Calculate each of the following

1. Clean Price (Assume that the current date is the relevant date for the price.)

2. YTM

3. Duration (you must still account for the fact that coupons are not exactly 1 period away from today.)

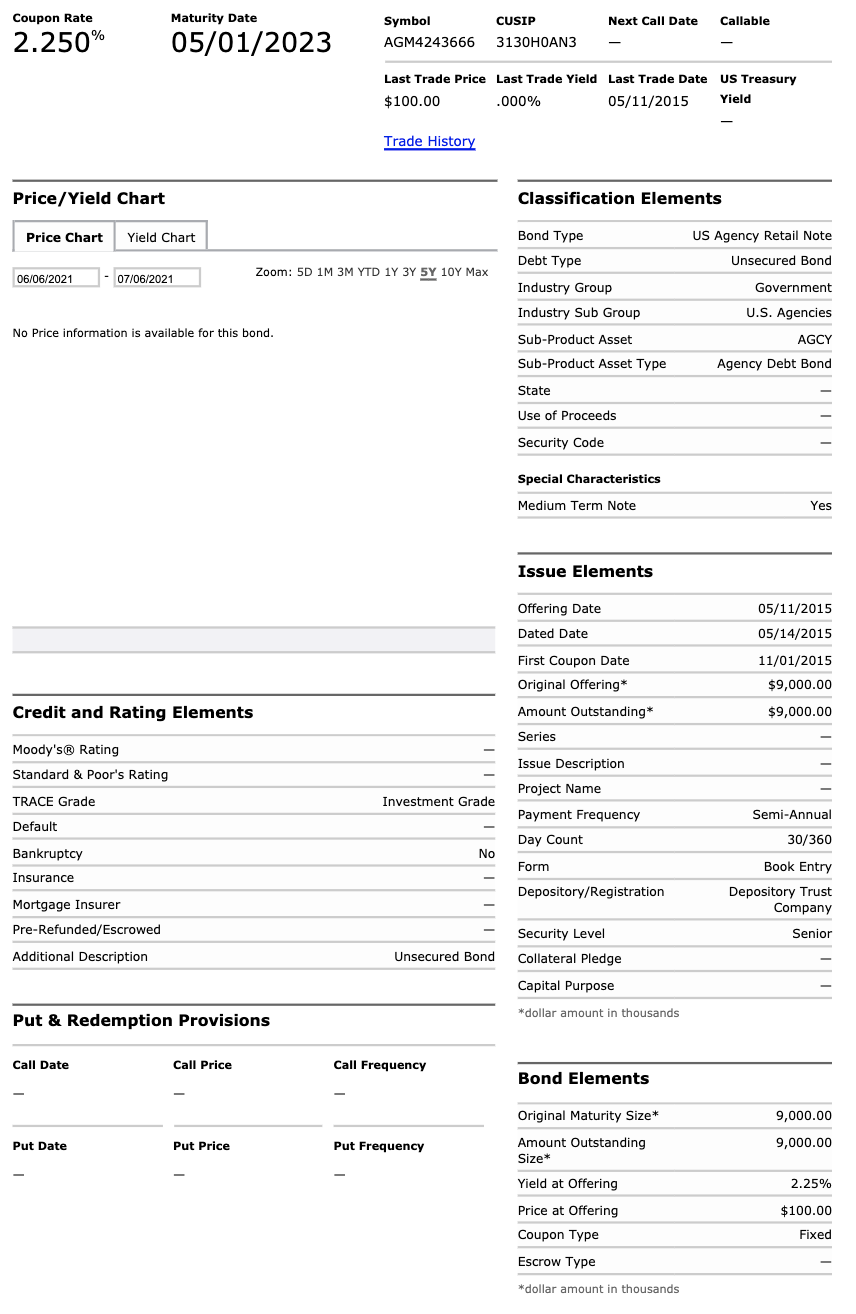

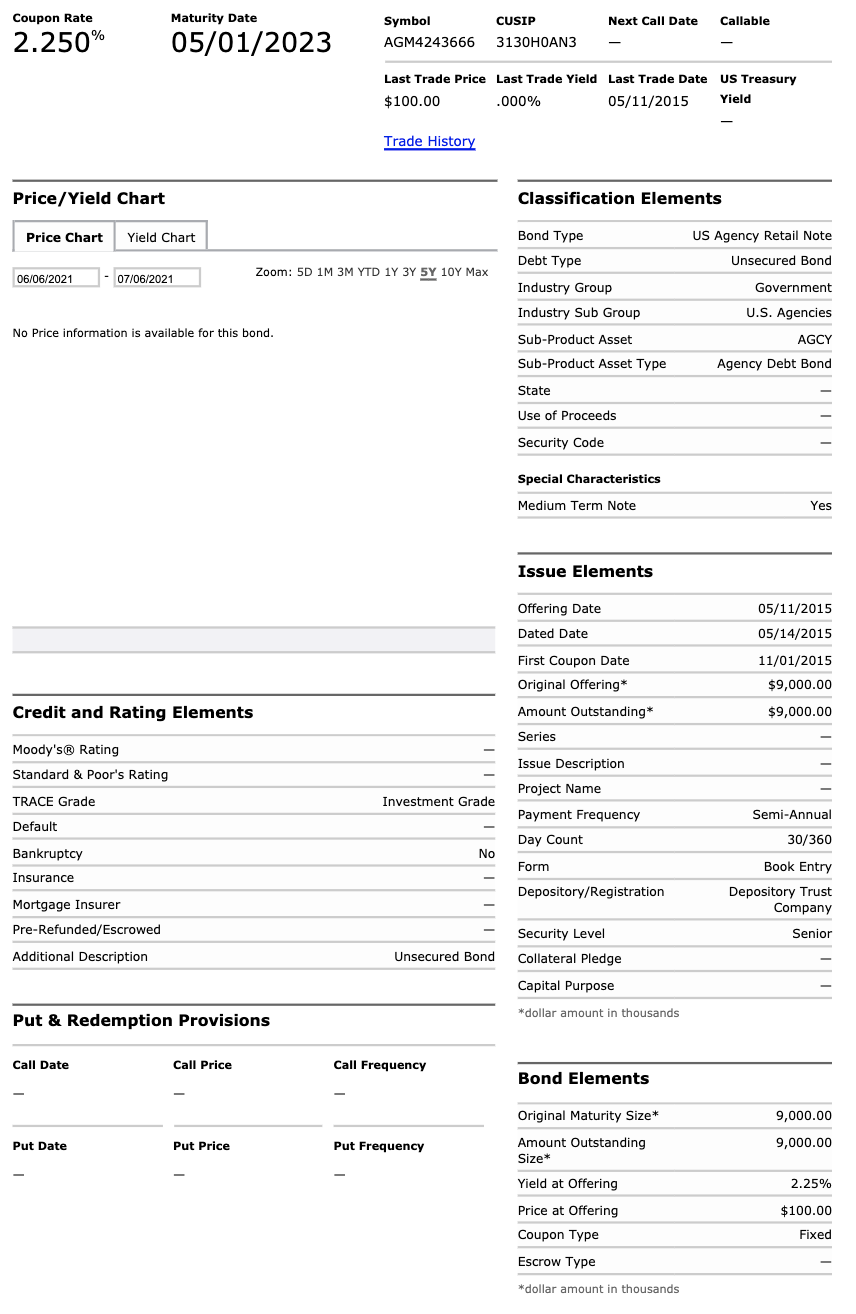

Maturity Date CUSIP Next Call Date Callable Coupon Rate % 2.250% 05/01/2023 Symbol AGM4243666 3130HOAN3 Last Trade Price Last Trade Yield Last Trade Date $100.00 .000% 05/11/2015 US Treasury Yield Trade History Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type US Agency Retail Note Unsecured Bond Debt Type 06/06/2021 07/06/2021 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max Industry Group Industry Sub Group Sub-Product Asset Government U.S. Agencies No Price information is available for this bond. AGCY Sub-Product Asset Type Agency Debt Bond State Use of Proceeds Security Code Special Characteristics Medium Term Note Yes Issue Elements Offering Date 05/11/2015 05/14/2015 Dated Date First Coupon Date Original Offering* Amount Outstanding* 11/01/2015 $9,000.00 Credit and Rating Elements $9,000.00 Series Moody's Rating Standard & Poor's Rating TRACE Grade Investment Grade Issue Description Project Name Payment Frequency Day Count Semi-Annual Default 30/360 Bankruptcy No Form Book Entry Insurance Depository/Registration Depository Trust Company Mortgage Insurer Pre-Refunded/Escrowed Senior Security Level Collateral Pledge Additional Description Unsecured Bond Capital Purpose *dollar amount in thousands Put & Redemption Provisions Call Date Call Price Call Frequency Bond Elements 9,000.00 Original Maturity Size* Amount Outstanding Size* Put Date Put Price Put Frequency 9,000.00 2.25% Yield at Offering Price at Offering Coupon Type $100.00 Fixed Escrow Type *dollar amount in thousands Maturity Date CUSIP Next Call Date Callable Coupon Rate % 2.250% 05/01/2023 Symbol AGM4243666 3130HOAN3 Last Trade Price Last Trade Yield Last Trade Date $100.00 .000% 05/11/2015 US Treasury Yield Trade History Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type US Agency Retail Note Unsecured Bond Debt Type 06/06/2021 07/06/2021 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max Industry Group Industry Sub Group Sub-Product Asset Government U.S. Agencies No Price information is available for this bond. AGCY Sub-Product Asset Type Agency Debt Bond State Use of Proceeds Security Code Special Characteristics Medium Term Note Yes Issue Elements Offering Date 05/11/2015 05/14/2015 Dated Date First Coupon Date Original Offering* Amount Outstanding* 11/01/2015 $9,000.00 Credit and Rating Elements $9,000.00 Series Moody's Rating Standard & Poor's Rating TRACE Grade Investment Grade Issue Description Project Name Payment Frequency Day Count Semi-Annual Default 30/360 Bankruptcy No Form Book Entry Insurance Depository/Registration Depository Trust Company Mortgage Insurer Pre-Refunded/Escrowed Senior Security Level Collateral Pledge Additional Description Unsecured Bond Capital Purpose *dollar amount in thousands Put & Redemption Provisions Call Date Call Price Call Frequency Bond Elements 9,000.00 Original Maturity Size* Amount Outstanding Size* Put Date Put Price Put Frequency 9,000.00 2.25% Yield at Offering Price at Offering Coupon Type $100.00 Fixed Escrow Type *dollar amount in thousands