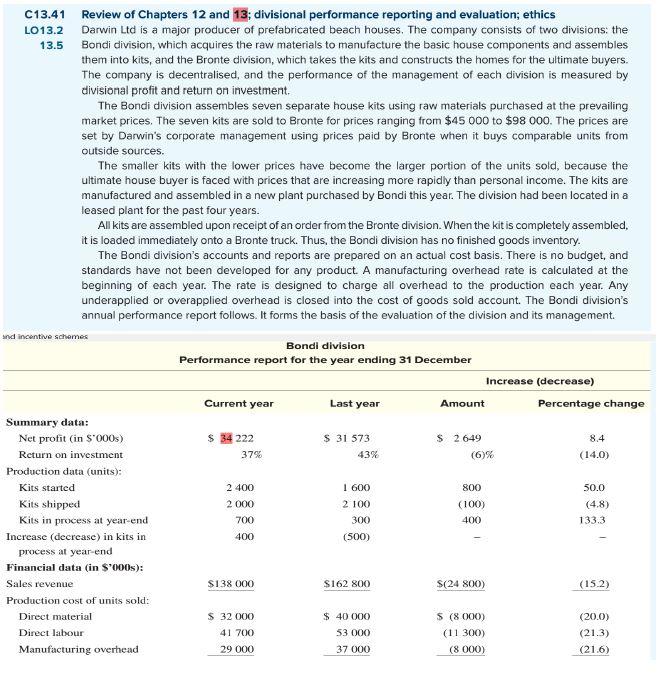

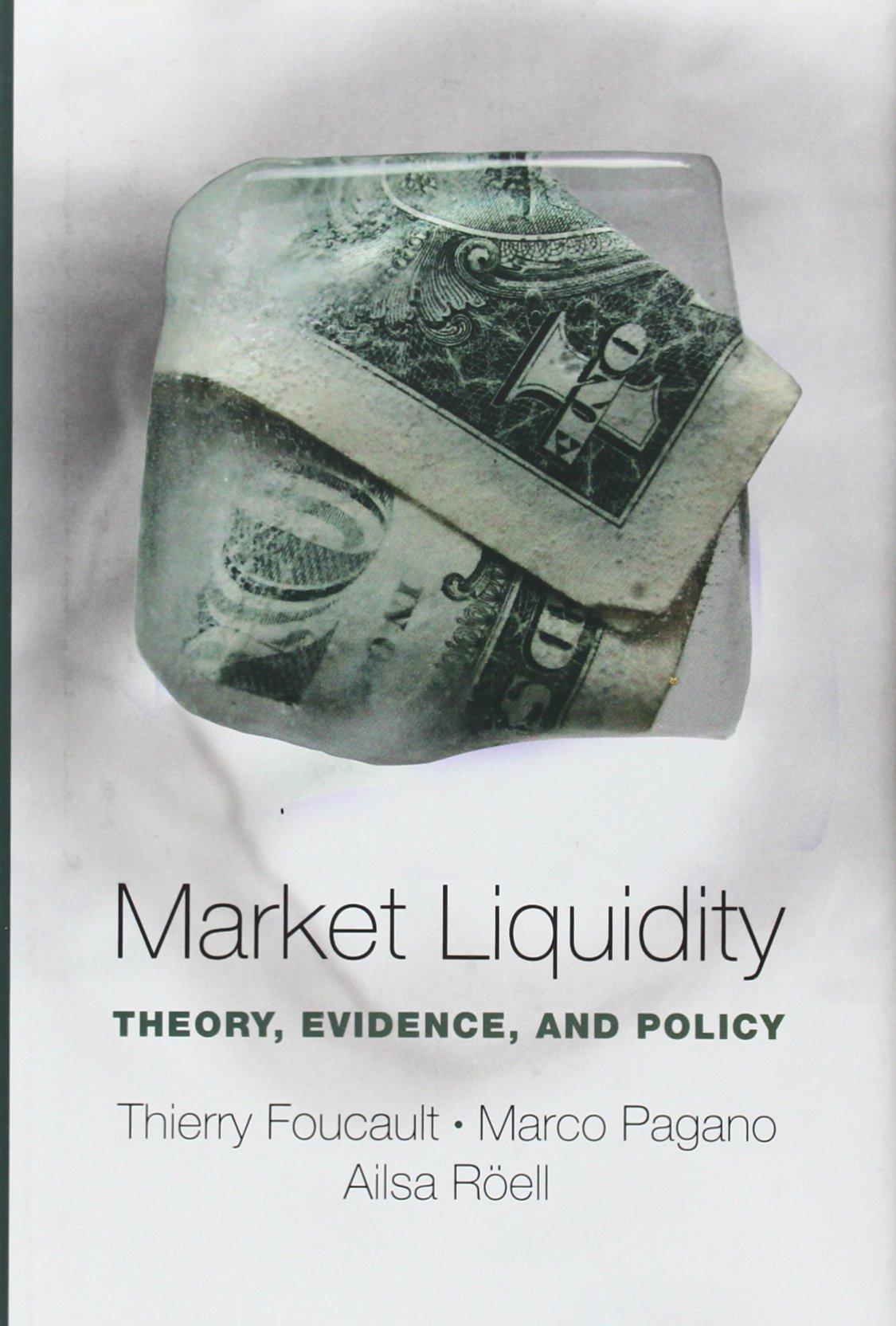

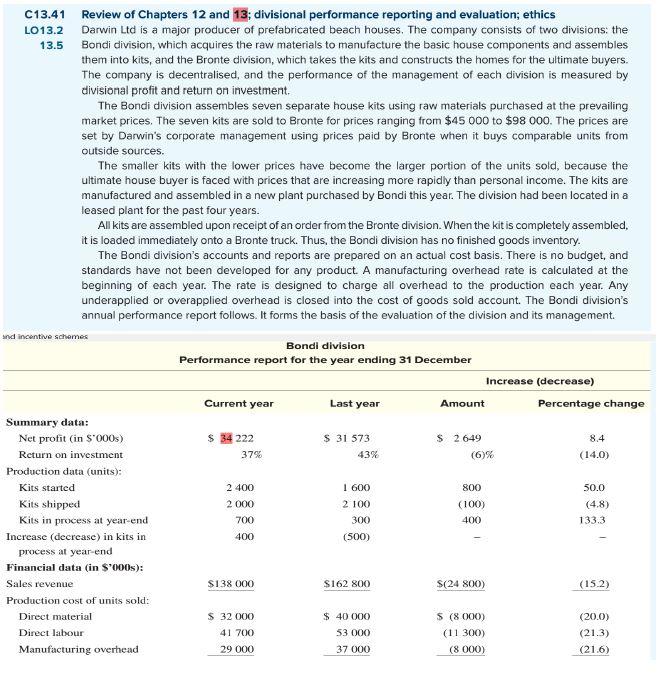

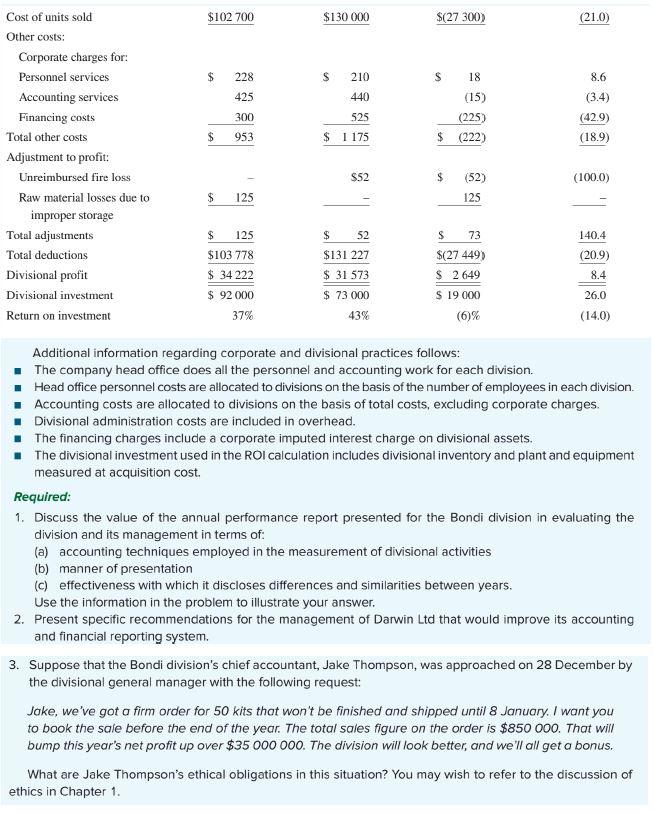

C13.41 Review of Chapters 12 and 13; divisional performance reporting and evaluation; ethics LO13.2 Darwin Ltd is a major producer of prefabricated beach houses. The company consists of two divisions: the 13.5 Bondi division, which acquires the raw materials to manufacture the basic house components and assembles them into kits, and the Bronte division, which takes the kits and constructs the homes for the ultimate buyers. The company is decentralised, and the performance of the management of each division is measured by divisional profit and return on investment. The Bondi division assembles seven separate house kits using raw materials purchased at the prevailing market prices. The seven kits are sold to Bronte for prices ranging from $45 000 to $98 000. The prices are set by Darwin's corporate management using prices paid by Bronte when it buys comparable units from outside sources. The smaller kits with the lower prices have become the larger portion of the units sold, because the ultimate house buyer is faced with prices that are increasing more rapidly than personal income. The kits are manufactured and assembled in a new plant purchased by Bondi this year. The division had been located in a leased plant for the past four years. All kits are assembled upon receipt of an order from the Bronte division. When the kit is completely assembled. it is loaded immediately onto a Bronte truck. Thus, the Bondi division has no finished goods inventory. The Bondi division's accounts and reports are prepared on an actual cost basis. There is no budget, and standards have not been developed for any product. A manufacturing overhead rate is calculated at the beginning of each year. The rate is designed to charge all overhead to the production each year. Any underapplied or overapplied overhead is closed into the cost of goods sold account. The Bondi division's annual performance report follows. It forms the basis of the evaluation of the division and its management ind incentive schemes Bondi division Performance report for the year ending 31 December Increase (decrease) Percentage change Current year Last year Amount $ 34 222 37% $ 31 573 43% $ 2649 (6)% 8.4 (14.0) 2 400 2000 700 1 600 2 100 300 (500) 800 (100) 400 Summary data: Net profit (in $'000s) Return on investment Production data (units): Kits started Kits shipped Kits in process at year-end Increase (decrease) in kits in process at year-end Financial data (in $'000s): Sales revenue Production cost of units sold: Direct material Direct labour Manufacturing overhead 50.0 (4.8) 133.3 400 $138 000 $162 800 $(24 800) (152) $ 32 000 41 700 29 000 $ 40 000 53 000 37 000 $ (8 000) (11 300) (8 000) (20.0) (21.3) (21.6) $102 700 $130 000 $(27 300) (21.0) $ 228 $ 210 $ 18 8.6 425 440 300 525 $ 1 175 (15) (225) $ (222) (3.4) (429) (18.9) $ 953 Cost of units sold Other costs: Corporate charges for: Personnel services Accounting services Financing costs Total other costs Adjustment to profit: Unreimbursed fire loss Raw material losses due to improper storage Total adjustments Total deductions Divisional profit Divisional investment Return on investment $52 $ (100.0) (52) 125 $ 125 $ 125 $103 778 $ 34 222 $ 92 000 37% $ 52 $131 227 $ 31 573 $ 73 000 43% $ 73 $(27 449) $ 2649 $ 19 000 (6)% 140.4 (20.9) 8.4 26.0 (14.0) Additional information regarding corporate and divisional practices follows: The company head office does all the personnel and accounting work for each division Head office personnel costs are allocated to divisions on the basis of the number of employees in each division Accounting costs are allocated to divisions on the basis of total costs, excluding corporate charges. Divisional administration costs are included in overhead. The financing charges include a corporate imputed interest charge on divisional assets. The divisional investment used in the ROI calculation includes divisional inventory and plant and equipment measured at acquisition cost. Required: 1. Discuss the value of the annual performance report presented for the Bondi division in evaluating the division and its management in terms of: (a) accounting techniques employed in the measurement of divisional activities (b) manner of presentation (c) effectiveness with which it discloses differences and similarities between years. Use the information in the problem to illustrate your answer. 2. Present specific recommendations for the management of Darwin Ltd that would improve its accounting and financial reporting system. 3. Suppose that the Bondi division's chief accountant, Jake Thompson, was approached on 28 December by the divisional general manager with the following request: Joke, we've got a firm order for 50 kits that won't be finished and shipped until 8 January. I want you to book the sale before the end of the year. The total sales figure on the order is $850 000. That will bump this year's net profit up over $35 000 000. The division will look better, and we'll all get a bonus. What are Jake Thompson's ethical obligations in this situation? You may wish to refer to the discussion of ethics in Chapter 1. C13.41 Review of Chapters 12 and 13; divisional performance reporting and evaluation; ethics LO13.2 Darwin Ltd is a major producer of prefabricated beach houses. The company consists of two divisions: the 13.5 Bondi division, which acquires the raw materials to manufacture the basic house components and assembles them into kits, and the Bronte division, which takes the kits and constructs the homes for the ultimate buyers. The company is decentralised, and the performance of the management of each division is measured by divisional profit and return on investment. The Bondi division assembles seven separate house kits using raw materials purchased at the prevailing market prices. The seven kits are sold to Bronte for prices ranging from $45 000 to $98 000. The prices are set by Darwin's corporate management using prices paid by Bronte when it buys comparable units from outside sources. The smaller kits with the lower prices have become the larger portion of the units sold, because the ultimate house buyer is faced with prices that are increasing more rapidly than personal income. The kits are manufactured and assembled in a new plant purchased by Bondi this year. The division had been located in a leased plant for the past four years. All kits are assembled upon receipt of an order from the Bronte division. When the kit is completely assembled. it is loaded immediately onto a Bronte truck. Thus, the Bondi division has no finished goods inventory. The Bondi division's accounts and reports are prepared on an actual cost basis. There is no budget, and standards have not been developed for any product. A manufacturing overhead rate is calculated at the beginning of each year. The rate is designed to charge all overhead to the production each year. Any underapplied or overapplied overhead is closed into the cost of goods sold account. The Bondi division's annual performance report follows. It forms the basis of the evaluation of the division and its management ind incentive schemes Bondi division Performance report for the year ending 31 December Increase (decrease) Percentage change Current year Last year Amount $ 34 222 37% $ 31 573 43% $ 2649 (6)% 8.4 (14.0) 2 400 2000 700 1 600 2 100 300 (500) 800 (100) 400 Summary data: Net profit (in $'000s) Return on investment Production data (units): Kits started Kits shipped Kits in process at year-end Increase (decrease) in kits in process at year-end Financial data (in $'000s): Sales revenue Production cost of units sold: Direct material Direct labour Manufacturing overhead 50.0 (4.8) 133.3 400 $138 000 $162 800 $(24 800) (152) $ 32 000 41 700 29 000 $ 40 000 53 000 37 000 $ (8 000) (11 300) (8 000) (20.0) (21.3) (21.6) $102 700 $130 000 $(27 300) (21.0) $ 228 $ 210 $ 18 8.6 425 440 300 525 $ 1 175 (15) (225) $ (222) (3.4) (429) (18.9) $ 953 Cost of units sold Other costs: Corporate charges for: Personnel services Accounting services Financing costs Total other costs Adjustment to profit: Unreimbursed fire loss Raw material losses due to improper storage Total adjustments Total deductions Divisional profit Divisional investment Return on investment $52 $ (100.0) (52) 125 $ 125 $ 125 $103 778 $ 34 222 $ 92 000 37% $ 52 $131 227 $ 31 573 $ 73 000 43% $ 73 $(27 449) $ 2649 $ 19 000 (6)% 140.4 (20.9) 8.4 26.0 (14.0) Additional information regarding corporate and divisional practices follows: The company head office does all the personnel and accounting work for each division Head office personnel costs are allocated to divisions on the basis of the number of employees in each division Accounting costs are allocated to divisions on the basis of total costs, excluding corporate charges. Divisional administration costs are included in overhead. The financing charges include a corporate imputed interest charge on divisional assets. The divisional investment used in the ROI calculation includes divisional inventory and plant and equipment measured at acquisition cost. Required: 1. Discuss the value of the annual performance report presented for the Bondi division in evaluating the division and its management in terms of: (a) accounting techniques employed in the measurement of divisional activities (b) manner of presentation (c) effectiveness with which it discloses differences and similarities between years. Use the information in the problem to illustrate your answer. 2. Present specific recommendations for the management of Darwin Ltd that would improve its accounting and financial reporting system. 3. Suppose that the Bondi division's chief accountant, Jake Thompson, was approached on 28 December by the divisional general manager with the following request: Joke, we've got a firm order for 50 kits that won't be finished and shipped until 8 January. I want you to book the sale before the end of the year. The total sales figure on the order is $850 000. That will bump this year's net profit up over $35 000 000. The division will look better, and we'll all get a bonus. What are Jake Thompson's ethical obligations in this situation? You may wish to refer to the discussion of ethics in Chapter 1