Answered step by step

Verified Expert Solution

Question

1 Approved Answer

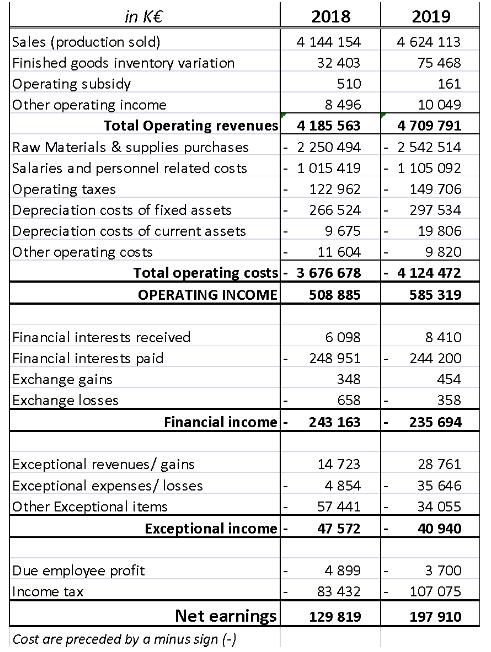

Calculate : 1) The successive levels of margins for year 2018 and year 2019, in French presentation 2) For each year, the % of each

Calculate :

1) The successive levels of margins for year 2018 and year 2019, in French presentation

2) For each year, the % of each margin in comparison with total production

3) According to you, what are the critical costs?

4) The growth rate of each margin between 2018 and 2019

5) What is your analysis?

in K Sales (production sold) Finished goods inventory variation Operating subsidy Other operating income Total Operating revenues Raw Materials & supplies purchases Salaries and personnel related costs Operating taxes Depreciation costs of fixed assets Depreciation costs of current assets Other operating costs Total operating costs OPERATING INCOME Financial interests received Financial interests paid Exchange gains Exchange losses Financial income Exceptional revenues/gains Exceptional expenses/losses Other Exceptional items Exceptional income Due employee profit Income tax Net earnings Cost are preceded by a minus sign (-) . - 2018 4 144 154 32 403 510 8 496 4 185 563 2 250 494 1 015 419 122 962 266 524 9 675 11 604 3 676 678 508 885 6 098 248 951 348 658 243 163 14 723 4 854 57 441 47 572 4 899 83 432 129 819 - - - 2019 4 624 113 75 468 161 10 049 4 709 791 2 542 514 1 105 092 149 706 297 534 19 806 9 820 4 124 472 585 319 8 410 244 200 454 358 235 694 28 761 35 646 34 055 40 940 3 700 107 075 197 910

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To perform the calculations Ill organize the data and compute the required values Here are th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started