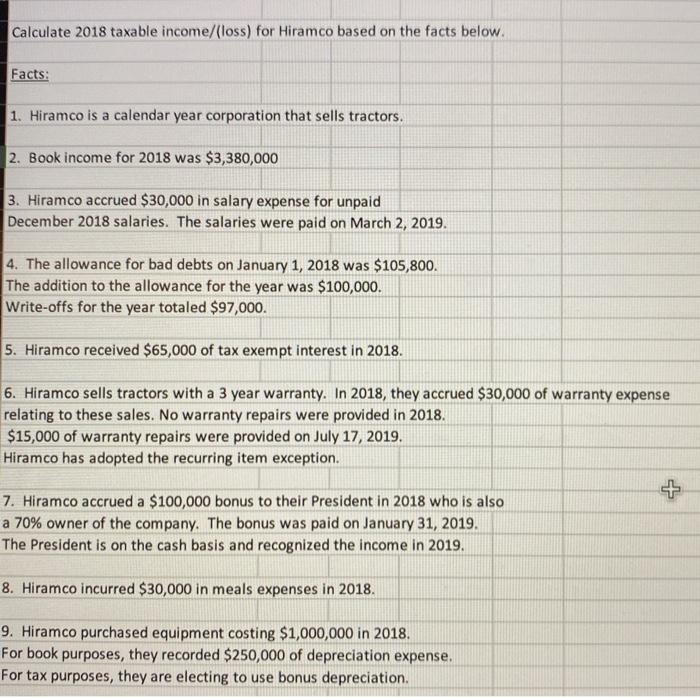

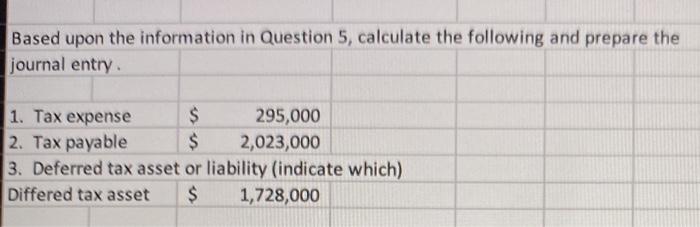

Calculate 2018 taxable income/(loss) for Hiramco based on the facts below. Facts: 1. Hiramco is a calendar year corporation that sells tractors. 2. Book income for 2018 was $3,380,000 3. Hiramco accrued $30,000 in salary expense for unpaid December 2018 salaries. The salaries were paid on March 2, 2019. 4. The allowance for bad debts on January 1, 2018 was $105,800. The addition to the allowance for the year was $100,000. Write-offs for the year totaled $97,000. 5. Hiramco received $65,000 of tax exempt interest in 2018. 6. Hiramco sells tractors with a 3 year warranty. In 2018, they accrued $30,000 of warranty expense relating to these sales. No warranty repairs were provided in 2018. $15,000 of warranty repairs were provided on July 17, 2019. Hiramco has adopted the recurring item exception. 7. Hiramco accrued a $100,000 bonus to their President in 2018 who is also a 70% owner of the company. The bonus was paid on January 31, 2019. The President is on the cash basis and recognized the income in 2019. 8. Hiramco incurred $30,000 in meals expenses in 2018. 9. Hiramco purchased equipment costing $1,000,000 in 2018. For book purposes, they recorded $250,000 of depreciation expense. For tax purposes, they are electing to use bonus depreciation. Based upon the information in Question 5, calculate the following and prepare the journal entry 1. Tax expense $ 295,000 2. Tax payable $ 2,023,000 3. Deferred tax asset or liability (indicate which) Differed tax asset $ 1,728,000 Calculate 2018 taxable income/(loss) for Hiramco based on the facts below. Facts: 1. Hiramco is a calendar year corporation that sells tractors. 2. Book income for 2018 was $3,380,000 3. Hiramco accrued $30,000 in salary expense for unpaid December 2018 salaries. The salaries were paid on March 2, 2019. 4. The allowance for bad debts on January 1, 2018 was $105,800. The addition to the allowance for the year was $100,000. Write-offs for the year totaled $97,000. 5. Hiramco received $65,000 of tax exempt interest in 2018. 6. Hiramco sells tractors with a 3 year warranty. In 2018, they accrued $30,000 of warranty expense relating to these sales. No warranty repairs were provided in 2018. $15,000 of warranty repairs were provided on July 17, 2019. Hiramco has adopted the recurring item exception. 7. Hiramco accrued a $100,000 bonus to their President in 2018 who is also a 70% owner of the company. The bonus was paid on January 31, 2019. The President is on the cash basis and recognized the income in 2019. 8. Hiramco incurred $30,000 in meals expenses in 2018. 9. Hiramco purchased equipment costing $1,000,000 in 2018. For book purposes, they recorded $250,000 of depreciation expense. For tax purposes, they are electing to use bonus depreciation. Based upon the information in Question 5, calculate the following and prepare the journal entry 1. Tax expense $ 295,000 2. Tax payable $ 2,023,000 3. Deferred tax asset or liability (indicate which) Differed tax asset $ 1,728,000