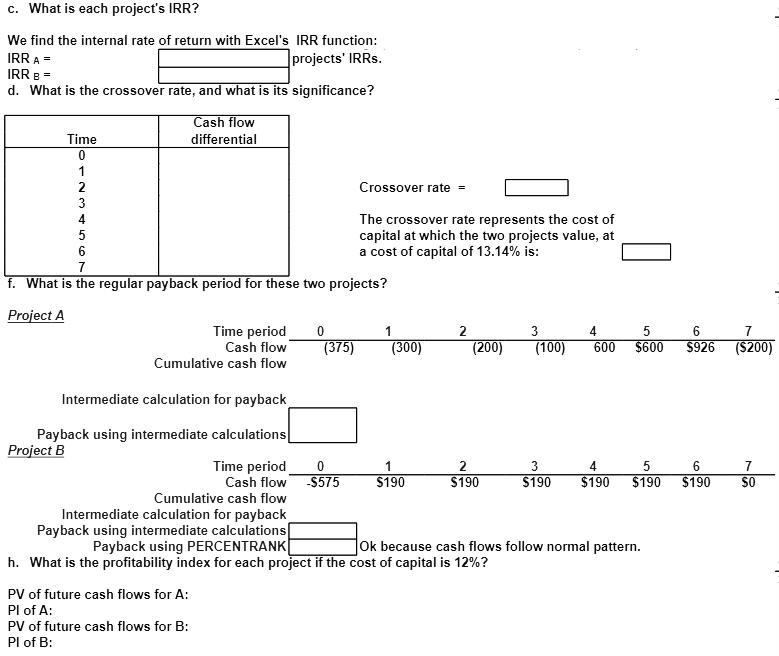

c. What is each project's IRR? We find the internal rate of return with Excel's IRR function: projects' IRRs. IRRA IRR B = d. What is the crossover rate, and what is its significance? Cash flow Time differential 0 1 2 Crossover rate - 3 4 The crossover rate represents the cost of 5 capital at which the two projects value, at 6 a cost of capital of 13.14% is: 7 f. What is the regular payback period for these two projects? Project A Time period Cash flow Cumulative cash flow 0 (375) 1 (300) 2 (200) 3 (100) 4 5 600 $600 6 $926 7 ($200) Intermediate calculation for payback 1 6 $190 7 SO Payback using intermediate calculations Project B Time period 0 2 3 4 5 Cash flow $575 $190 $190 $190 $190 $190 Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations Payback using PERCENTRANK Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: PV of future cash flows for B: Pl of B: c. What is each project's IRR? We find the internal rate of return with Excel's IRR function: projects' IRRs. IRRA IRR B = d. What is the crossover rate, and what is its significance? Cash flow Time differential 0 1 2 Crossover rate - 3 4 The crossover rate represents the cost of 5 capital at which the two projects value, at 6 a cost of capital of 13.14% is: 7 f. What is the regular payback period for these two projects? Project A Time period Cash flow Cumulative cash flow 0 (375) 1 (300) 2 (200) 3 (100) 4 5 600 $600 6 $926 7 ($200) Intermediate calculation for payback 1 6 $190 7 SO Payback using intermediate calculations Project B Time period 0 2 3 4 5 Cash flow $575 $190 $190 $190 $190 $190 Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations Payback using PERCENTRANK Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: PV of future cash flows for B: Pl of B