Answered step by step

Verified Expert Solution

Question

1 Approved Answer

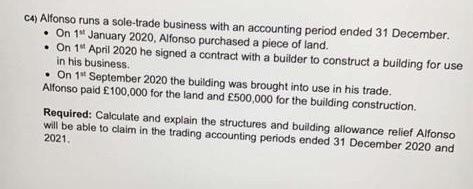

C4) Alfonso runs a sole-trade business with an accounting period ended 31 December. On 1st January 2020, Alfonso purchased a piece of land. On

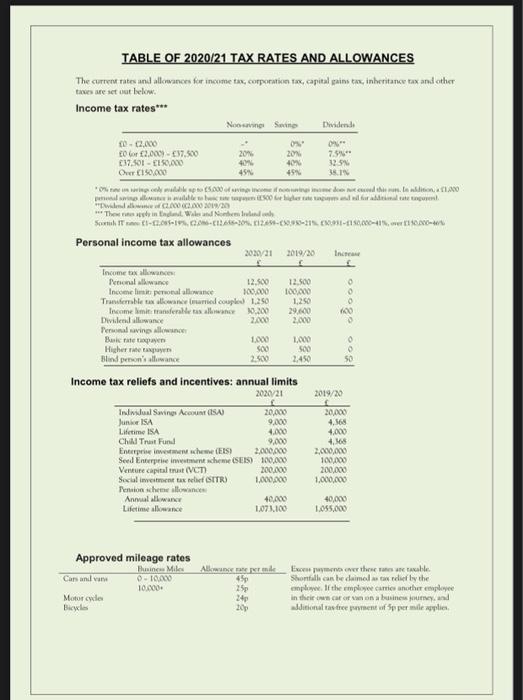

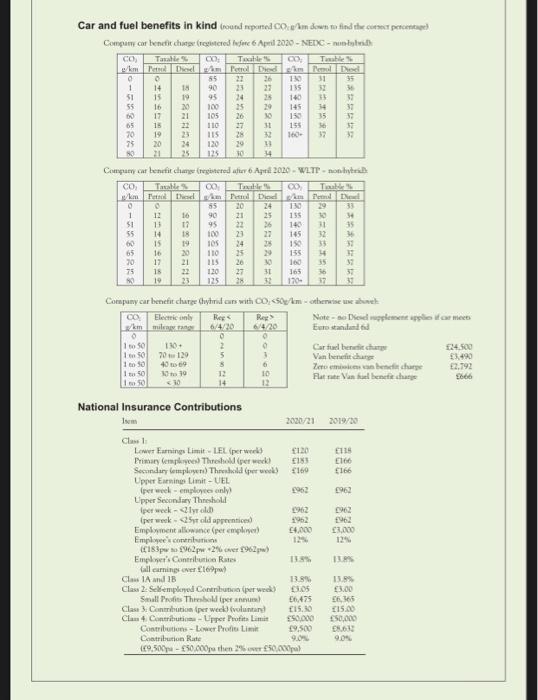

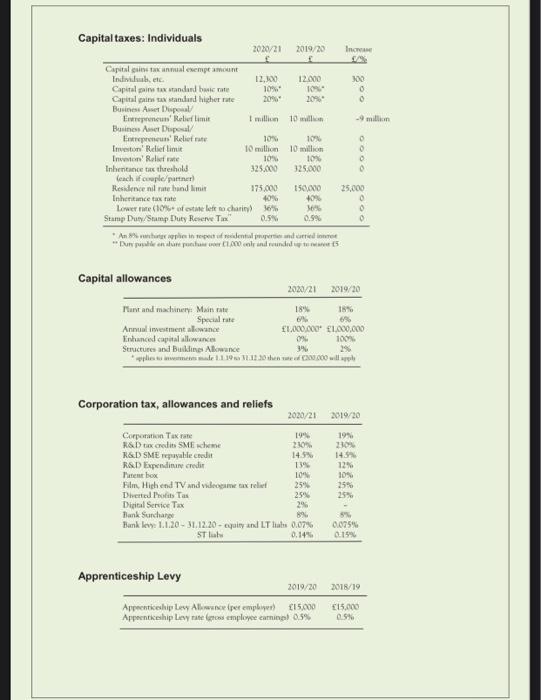

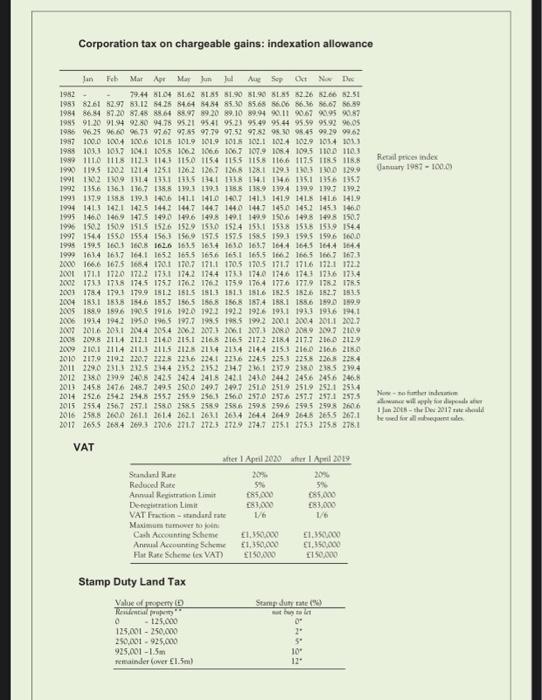

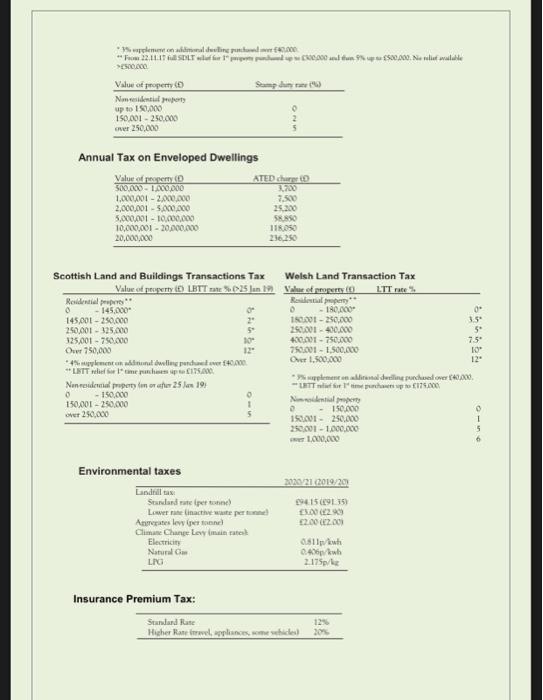

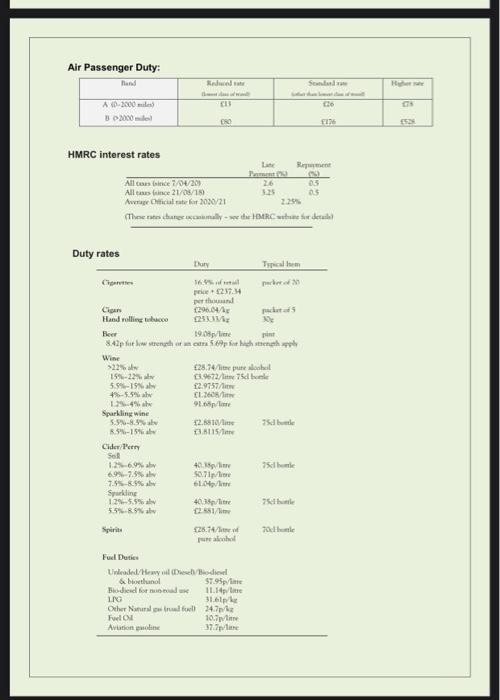

C4) Alfonso runs a sole-trade business with an accounting period ended 31 December. On 1st January 2020, Alfonso purchased a piece of land. On 1st April 2020 he signed a contract with a builder to construct a building for use in his business. On 1 September 2020 the building was brought into use in his trade. Alfonso paid 100,000 for the land and 500,000 for the building construction. Required: Calculate and explain the structures and building allowance relief Alfonso will be able to claim in the trading accounting periods ended 31 December 2020 and 2021. TABLE OF 2020/21 TAX RATES AND ALLOWANCES The current rates and allowances for income tax, corporation tax, capital gains taxx, inheritance tax and other taxes are set out below. Income tax rates*** 10-12,000 to or 2,000)-37,500 37,501-150,000 Over 150,000 Personal savings allowance Basic rate payen Higher rate taxpayer Blind person's allowance Income tax allowances Personal allowance Income limit personal allowance Transferable tax allowance (married coupled 1.250 Income limit transferable tas allowance 30.000 Dividend allowance 2.000 Cars and an penal single is available to be tape 500 for higher rate tages and all for additional tate toge "Dividend allowance of C2000 2000 2019/20 The res apply in England Wales and No Sortih IT E-12085-19%, 120-1266-20% 1259-09-21% 01-1150,000-41% over 15000- Personal income tax allowances Motorcycles Bicycles Noosavings Sing Individual Savings Account (ISA) Junior ISA Lifetime ISA 20% Approved mileage rates Business Miles 0-10,000 10,000 Venture capital trust (VCT) Social investment tax relief (STR) Pension scheme allowances Annual allowance Lifetime allowance 2020/21 2019/20 f 12,500 100,000 Child Truit Funl Enterprise investment scheme (EIS) Seed Enterprise investment scheme (SEIS) 1,000 500 2,500 Income tax reliefs and incentives: annual limits 2020/21 20% 40% 0%" 12,500 100,000 20,000 9,000 4.000 9,000 2,000,000 100,000 200,000 1,000,000 Allowance rate per mde 45p 25p 24p 20p 40,000 1,073,100 1,250 29,600 2,000 1,000 500 2450 Dividends 0%" 7.5%** 32.5% 38.1% Increase 600 2019/20 50 f 20,000 4,368 4,000 4,368 2,000,000 100,000 200,000 1,000,000 40,000 1,055,000 Excess payments over these rates are taxable. Shortfall can be claimed as tax relief by the employee. If the employee carries another employee in their own car or van on a business journey, and additional rasfree psement of 5p per mile applies. Car and fuel benefits in kind (round reported CO, g/km down to find the corect percentage) Company car benefit charge (registered before 6 April 2020-NEDC-nuolybrid Co CO; Table e/km Petrol Diesel km Petrol Died 0 1 51 $2883: 55 16 60 17 18 20 80 21 CO /km 0 1 $1 55 75 80 CO km 0 14 15 0 1 to 50 1 to 50 to 50 19 1 1 to 50 150 Isem 12 13 14 18 19 20 21 22 23 24 25 15 16 16 17 85 90 95 100 105 110 115 120 125 130+ 70129 40 to 69 30 to 30 30 95 18 100 19 105 20 110 21 115 18 22 120 19 23 125 CO Taxable% km Penol Died 26 130 23 27 135 24 28 140 Reg 6/4/20 HAAAABAAR 0 2 5 8 12 14 22 25 26 Company car benefit change (registered after 6 Aprill 2020-WLTP-non-hybri Taxable% 00 Truble Fetsol Diesel km Petrol Diod g/km 0 130 135 30 140 31 145 150 55 20 90 (all earnings over 169) 27 28 29 30 S8825855 21 22 24 27 National Insurance Contributions ABARRERAS 30 31 155 32 160- 33 29 145 34 150 34 24 25 26 28 29 30 31 32 Company car benefit charge (hybrid cars with CO,

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Land pruchased on 01012020 for Singed Contract on 010420...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started