Answered step by step

Verified Expert Solution

Question

1 Approved Answer

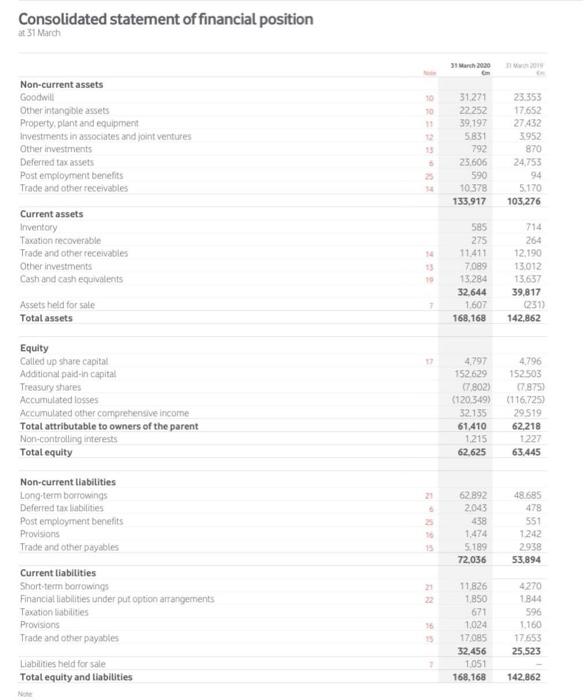

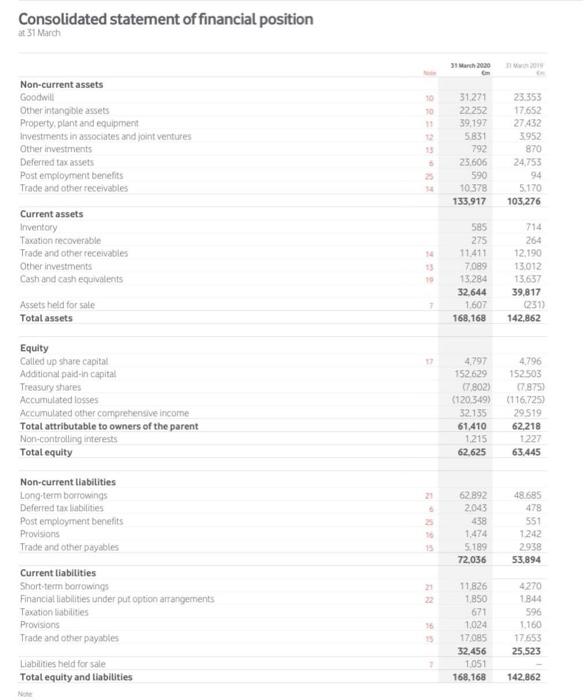

calculate at least ten financial ratios for the years attached Consolidated statement of financial position at 31 March 3 March 2020 10 10 Non-current assets

calculate at least ten financial ratios for the years attached

Consolidated statement of financial position at 31 March 3 March 2020 10 10 Non-current assets Goodwill Other intangible assets Property, plant and equipment Investments in associates and joint ventures Other investments Deferred tax assets Post employment benefits Trade and other receivables Current assets Inventory Taxation recoverable Trade and other receivables Other investments Cash and cash equivalents Assets held for sale Total assets 31.271 22252 39,197 5831 792 25.606 590 10378 133,917 23.353 17652 27432 3952 870 24,753 94 5.170 103.276 14 585 275 11411 7,089 13.284 32.644 1.607 168,168 10 264 12.190 13.012 13.657 39.817 (231) 142.862 Equity Called up share capital Additional paid in capital Treasury shares Accumulated losses Accumulated other comprehensive income Total attributable to owners of the parent Non-controlling interests Total equity 4,797 152629 (7.802) (120.349) 32.135 61,410 1.215 62.625 4.796 152503 07875 (116.725) 29519 62.218 1227 63.445 Non-current liabilities Long-term borrowings Deferred tax liabilities Post employment benefits Provisions Trade and other payables Current liabilities Short-term borrowings Financial liabilities under put option arrangements Taxation abilities Provisions Trade and other payables 62.892 2043 438 1.474 5189 72.036 48 685 478 551 1.242 2.938 53,894 1 11826 1.850 671 1.024 17085 32.456 1051 168.168 4270 1844 596 1160 17653 25.523 Liabilities held for sale Total equity and liabilities 142.862 Consolidated statement of financial position at 31 March 3 March 2020 10 10 Non-current assets Goodwill Other intangible assets Property, plant and equipment Investments in associates and joint ventures Other investments Deferred tax assets Post employment benefits Trade and other receivables Current assets Inventory Taxation recoverable Trade and other receivables Other investments Cash and cash equivalents Assets held for sale Total assets 31.271 22252 39,197 5831 792 25.606 590 10378 133,917 23.353 17652 27432 3952 870 24,753 94 5.170 103.276 14 585 275 11411 7,089 13.284 32.644 1.607 168,168 10 264 12.190 13.012 13.657 39.817 (231) 142.862 Equity Called up share capital Additional paid in capital Treasury shares Accumulated losses Accumulated other comprehensive income Total attributable to owners of the parent Non-controlling interests Total equity 4,797 152629 (7.802) (120.349) 32.135 61,410 1.215 62.625 4.796 152503 07875 (116.725) 29519 62.218 1227 63.445 Non-current liabilities Long-term borrowings Deferred tax liabilities Post employment benefits Provisions Trade and other payables Current liabilities Short-term borrowings Financial liabilities under put option arrangements Taxation abilities Provisions Trade and other payables 62.892 2043 438 1.474 5189 72.036 48 685 478 551 1.242 2.938 53,894 1 11826 1.850 671 1.024 17085 32.456 1051 168.168 4270 1844 596 1160 17653 25.523 Liabilities held for sale Total equity and liabilities 142.862

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started