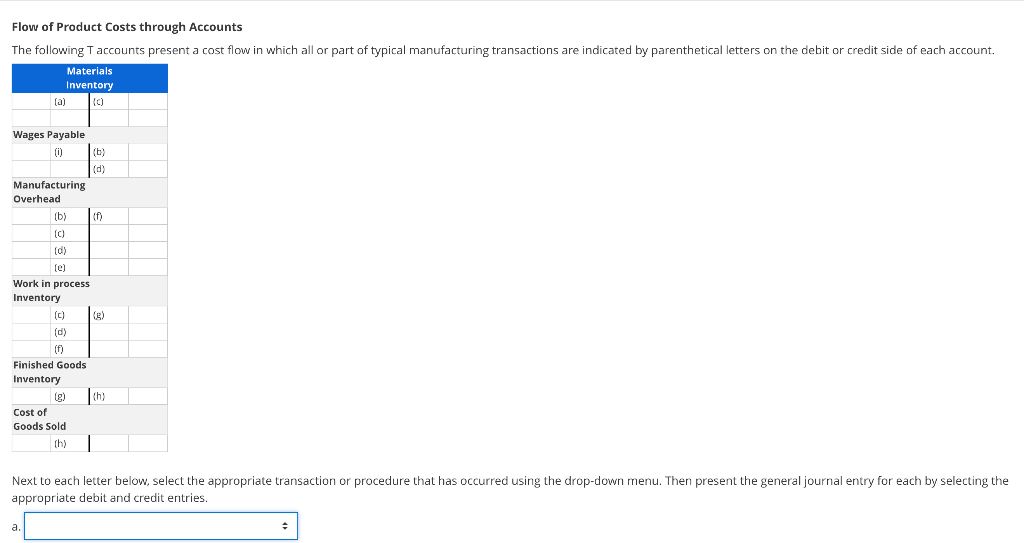

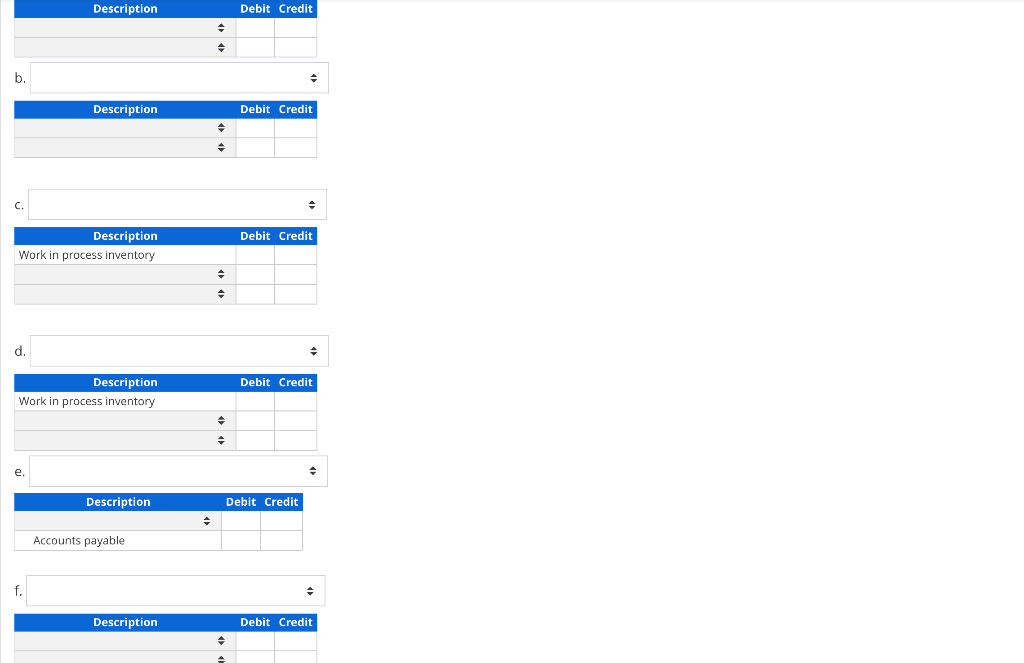

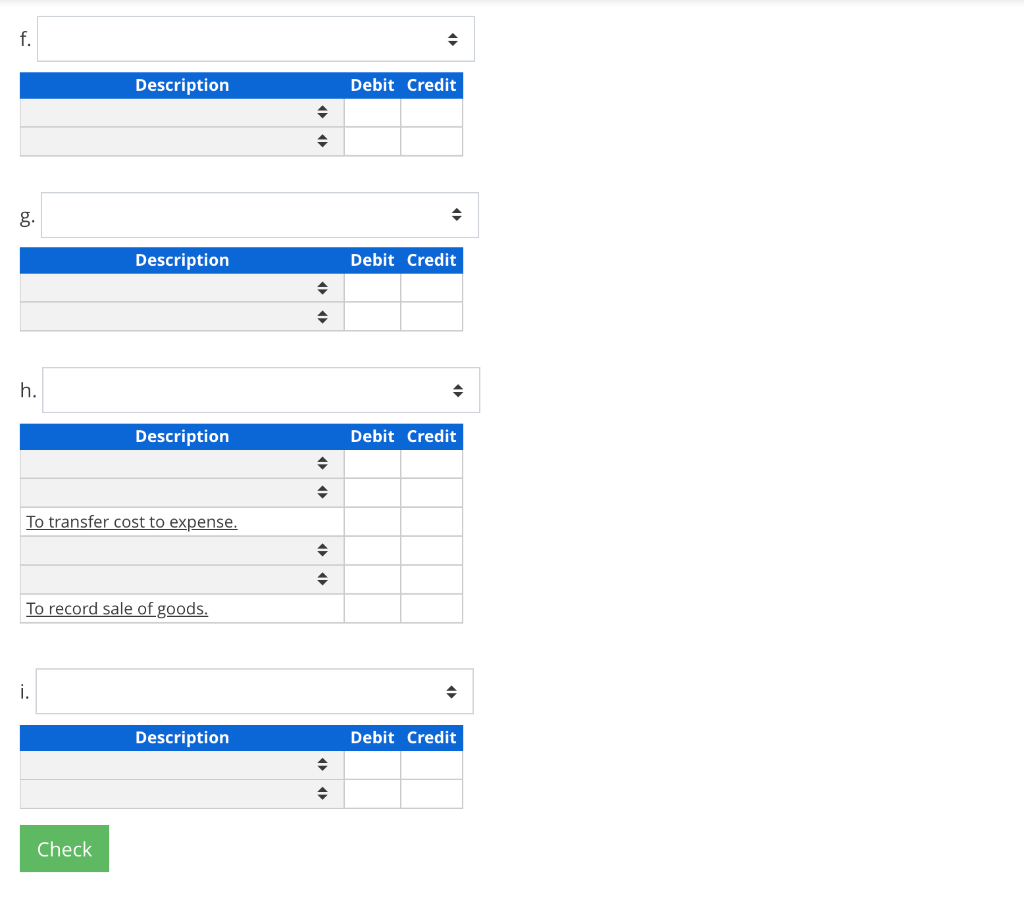

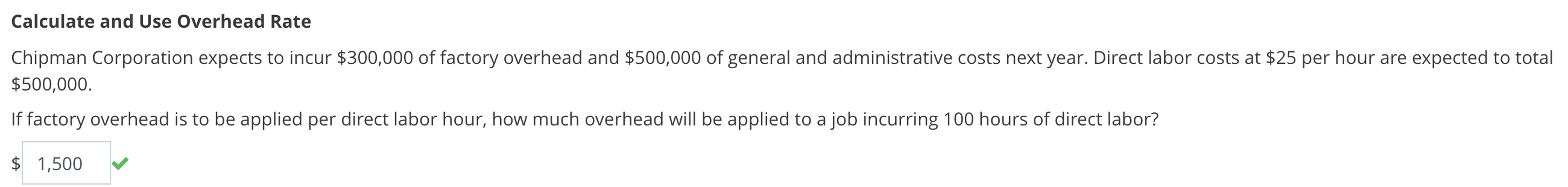

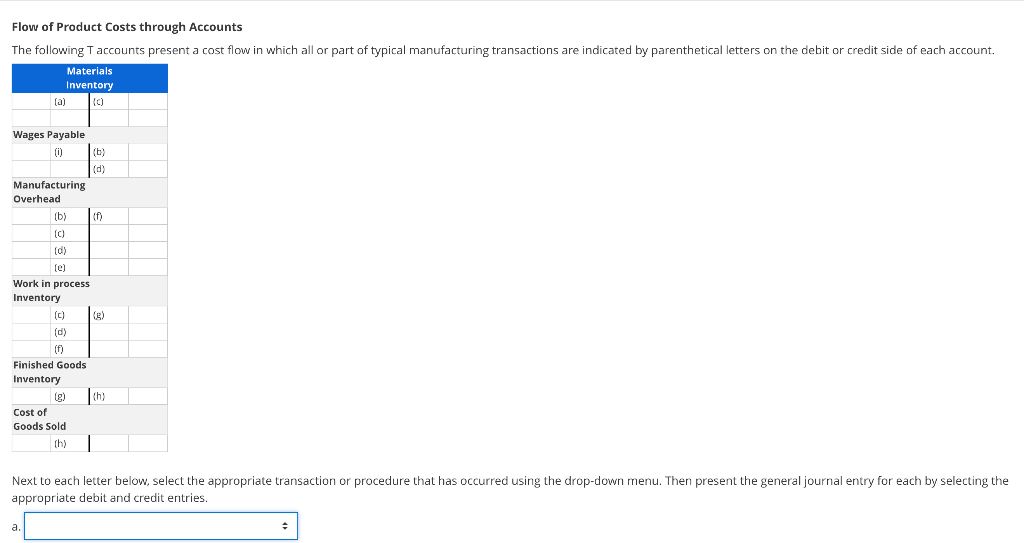

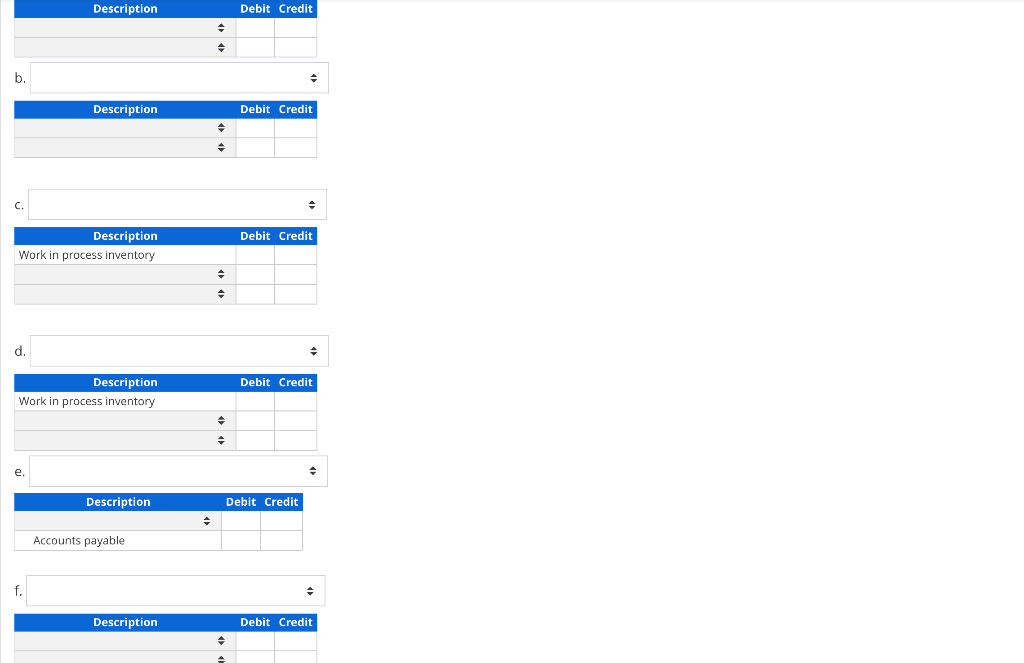

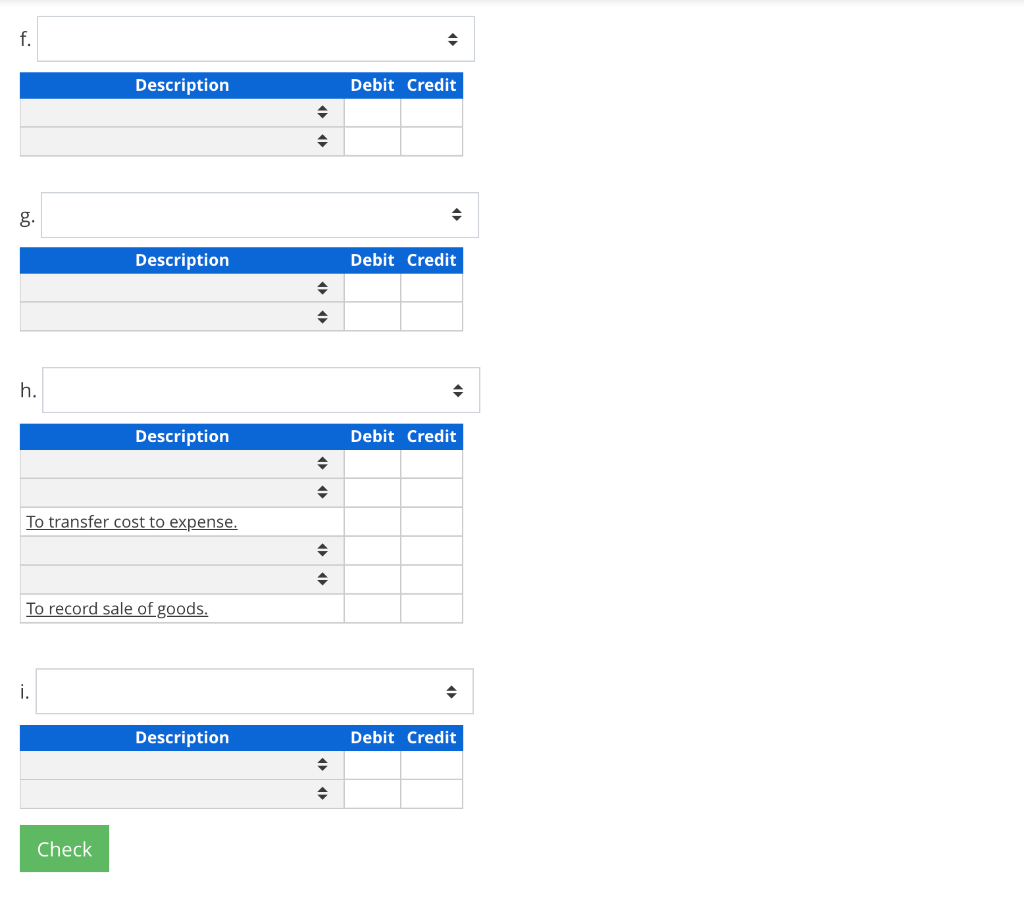

Calculate and Use Overhead Rate Chipman Corporation expects to incur $300,000 of factory overhead and $500,000 of general and administrative costs next year. Direct labor costs at $25 per hour are expected to total $500,000. If factory overhead is to be applied per direct labor hour, how much overhead will be applied to a job incurring 100 hours of direct labor? $ 1,500 Flow of Product Costs through Accounts The following Taccounts present a cost flow in which all or part of typical manufacturing transactions are indicated by parenthetical letters on the debit or credit side of each account. Materials Inventory la) (0) Wages Payable (0) (b) Manufacturing Overhead (b) 10 (d) (e) Work in process Inventory (c) (d) (e) Finished Goods Inventory (g) Cost of Goods Sold (h) Next to each letter below, select the appropriate transaction or procedure that has occurred using the drop-down menu. Then present the general journal entry for each by selecting the appropriate debit and credit entries. Description Debit Credit b. Description Debit Credit C. Debit Credit Description Work in process inventory d. Debit Credit Description Work in process inventory e. Description Debit Credit Accounts payable f. Description Debit Credit f. Description Debit Credit 8 Description Debit Credit h. Description Debit Credit To transfer cost to expense. To record sale of goods. i. Description Debit Credit Check Calculate and Use Overhead Rate Chipman Corporation expects to incur $300,000 of factory overhead and $500,000 of general and administrative costs next year. Direct labor costs at $25 per hour are expected to total $500,000. If factory overhead is to be applied per direct labor hour, how much overhead will be applied to a job incurring 100 hours of direct labor? $ 1,500 Flow of Product Costs through Accounts The following Taccounts present a cost flow in which all or part of typical manufacturing transactions are indicated by parenthetical letters on the debit or credit side of each account. Materials Inventory la) (0) Wages Payable (0) (b) Manufacturing Overhead (b) 10 (d) (e) Work in process Inventory (c) (d) (e) Finished Goods Inventory (g) Cost of Goods Sold (h) Next to each letter below, select the appropriate transaction or procedure that has occurred using the drop-down menu. Then present the general journal entry for each by selecting the appropriate debit and credit entries. Description Debit Credit b. Description Debit Credit C. Debit Credit Description Work in process inventory d. Debit Credit Description Work in process inventory e. Description Debit Credit Accounts payable f. Description Debit Credit f. Description Debit Credit 8 Description Debit Credit h. Description Debit Credit To transfer cost to expense. To record sale of goods. i. Description Debit Credit Check