Answered step by step

Verified Expert Solution

Question

1 Approved Answer

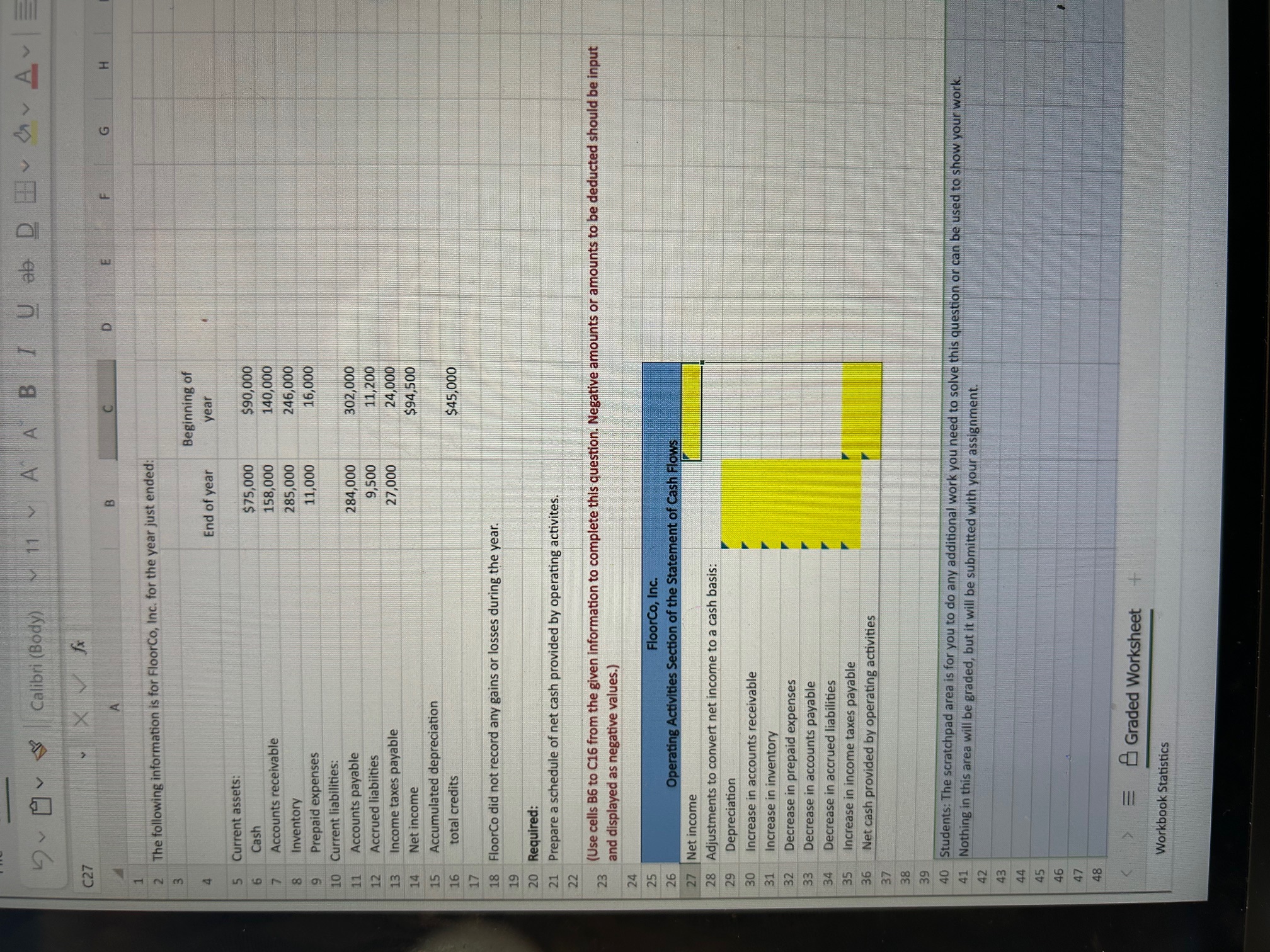

C27 1 2 3 4 5 6 7 8 9 10 11 12 13 14 50 23 30 31 32 33 Current assets: Cash

C27 1 2 3 4 5 6 7 8 9 10 11 12 13 14 50 23 30 31 32 33 Current assets: Cash 47 48 K 4 Accounts receivable Inventory Prepaid expenses Current liabilities: Calibri (Body) The following information is for FloorCo, Inc. for the year just ended: Xfx Accounts payable Accrued liabiities Income taxes payable Net income Accumulated depreciation total credits 24 25 26 27 Net income 28 Adjustments to convert net income to a cash basis: 29 Depreciation Increase in accounts receivable Increase in inventory Decrease in prepaid expenses Decrease in accounts payable Decrease in accrued liabilities Increase in income taxes payable Net cash provided by operating activities A > 15 16 17 18 FloorCo did not record any gains or losses during the year. 19 20 Required: 21 Prepare a schedule of net cash provided by operating activites. 22 E 11 AA BI U ab DE AE B Workbook Statistics End of year Graded Worksheet $75,000 158,000 285,000 11,000 284,000 9,500 27,000 FloorCo, Inc. Operating Activities Section of the Statement of Cash Flows C Beginning of year (Use cells B6 to C16 from the given information to complete this question. Negative amounts or amounts to be deducted should be input and displayed as negative values.) $90,000 140,000 246,000 16,000 34 35 36 37 38 39 40 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 41 Nothing in this area will be graded, but it will be submitted with your assignment. 42 43 44 45 46 302,000 11,200 24,000 $94,500 $45,000 D G

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Heres the schedule of net cash provided by operating activities for FloorCo Inc based on the information provided Category Amount Net income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started