Question

Calculate arc ltd taxable total profit for the accounting period in 17 month period to 31 may 2021 Compare by arc ltd total corporation tax

Calculate arc ltd taxable total profit for the accounting period in 17 month period to 31 may 2021

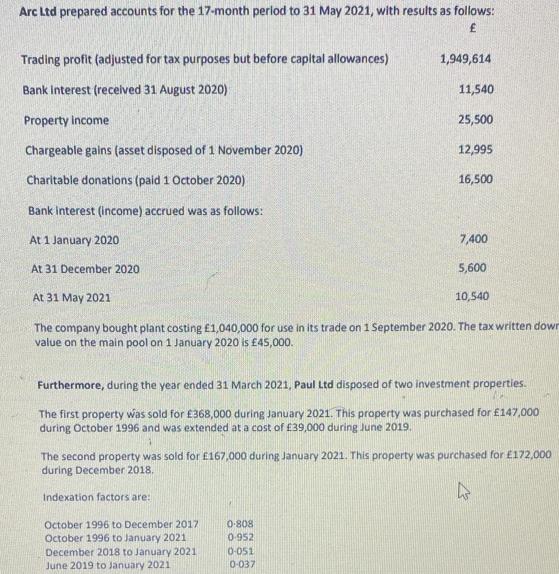

Arc Ltd prepared accounts for the 17-month period to 31 May 2021, with results as follows: Trading profit (adjusted for tax purposes but before capital allowances) Bank Interest (received 31 August 2020) Property income Chargeable gains (asset disposed of 1 November 2020) Charitable donations (paid 1 October 2020) Bank interest (income) accrued was as follows: At 1 January 2020 At 31 December 2020 Indexation factors are: 1,949,614 October 1996 to December 2017 October 1996 to January 2021 11,540 25,500 12,995 16,500 At 31 May 2021 The company bought plant costing 1,040,000 for use in its trade on 1 September 2020. The tax written down value on the main pool on 1 January 2020 is 45,000. December 2018 to January 2021 June 2019 to January 2021 7,400 Furthermore, during the year ended 31 March 2021, Paul Ltd disposed of two investment properties. The first property was sold for 368,000 during January 2021. This property was purchased for 147,000 during October 1996 and was extended at a cost of 39,000 during June 2019. 0-808 0-952 0-051 0-037 5,600 The second property was sold for 167,000 during January 2021. This property was purchased for 172,000 during December 2018. 10,540 27

Step by Step Solution

3.63 Rating (124 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the taxable total profit for the accounting period of Arc Ltd for the 17month period ending on 31 May 2021 we need to consider the follow...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started