Answered step by step

Verified Expert Solution

Question

1 Approved Answer

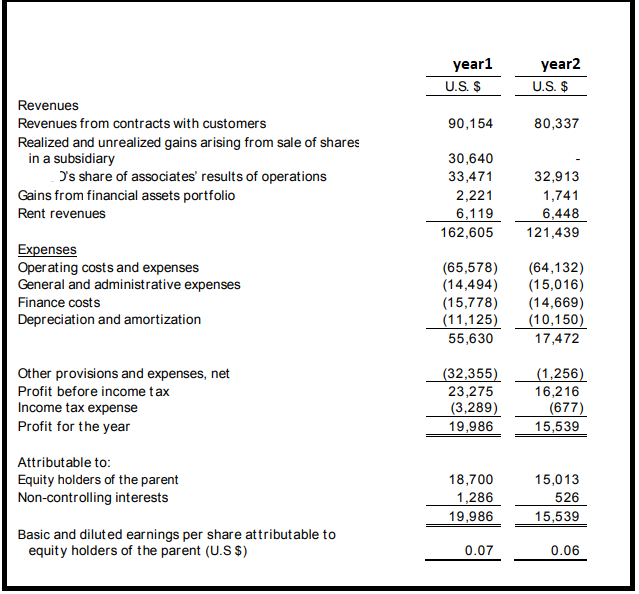

calculate and explain Accounts receivable turnover year1 year2 U.S. $ U.S. $ Revenues Revenues from contracts with customers 90,154 80,337 Realized and unrealized gains arising

calculate and explain

Accounts receivable turnover

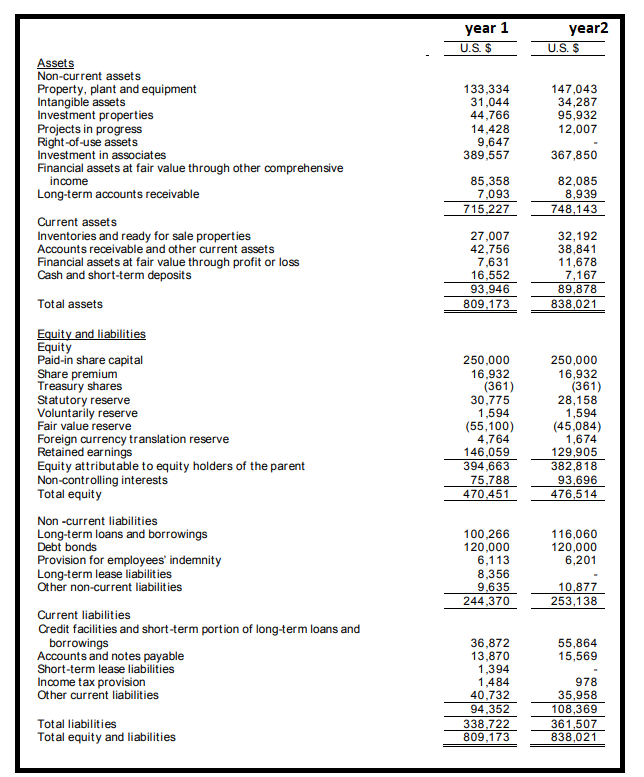

year1 year2 U.S. $ U.S. $ Revenues Revenues from contracts with customers 90,154 80,337 Realized and unrealized gains arising from sale of shares in a subsidiary D's share of associates' results of operations Gains from financial assets portfolio Rent revenues 30,640 33,471 2,221 6,119 162,605 32,913 1,741 6,448 121,439 Expenses Operating costs and expenses General and administrative expenses Finance costs Depreciation and amortization (65,578) (14,494) (15,778) (11,125) 55,630 (64,132) (15,016) (14,669) (10,150) 17,472 Other provisions and expenses, net Profit before income tax Income tax expense Profit for the year (32,355) 23,275 (3,289) 19,986 (1,256) 16,216 (677) 15,539 Attributable to: Equity holders of the parent Non-controlling interests 18,700 1,286 19,986 15,013 526 15,539 Basic and diluted earnings per share attributable to equity holders of the parent (U.S $) 0.07 0.06 year 1 year2 U.S. $ U.S. $ Assets Non-current assets Property, plant and equipment Intangible assets Investment properties Projects in progress Right-of-use assets Investment in associates Financial assets at fair value through other comprehensive income Long-term accounts receivable 133,334 31,044 44,766 14,428 9,647 389,557 147,043 34,287 95,932 12,007 367,850 85,358 7,093 715,227 82,085 8,939 748,143 Current assets Inventories and ready for sale properties Accounts receivable and other current assets Financial assets at fair value through profit or loss Cash and short-term deposits 27,007 42,756 7,631 16,552 93,946 809,173 32,192 38,841 11,678 7,167 89,878 838,021 Total assets Equity and liabilities Equity Paid-in share capital Share premium Treasury shares Statutory reserve Voluntarily reserve Fair value reserve Foreign currency translation reserve Retained earnings Equity attributable to equity holders of the parent Non-controlling interests Total equity 250,000 16,932 (361) 30,775 1,594 (55,100) 4,764 146,059 394,663 75,788 470,451 250,000 16,932 (361) 28,158 1,594 (45,084) 1,674 129,905 382,818 93,696 476,514 Non-current liabilities Long-term loans and borrowings Debt bonds Provision for employees' indemnity Long-term lease liabilities Other non-current liabilities 116,060 120,000 6,201 100,266 120,000 6,113 8,356 9,635 244,370 10.877 253,138 Current liabilities Credit facilities and short-term portion of long-term loans and borrowings Accounts and notes payable Short-term lease liabilities Income tax provision Other current liabilities 55,864 15,569 36 13,870 1,394 1,484 40,732 94,352 338,722 809,173 978 35,958 108,369 361,507 838,021 Total liabilities Total equity and liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started