Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cairo Ingot, Ltd. Cairo Ingot, Ltd., is the Egyptian subsidiary of Trans-Mediterranean Aluminum, a British multinational that fashions automobile engine blocks from aluminum. Trans-Mediterranean's home

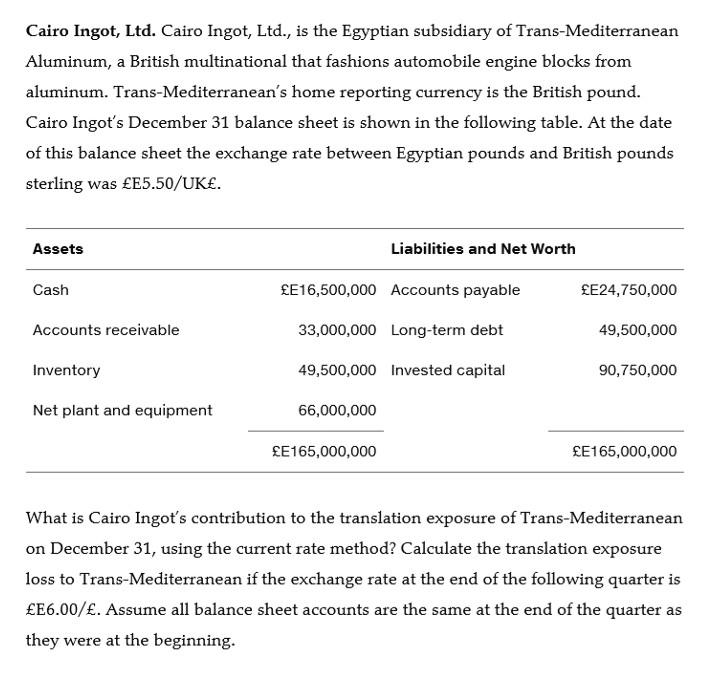

Cairo Ingot, Ltd. Cairo Ingot, Ltd., is the Egyptian subsidiary of Trans-Mediterranean Aluminum, a British multinational that fashions automobile engine blocks from aluminum. Trans-Mediterranean's home reporting currency is the British pound. Cairo Ingot's December 31 balance sheet is shown in the following table. At the date of this balance sheet the exchange rate between Egyptian pounds and British pounds sterling was E5.50/UK. Assets Liabilities and Net Worth Cash E16,500,000 Accounts payable E24,750,000 Accounts receivable 33,000,000 Long-term debt 49,500,000 Inventory 49,500,000 Invested capital 90,750,000 Net plant and equipment 66,000,000 E165,000,000 E165,000,000 What is Cairo Ingot's contribution to the translation exposure of Trans-Mediterranean on December 31, using the current rate method? Calculate the translation exposure loss to Trans-Mediterranean if the exchange rate at the end of the following quarter is E6.00/. Assume all balance sheet accounts are the same at the end of the quarter as they were at the beginning

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started