Answered step by step

Verified Expert Solution

Question

1 Approved Answer

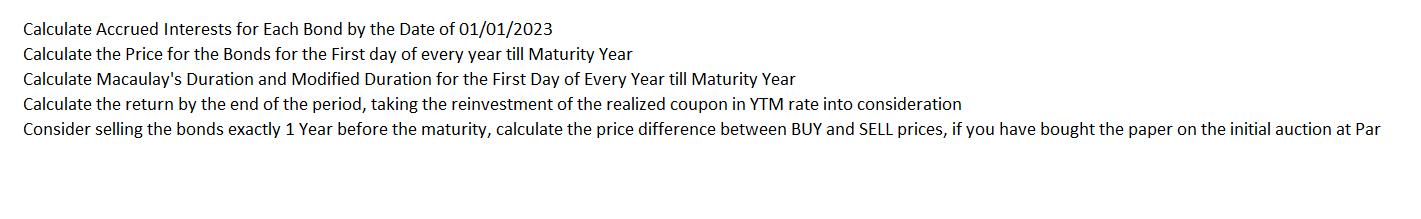

Calculate Accrued Interests for Each Bond by the Date of 01/01/2023 Calculate the price for the Bonds for the First day of every year

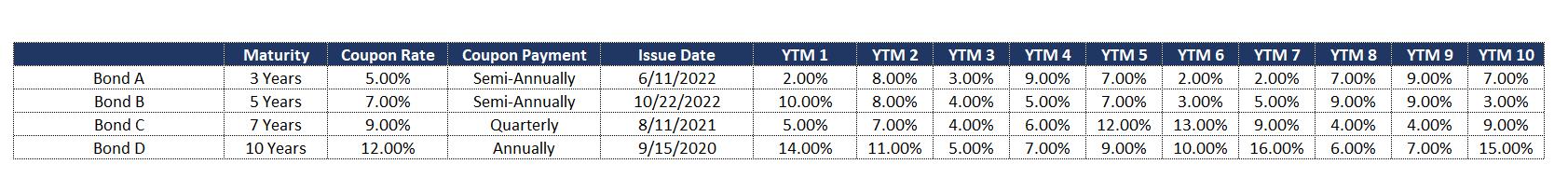

Calculate Accrued Interests for Each Bond by the Date of 01/01/2023 Calculate the price for the Bonds for the First day of every year till Maturity Year Calculate Macaulay's Duration and Modified Duration for the First Day of Every Year till Maturity Year Calculate the return by the end of the period, taking the reinvestment of the realized coupon in YTM rate into consideration Consider selling the bonds exactly 1 Year before the maturity, calculate the price difference between BUY and SELL prices, if you have bought the paper on the initial auction at Par Bond A Bond B Bond C Bond D Maturity 3 Years 5 Years 7 Years 10 Years Coupon Rate 5.00% 7.00% 9.00% 12.00% Coupon Payment Semi-Annually Semi-Annually Quarterly Annually Issue Date 6/11/2022 10/22/2022 8/11/2021 9/15/2020 YTM 1 2.00% 10.00% 5.00% 14.00% YTM 2 YTM 3 YTM 4 YTM 5 YTM 6 YTM 7 8.00% 3.00% 9.00% 7.00% 2.00% 2.00% 8.00% 4.00% 5.00% 7.00% 3.00% 5.00% 7.00% 4.00% 6.00% 12.00% 13.00% 9.00% 11.00% 5.00% 7.00% 9.00% 10.00% 16.00% YTM 9 YTM 10 YTM 8 7.00% 9.00% 7.00% 9.00% 9.00% 3.00% 4.00% 4.00% 9.00% 6.00% 7.00% 15.00%

Step by Step Solution

★★★★★

3.60 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the accrued interest for each bond by the date of 01012023 we need to determine the number of days since the last coupon payment and use the formula Accrued Interest Face Value x Coupon R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started