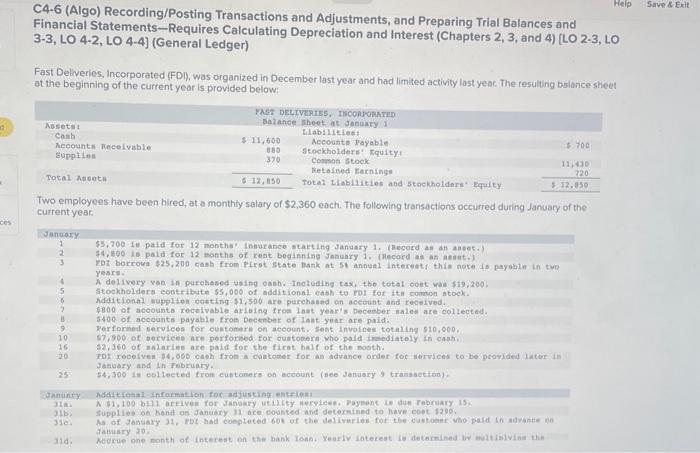

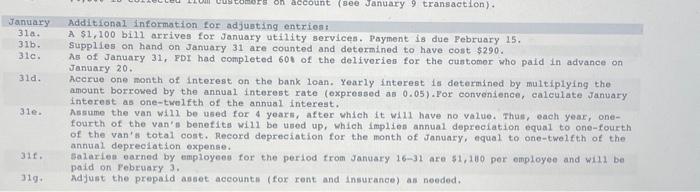

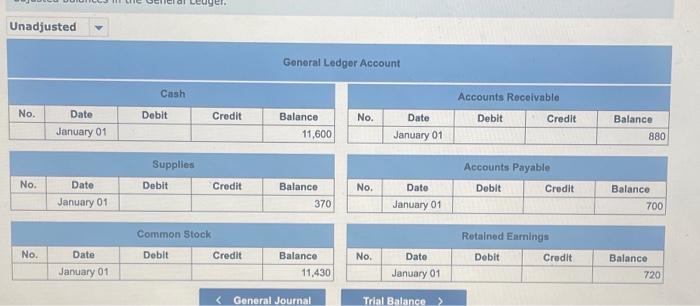

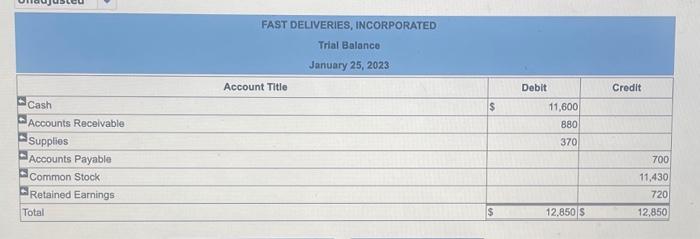

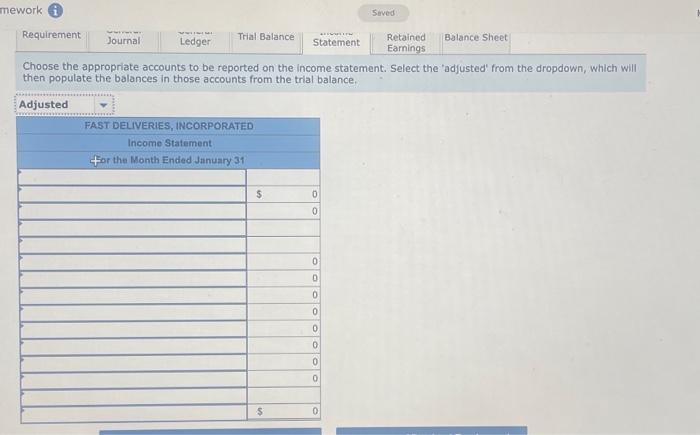

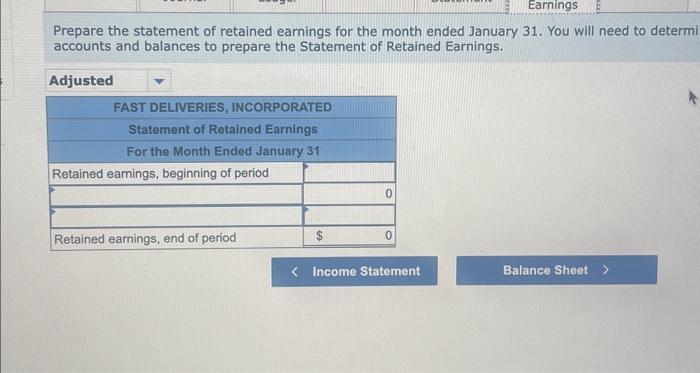

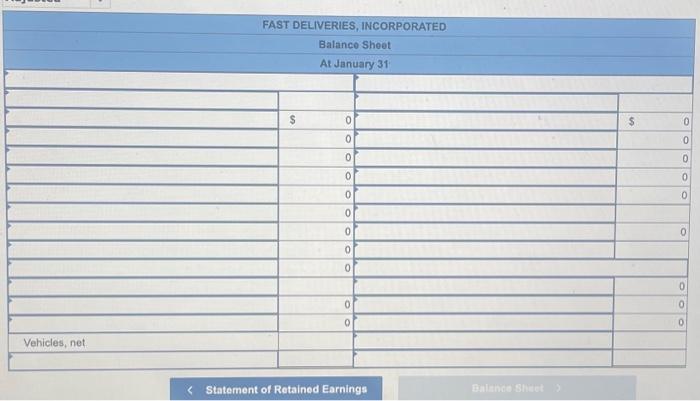

C4-6 (Algo) Recording/Posting Transactions and Adjustments, and Preparing Trial Balances and Financial Statements-Requires Calculating Depreciation and Interest (Chapters 2, 3, and 4) (LO 2-3, LO 3-3, LO 4-2, LO 4-4) (General Ledger) Fast Deliveries, Incorporated (FDI), was organized in December last year and had limited activity last year. The resulting balonce sheet at the beginning of the current year is provided below: Two employees have been hired, at a monthly salary of $2,360 eoch. The following transactions occurred during January of the current year: January Adititional information for adjugting entriog: 31a. A $1,100 bill arrives for January utility services. Payment is due February 15. 31b. Supplies on hand on January 31 are counted and determined to have cost $290. 31e. As of January 31, FDI had completed 60t of the deliveriea for the cuntomor who paid in advance on vanuary 20 . 31d. Acerue one month of interest on the bank loan. Yearly interest is determined by multiplying the amount borrowed by the annual interest rate (expressed as 0 .05). For convenience, ealcilate January interest as one-twelfth of the annual interest. 31e. Assume the van wi11 be used for 4 yeark, after which it wil1 have no valuo. Thul, oach year, onefourth of the van'i benetite will be ueed up, Which implion annual depreciation equal to one-fourth of the van's total cost. Record depreciation for the month of January, equal to one-twelfth of the annual depreciation expenae. 31t. Salariea earned by employees for the perlod from January 1631 are 51,140 per employee and will be paid on Pebruary 3 , 319, Adjust the prepald aseet accounte (for rent and insurance) an needed. Unadjusted General Ledger Account \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 11,600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 880 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Supplies } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 370 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 700 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Dobit & Credit & Balance \\ \hline & January 01 & & & 11,430 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Dato & Debit & Credit & Balance \\ \hline & January 01 & & & 720 \\ \hline \end{tabular} FAST DELIVERIES, INCORPORATED Trial Balance January 25,2023 Choose the appropriate accounts to be reported on the income statement. Select the 'adjusted' from the dropdown, which will then populate the balances in those accounts from the trial balance. Prepare the statement of retained earnings for the month ended January 31. You will need to determ accounts and balances to prepare the Statement of Retained Earnings