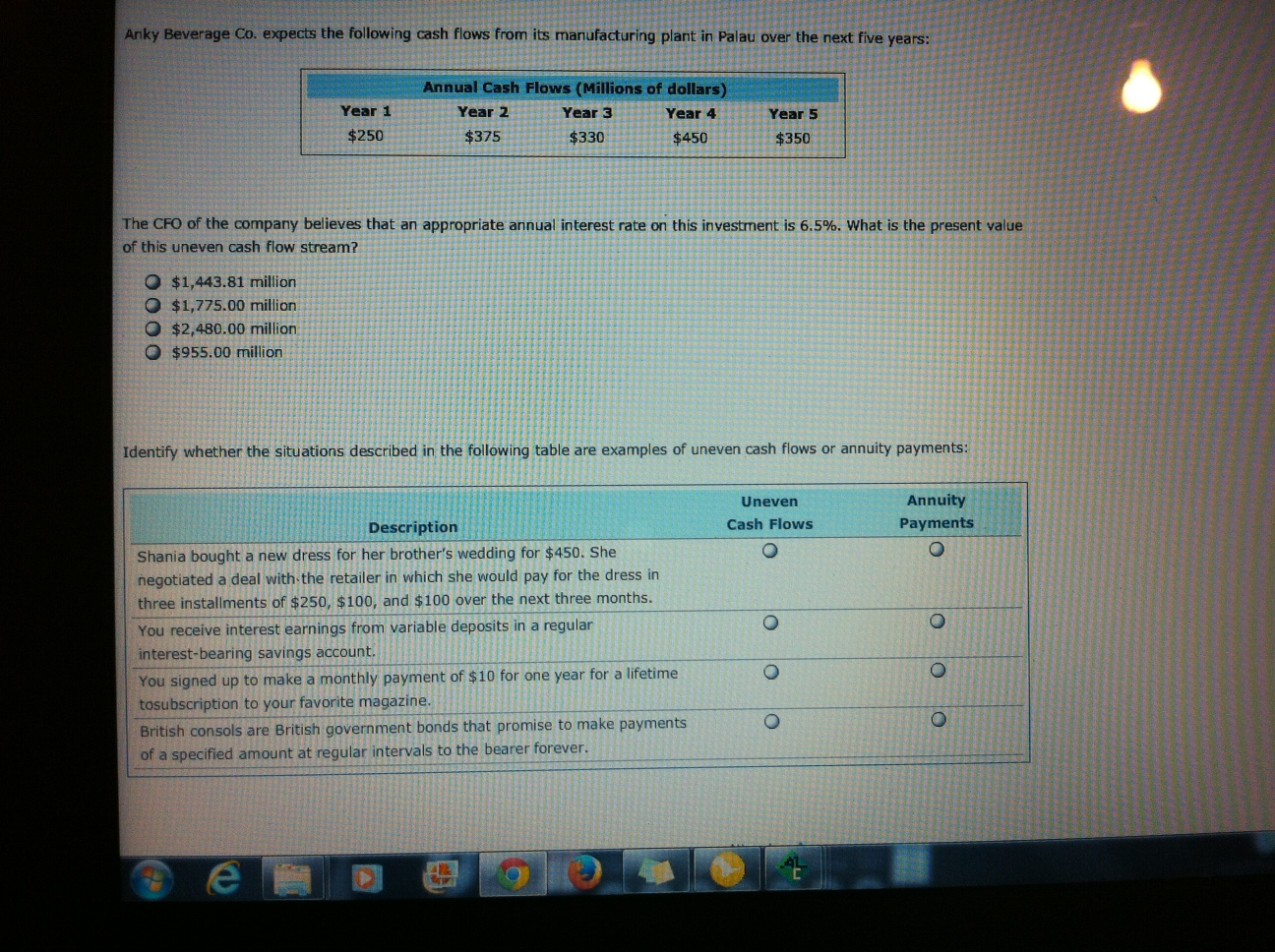

Calculate annuity cash flows Your goal is to have $12,500 in your bank account by the end of six years. If the interest rate remains constant at 5% and you want to make annual identical deposits, how much will you need to deposit in your account at the end of each year to reach your goal? If your deposits were made at the beginning of each year rather than an at the end, by how much would the amount of your deposit change if you still wanted to reach your goal by the end of six years? Anky Beverage Co. expects the following cash flows from its manufacturing plant in Palau over the next five years: The CFO of the company believes that an appropriate annual interest rate on this investment is 6.5%. What is the present value of this uneven cash flow stream? loyd is a divorce attorney who practices law in Florida. He wants to join the American Divorce Lawyers Association {ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $700 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $6,000 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it's a great deal. Suppose that the appropriate annual interest rate is 7.9%. What is the minimum number of years that Lloyd must remain a member of the ADLA so that the lifetime membership is cheaper (on a present value basis) than paying $700 in annual membership dues? (Note: Round your answer up to the nearest year.) In 1626, Dutchman Peter Minuit purchased Manhattan Island from a local Native American tribe. Historians estimate that the price he paid for the island was about $24 worth of goods, including beads, trinkets, cloth, kettles, and axe heads. Many people find it laughable that Manhattan Island would be sold for $24, but you need to consider the future value (FV) of that price in more current times. If the $24 purchase price could have been invested at a 4.75% annual interest rate, what is its value as of 2012 (386 years later)