Calculate cost of goods sold and estimated annual sales for years 2021-2025, create a depreciation schedule, and complete the following pro forma income statements for Kevins Convenience Store, LLC considering the following assumptions:

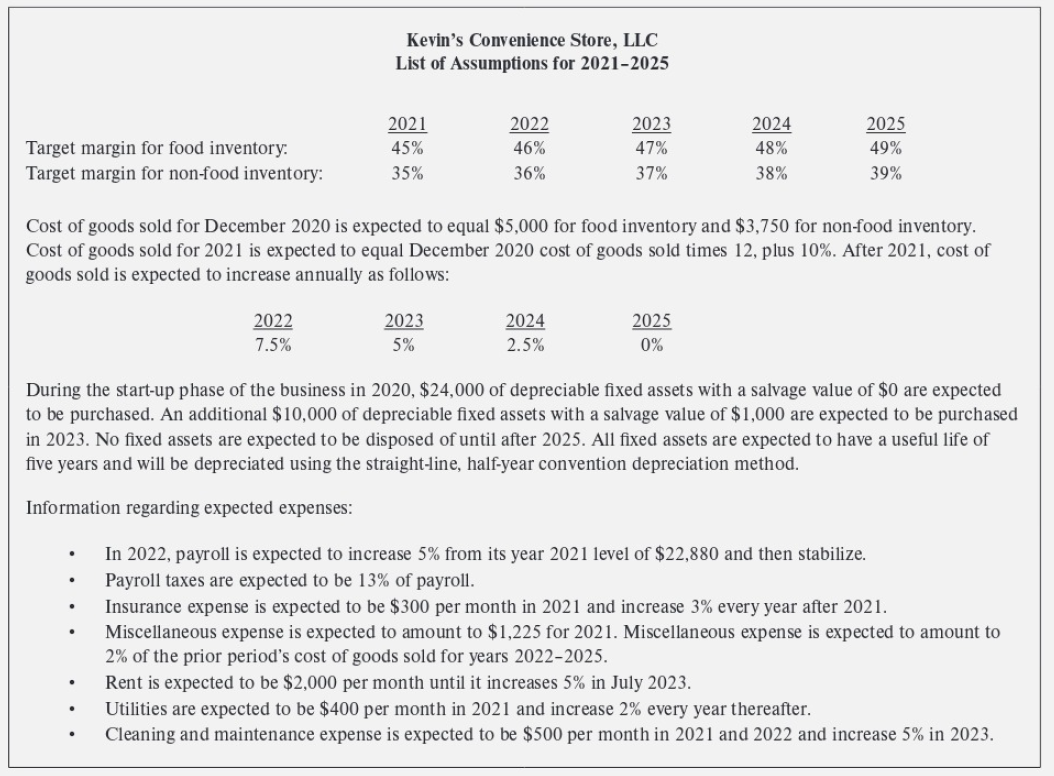

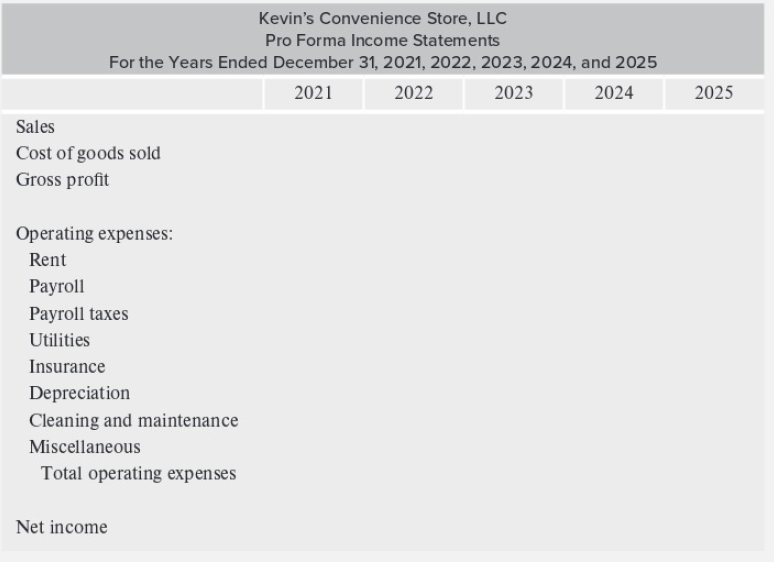

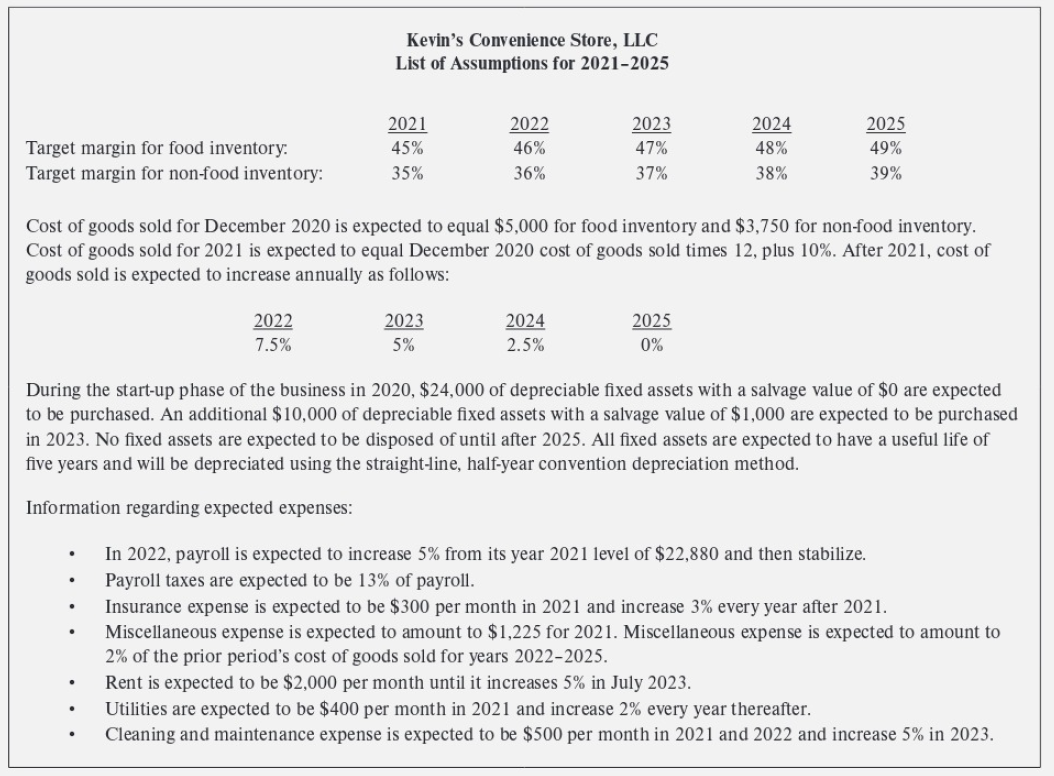

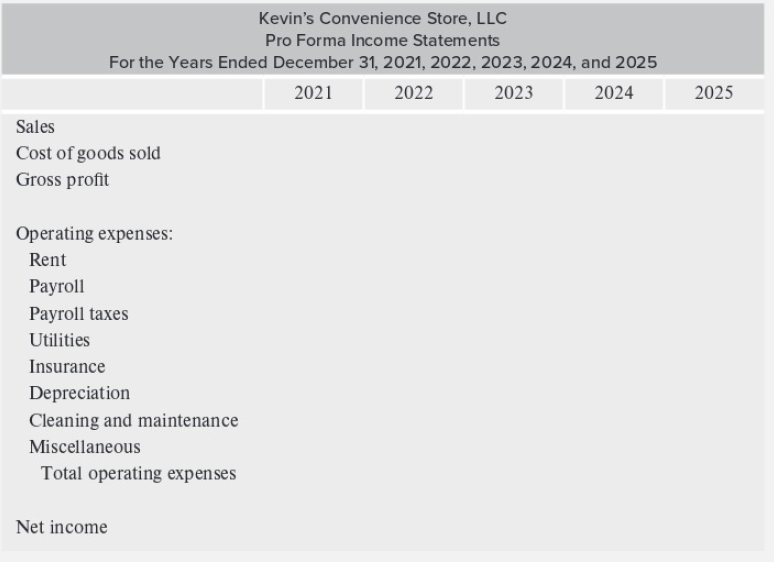

Kevin's Convenience Store, LLC List of Assumptions for 2021-2025 Target margin for food inventory: Target margin for non-food inventory: 2021 45% 35% 2022 46% 36% 2023 47% 37% 2024 48% 38% 2025 49% 39% Cost of goods sold for December 2020 is expected to equal $5,000 for food inventory and $3,750 for non-food inventory. Cost of goods sold for 2021 is expected to equal December 2020 cost of goods sold times 12, plus 10%. After 2021, cost of goods sold is expected to increase annually as follows: 2022 7.5% 2023 5% 2024 2.5% 2025 0% During the start-up phase of the business in 2020, $24,000 of depreciable fixed assets with a salvage value of $0 are expected to be purchased. An additional $10,000 of depreciable fixed assets with a salvage value of $1,000 are expected to be purchased in 2023. No fixed assets are expected to be disposed of until after 2025. All fixed assets are expected to have a useful life of five years and will be depreciated using the straight-line, half-year convention depreciation method. Information regarding expected expenses: In 2022, payroll is expected to increase 5% from its year 2021 level of $22,880 and then stabilize. Payroll taxes are expected to be 13% of payroll. Insurance expense is expected to be $300 per month in 2021 and increase 3% every year after 2021. Miscellaneous expense is expected to amount to $1,225 for 2021. Miscellaneous expense is expected to amount to 2% of the prior period's cost of goods sold for years 2022-2025. Rent is expected to be $2,000 per month until it increases 5% in July 2023. Utilities are expected to be $400 per month in 2021 and increase 2% every year thereafter. Cleaning and maintenance expense is expected to be $500 per month in 2021 and 2022 and increase 5% in 2023. Kevin's Convenience Store, LLC Pro Forma Income Statements For the Years Ended December 31, 2021, 2022, 2023, 2024, and 2025 2021 2022 2023 2024 Sales Cost of goods sold Gross profit 2025 Operating expenses: Rent Payroll Payroll taxes Utilities Insurance Depreciation Cleaning and maintenance Miscellaneous Total operating expenses Net income Kevin's Convenience Store, LLC List of Assumptions for 2021-2025 Target margin for food inventory: Target margin for non-food inventory: 2021 45% 35% 2022 46% 36% 2023 47% 37% 2024 48% 38% 2025 49% 39% Cost of goods sold for December 2020 is expected to equal $5,000 for food inventory and $3,750 for non-food inventory. Cost of goods sold for 2021 is expected to equal December 2020 cost of goods sold times 12, plus 10%. After 2021, cost of goods sold is expected to increase annually as follows: 2022 7.5% 2023 5% 2024 2.5% 2025 0% During the start-up phase of the business in 2020, $24,000 of depreciable fixed assets with a salvage value of $0 are expected to be purchased. An additional $10,000 of depreciable fixed assets with a salvage value of $1,000 are expected to be purchased in 2023. No fixed assets are expected to be disposed of until after 2025. All fixed assets are expected to have a useful life of five years and will be depreciated using the straight-line, half-year convention depreciation method. Information regarding expected expenses: In 2022, payroll is expected to increase 5% from its year 2021 level of $22,880 and then stabilize. Payroll taxes are expected to be 13% of payroll. Insurance expense is expected to be $300 per month in 2021 and increase 3% every year after 2021. Miscellaneous expense is expected to amount to $1,225 for 2021. Miscellaneous expense is expected to amount to 2% of the prior period's cost of goods sold for years 2022-2025. Rent is expected to be $2,000 per month until it increases 5% in July 2023. Utilities are expected to be $400 per month in 2021 and increase 2% every year thereafter. Cleaning and maintenance expense is expected to be $500 per month in 2021 and 2022 and increase 5% in 2023. Kevin's Convenience Store, LLC Pro Forma Income Statements For the Years Ended December 31, 2021, 2022, 2023, 2024, and 2025 2021 2022 2023 2024 Sales Cost of goods sold Gross profit 2025 Operating expenses: Rent Payroll Payroll taxes Utilities Insurance Depreciation Cleaning and maintenance Miscellaneous Total operating expenses Net income