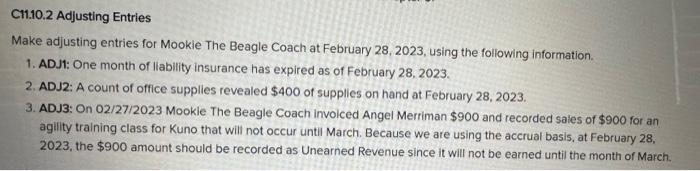

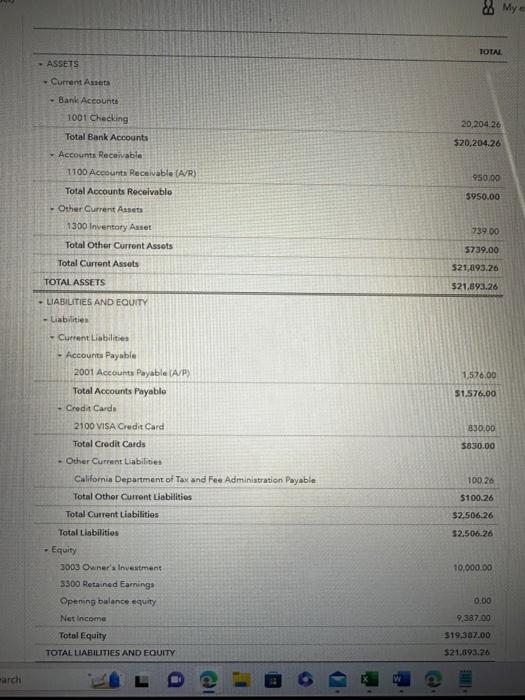

C11.10.2 Adjusting Entries Make adjusting entries for Mookie The Beagle Coach at February 28, 2023, using the following information. 1. ADJ1: One month of llability insurance has expired as of February 28,2023. 2. ADJ2: A count of office supplies revealed $400 of supplies on hand at February 28,2023. 3. ADJ3: On 02/27/2023 Mookle The Beagle Coach involced Angel Merriman $900 and recorded sales of $900 for an agility training class for Kuno that will not occur until March. Because we are using the accrual basis, at February 28 , 2023, the $900 amount should be recorded as Unearned Revenue since it will not be earned until the month of March. - ASSETS - Cument Asacta - Bank Aceounts 1001 Checking 20,20426 Total Bank Accounts $20,204.26 - Accoumts Recesiable 1100 Accounti Recelvable (AVR) 950,00 Total Accounts Receivablo $950.00 - Other Current Aasets 1300 invertory Asset 739.00 Total Other Current Assots 5739.00 Total Current Assets 521,895.26 TOTAL ASSETS $21,893.26 - liAbIUTIES AND EOUITY - Liabilitien - Curtent Liebilities - Aucounts Payable 2001 Accounti Paybble (AvP) 1,576.00 Total Accounts Paysble 51.576,00 - Credit Carde 2100 VISA Cred Card 1830.00 Total Crodit Cards $830.00 - Other Current Liabilities California Department of Tax and Fee Adminiatration Payable 10.2 .26 Total Other Current Liabilitios 5100.26 Total Current Liabilities Total tiabilitios 52506.26 \begin{tabular}{ll} \hline Total Current Liabilities & 52.506 .26 \\ \hline Total tiabilitios & 52.506 .26 \end{tabular} - Equity 3003 Owner'a Investment 10,000.00 3300 Retained Earninga Opening balance equity 0.00 Net income 9,387.00 Total Equity. $19,387.00 TOTAL LLABIUTES AND EQUITY 521.693,26 C11.10.2 Adjusting Entries Make adjusting entries for Mookie The Beagle Coach at February 28, 2023, using the following information. 1. ADJ1: One month of llability insurance has expired as of February 28,2023. 2. ADJ2: A count of office supplies revealed $400 of supplies on hand at February 28,2023. 3. ADJ3: On 02/27/2023 Mookle The Beagle Coach involced Angel Merriman $900 and recorded sales of $900 for an agility training class for Kuno that will not occur until March. Because we are using the accrual basis, at February 28 , 2023, the $900 amount should be recorded as Unearned Revenue since it will not be earned until the month of March. - ASSETS - Cument Asacta - Bank Aceounts 1001 Checking 20,20426 Total Bank Accounts $20,204.26 - Accoumts Recesiable 1100 Accounti Recelvable (AVR) 950,00 Total Accounts Receivablo $950.00 - Other Current Aasets 1300 invertory Asset 739.00 Total Other Current Assots 5739.00 Total Current Assets 521,895.26 TOTAL ASSETS $21,893.26 - liAbIUTIES AND EOUITY - Liabilitien - Curtent Liebilities - Aucounts Payable 2001 Accounti Paybble (AvP) 1,576.00 Total Accounts Paysble 51.576,00 - Credit Carde 2100 VISA Cred Card 1830.00 Total Crodit Cards $830.00 - Other Current Liabilities California Department of Tax and Fee Adminiatration Payable 10.2 .26 Total Other Current Liabilitios 5100.26 Total Current Liabilities Total tiabilitios 52506.26 \begin{tabular}{ll} \hline Total Current Liabilities & 52.506 .26 \\ \hline Total tiabilitios & 52.506 .26 \end{tabular} - Equity 3003 Owner'a Investment 10,000.00 3300 Retained Earninga Opening balance equity 0.00 Net income 9,387.00 Total Equity. $19,387.00 TOTAL LLABIUTES AND EQUITY 521.693,26