Question

Cabin Telecom (CT), an electronics retailer, has 3,000 units of Apple iPhone 8 as part of their inventory. The units were purchased from Apple

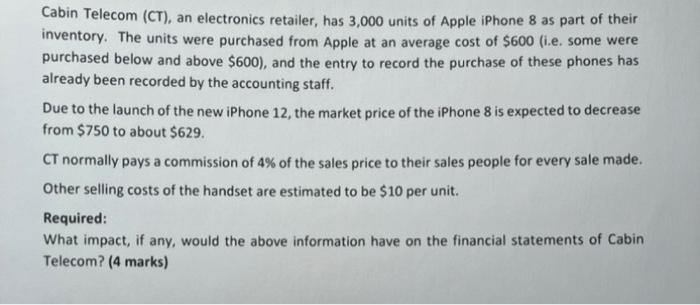

Cabin Telecom (CT), an electronics retailer, has 3,000 units of Apple iPhone 8 as part of their inventory. The units were purchased from Apple at an average cost of $600 (i.e. some were purchased below and above $600), and the entry to record the purchase of these phones has already been recorded by the accounting staff. Due to the launch of the new iPhone 12, the market price of the iPhone 8 is expected to decrease from $750 to about $629. CT normally pays a commission of 4% of the sales price to their sales people for every sale made. Other selling costs of the handset are estimated to be $10 per unit. Required: What impact, if any, would the above information have on the financial statements of Cabin Telecom? (4 marks)

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

6th Canadian edition

1118644948, 978-1118805084, 1118805089, 978-1118644942

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App