Answered step by step

Verified Expert Solution

Question

1 Approved Answer

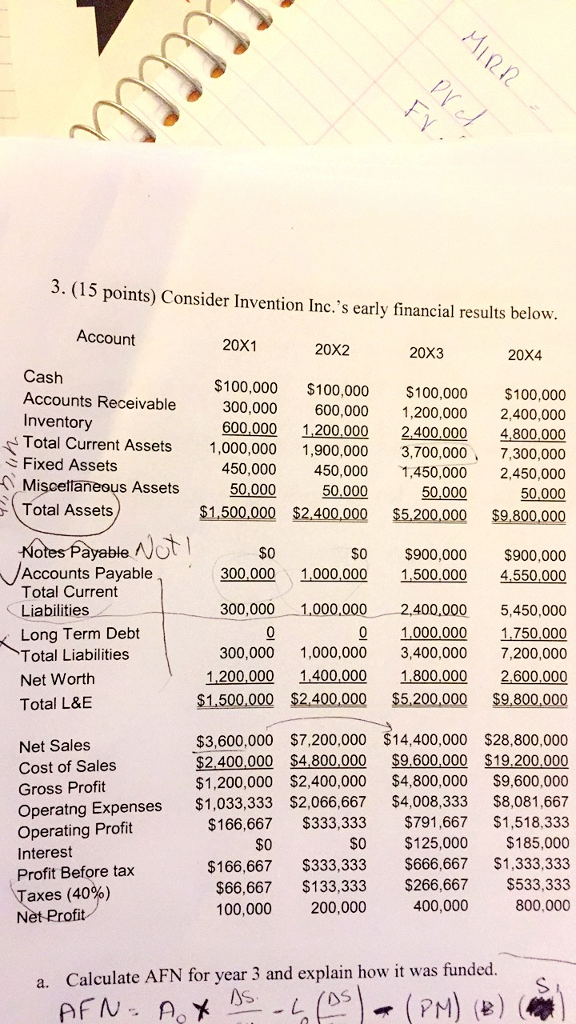

CALCULATE AFN FOR YEAR 3 AND EXPLAIN HOW IT WAS FUNDED? CALCULATE AFN FOR YEAR 4 AND EXPLAIN HOW WAS IT FUNDED? 3. (15 points)

CALCULATE AFN FOR YEAR 3 AND EXPLAIN HOW IT WAS FUNDED?

CALCULATE AFN FOR YEAR 4 AND EXPLAIN HOW WAS IT FUNDED?

3. (15 points) Consider Invention Inc.'s early financial results below Account 20X1 20X2 20X3 20X4 Cash $100,000 $100,000 $100,000 00,000 Accounts Receivable 300,000 600,000 200,000 2,400,000 Inventory 600,000 1 2,400,000 4,800,000 1,200,000 Total Current Assets 1,000,000 1,900,000 3,700,000 7,300,000 Fixed Assets 450,000 450,000 1,450,000 2,450,000 n Miscellaneous Assets 50,000 0.000 0.000 50,000 Total Assets $1,500,000 $2.400,000 $5.200,000 $9.800.000 Notes payable Not $0 $0 $900,000 $900,000 Accounts Payable 00.000 1000,000 1,500,000 4,550,000 Total Current 300,000 00.000 2,400,000 5,450,000 Liabilities 0 1,000,000 1,750,000 Long Term Debt 300,000 1,000,000 3,400,000 7,200,000 Total Liabilities 1,200,000 1,400,000 1,800,000 2,600,000 Net Worth $1.500,000 $2.400,000 S5.200,000 $9,800,000 Total L&E $3,600,000 $7,200,000 $14,400,000 $28,800,000 Net Sales $2,400,000 $4.800.000 9,600,000 $19,200,000 Cost of Sales $1,200,000 $2,400,000 $4,800,000 $9,600,000 Gross Profit g Expenses $1,033,333 $2,066,667 $4,008,333 $8,081,667 Opera $166,667 $333,333 $791,667 $1,518,333 Operating Profit $125,000 $185,000 $0 $0 nterest $166,667 $333,333 $666,667 $1,333,333 Profit Before tax $66,667 $133,333 $266,667 $533,333 axes (40%) 400,000 800,000 100,000 200,000 a. Calculate AFN for year 3 and explain how it was funded. (PM) (P)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started