Answered step by step

Verified Expert Solution

Question

1 Approved Answer

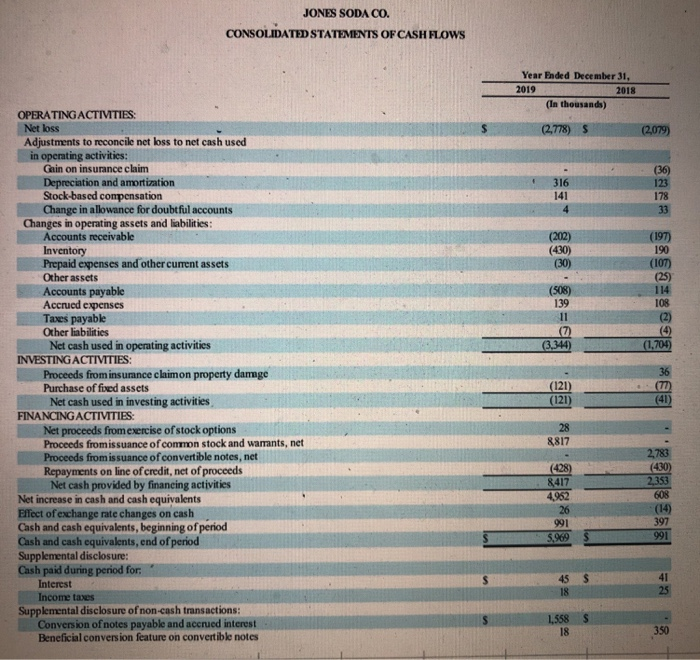

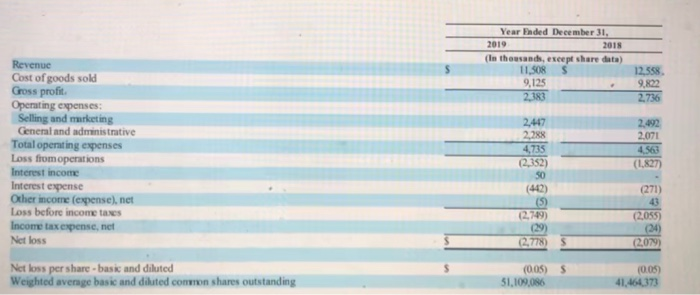

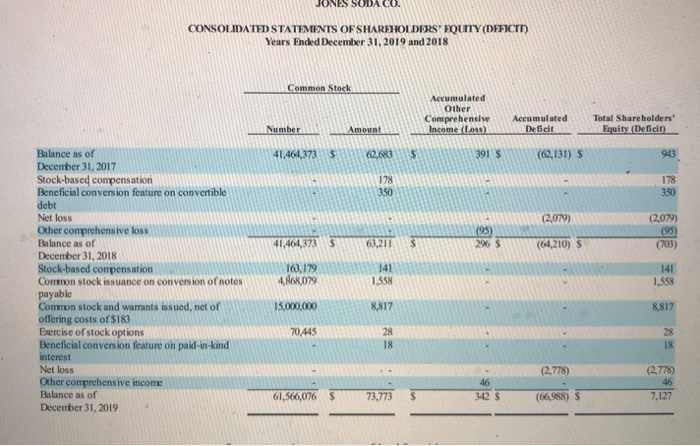

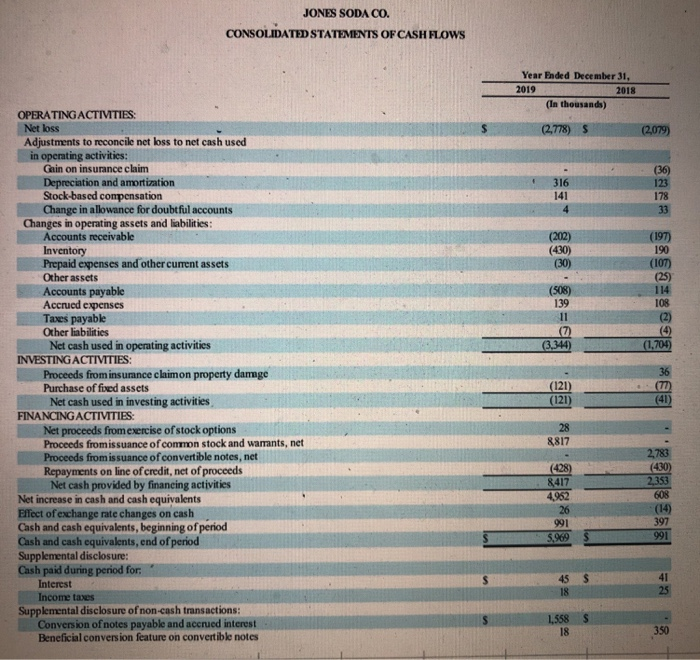

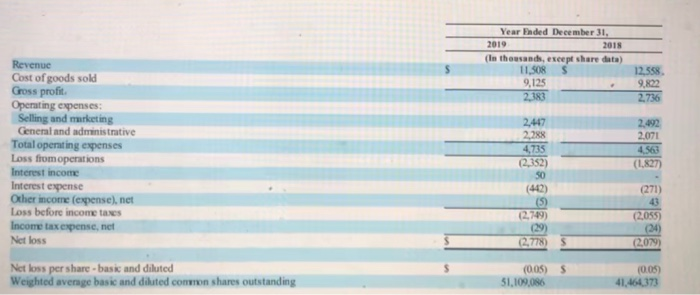

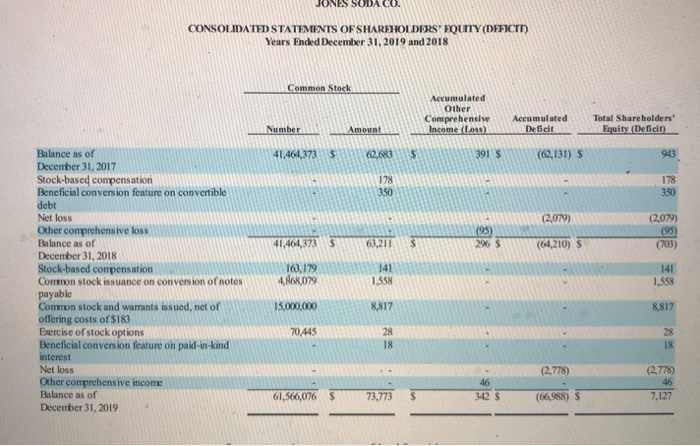

calculate CFFA |Cash flow from assest| and cash flow to creditors and investors. financial cash flow identity eqaution. for 2018 and 2019 all infomation needed

calculate CFFA |Cash flow from assest| and cash flow to creditors and investors. financial cash flow identity eqaution. for 2018 and 2019 all infomation needed is provided below

JONES SODA CO. CONSOLIDATED STATEMENTS OF CASH FLOWS Year Ended December 31, 2019 2018 (In thousands) (2.778) S (2,079) 316 141 4 (36) 123 178 33 (202) (430) (30) (197) 190 (107 (25) 114 108 (2) (508) 139 11 (7) (3,344) (1,704) OPERATING ACTIVITIES: Net loss Adjustments to reconcile net loss to net cash used in operating activities: Gain on insurance claim Depreciation and amortization Stock-based compensation Change in allowance for doubtful accounts Changes in operating assets and liabilities: Accounts receivable Inventory Prepaid expenses and other current assets Other assets Accounts payable Accrued expenses Taxes payable Other liabilities Net cash used in operating activities INVESTING ACTIVITIES: Proceeds from insurance claimon property damge Purchase of fixed assets Net cash used in investing activities FINANCING ACTIVITIES Net proceeds from exercise of stock options Proceeds fromissuance of conmon stock and warrants, net Proceeds from issuance of convertible notes, net Repayments on line of credit, net of proceeds Net cash provided by financing activities Net increase in cash and cash equivalents Effect of exchange rate changes on cash Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Supplemental disclosure Cash paid during period for Interest Income taxes Supplemental disclosure of non-cash transactions: Conversion of notes payable and accrued interest Beneficial conversion feature on convertible notes (77) (41) (121) 28 &817 (428) 8417 4,962 26 991 5,969 2,783 (430) 2353 608 (14) 397 991 S 45 18 41 25 S 1.558 18 350 Year Ended December 31. 2019 2018 (In thousands, except share data) 11.508 9,125 2,383 12.558 9,822 2.736 Revenue Cost of goods sold Gross profit Operating expenses: Selling and marketing General and administrative Total operating expenses Loss from operations Interest income Interest expense Other income (expense), net Loss before income taxes Income taxexpense, net Net loss 2492 2.071 4.563 (1.827 2,447 2.288 4735 (2,352) 50 (412 (5) (2.749) (29 (2,778) (271) (2,055) (34) (2,079 Net loss per share - basic and diluted Weighted average basic and diluted contron shares outstanding (005) 51,109,086 (0.05) 41.464373 NES SODA CO. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (DEFICIT) Years Ended December 31, 2019 and 2018 Common Stock Accumulated Other Comprehensive Income (Loss) Number Accumulated Deficit Total Shareholders Equity Deficit Amount 41,464,373 $ 62,683 $ 391 S (62,131) $ 9443 178 350 178 350 (2,079) (95) 296 $ (2,079) (95) (703) 41,464,373 $ 63,211 $ (64,210) S Balance as of December 31, 2017 Stock-based compensation Beneficial conversion feature on convertible debt Net loss Other comprehensive loss Balance as of December 31, 2018 Stock-based compensation Common stock issuance on conversion of notes payable Common stock and wamants issued, net of offering costs of 5183 Exercise of stock options Beneficial conversion feature on paid-in-kind interest Net loss Other comprehensive income Balance as of December 31, 2019 163, 179 4,868,079 141 1.358 141 1.558 15,000,000 8,817 8,817 70,445 28 18 28 18 (2.778) 46 342 S (2.778) 46 7,127 61,566,076 $ 73,773 $ (66,988) S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started