Answered step by step

Verified Expert Solution

Question

1 Approved Answer

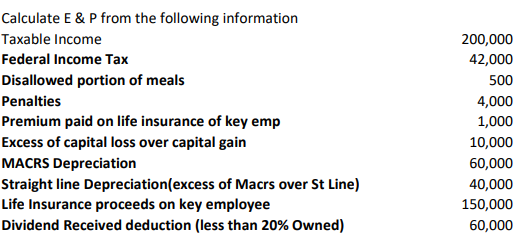

Calculate E & P from the following information begin{tabular}{lr} Taxable Income & 200,000 Federal Income Tax & 42,000 Disallowed portion of meals &

Calculate E \& P from the following information \begin{tabular}{lr} Taxable Income & 200,000 \\ Federal Income Tax & 42,000 \\ Disallowed portion of meals & 500 \\ Penalties & 4,000 \\ Premium paid on life insurance of key emp & 1,000 \\ Excess of capital loss over capital gain & 10,000 \\ MACRS Depreciation & 60,000 \\ Straight line Depreciation(excess of Macrs over St Line) & 40,000 \\ Life Insurance proceeds on key employee & 150,000 \\ Dividend Received deduction (less than 20\% Owned) & 60,000 \end{tabular}

Calculate E \& P from the following information \begin{tabular}{lr} Taxable Income & 200,000 \\ Federal Income Tax & 42,000 \\ Disallowed portion of meals & 500 \\ Penalties & 4,000 \\ Premium paid on life insurance of key emp & 1,000 \\ Excess of capital loss over capital gain & 10,000 \\ MACRS Depreciation & 60,000 \\ Straight line Depreciation(excess of Macrs over St Line) & 40,000 \\ Life Insurance proceeds on key employee & 150,000 \\ Dividend Received deduction (less than 20\% Owned) & 60,000 \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started