calculate EVA for real estate and construction

i need help with 13-28

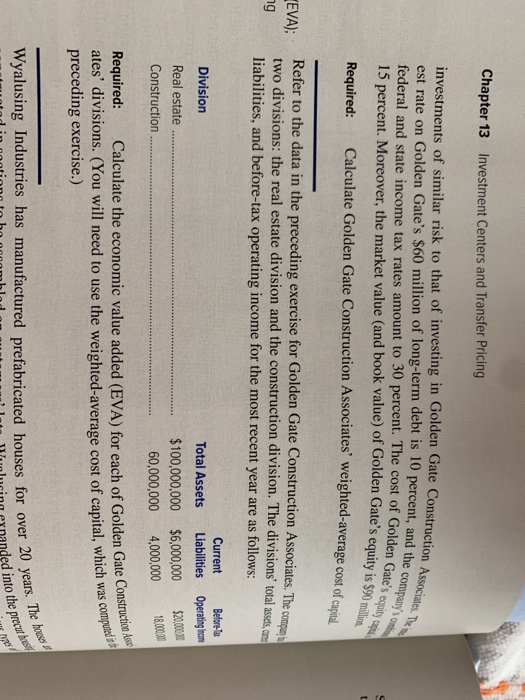

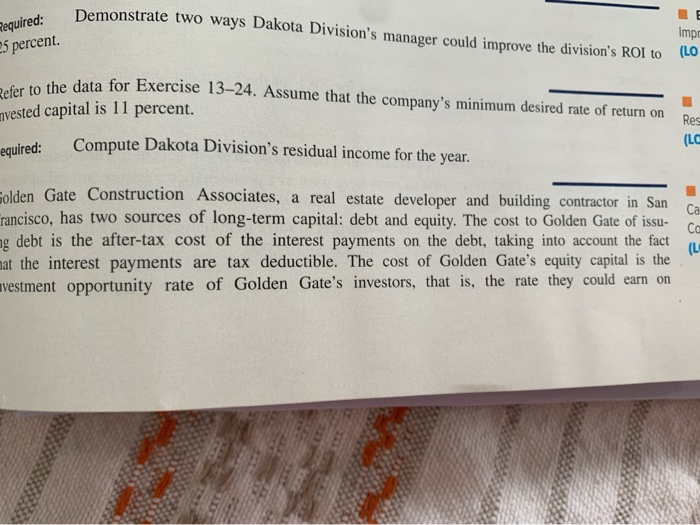

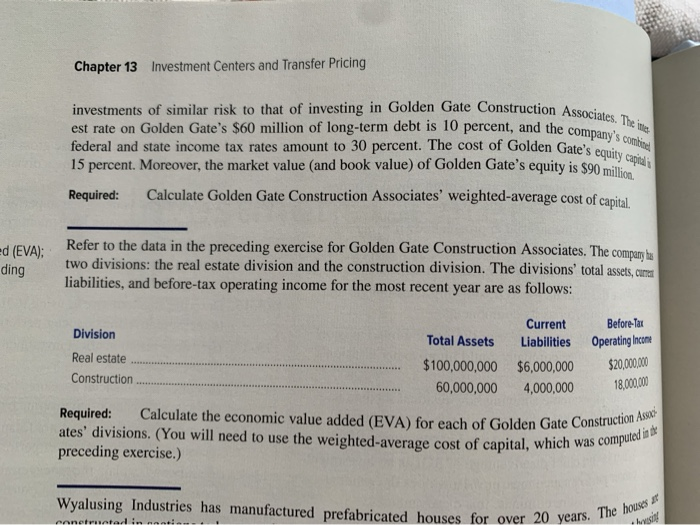

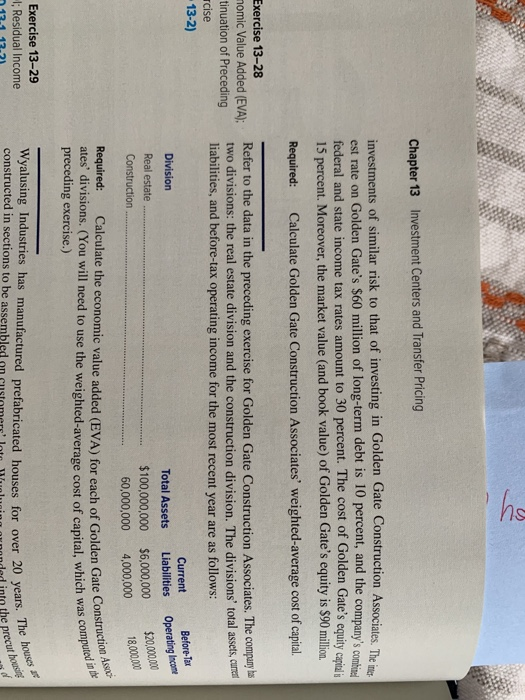

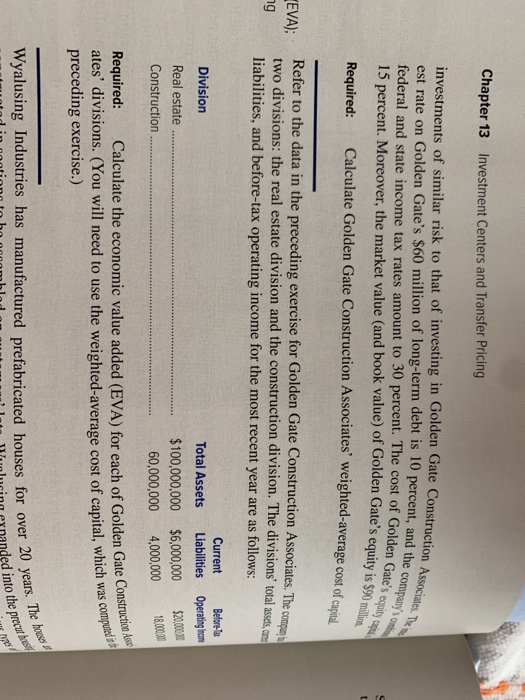

Impo Demonstrate two ways Dakota Division's manager could improve the division's ROI too Demonst Required: 25 percent e data for Exercise 13-24. Assume that the company's minimum desired rate of return on mvested capital is 11 percent. Res cauired: Compute Dakota Division's residual income for the year. Golden Gate Construction Associates, a real estate developer and building contractor in San rancisco, has two sources of long-term capital: debt and equity. The cost to Golden Gate of issu- og debt is the after-tax cost of the interest payments on the debt, taking into account the fact mat the interest payments are tax deductible. The cost of Golden Gate's equity capital is the nvestment opportunity rate of Golden Gate's investors, that is, the rate they could earn on Chapter 13 Investment Centers and Transfer Pricing Associates. The inter od the company's combine en Gate's equity capitais investments of similar risk to that of investing in Golden Gate Construction Associat est rate on Golden Gate's $60 million of long-term debt is 10 percent, and the com federal and state income tax rates amount to 30 percent. The cost of Golden Gate's 15 percent. Moreover, the market value and book value) of Golden Gate's equity is $90 m Required: Calculate Golden Gate Construction Associates' weighted-average cost of capital Ed (EVA): ding Refer to the data in the preceding exercise for Golden Gate Construction Associates. The company ha! two divisions: the real estate division and the construction division. The divisions' total assets, comme liabilities, and before-tax operating income for the most recent year are as follows: Division Real estate Construction Total Assets $100,000,000 60,000,000 Current Liabilities $6,000,000 4,000,000 Before-Tat Operating Income $20,000,000 18,000,000 Required: Calculate the economic value added (EVA) for each of Golden Gate Construc ates' divisions. (You will need to use the weighted average cost of capital, which wa preceding exercise.) vate Construction Assoc "pital, which was computed in Wyalusing Industries has manufactured prefabricated houses for over 20 years." concreted in anti- 20 years. The houses of + Refer to the preceding exercise. livestment for Demonstrate two ways Dakota Division's manager could improve the division's ROI toll Demons Required: 25 percent. he data for Exercise 13-24. Assume that the company's minimum desired rate of return on Refer to the data for Exe invested capital is 11 percent. uired: Compute Dakota Division's residual income for the year. Golden Gate Construction Associates, a real estate developer and building contractor in San Francisco, has two sources of long-term capital: debt and equity. The cost to Golden Gate of issu- ing debt is the after-tax cost of the interest payments on the debt, taking into account the fact that the interest payments are tax deductible. The cost of Golden Gate's equity capital is the investment opportunity rate of Golden Gate's investors, that is, the rate they could earn on Chapter 13 Investment Centers and Transfer Pricing investments of similar risk to that of investing in Golden Gate Construction Associates. The est rate on Golden Gate's $60 million of long-term debt is 10 percent, and the company's combine federal and state income tax rates amount to 30 percent. The cost of Golden Gate's equity capitalis 15 percent. Moreover, the market value (and book value) of Golden Gate's equity is $90 million. Required: Calculate Golden Gate Construction Associates' weighted-average cost of capital. Exercise 13-28 nomic Value Added (EVA); tinuation of Preceding rcise 13-2) Refer to the data in the preceding exercise for Golden Gate Construction Associates. The company has two divisions: the real estate division and the construction division. The divisions' total assets, cum liabilities, and before-tax operating income for the most recent year are as follows: Division Current Liabilities $6,000,000 4,000,000 Total Assets $100,000,000 60,000,000 Before-Tex Operating Income $20,000,000 Real estate Construction .... 18,000,000 Required: Calculate the economic value added (EVA) for each of Golden Gate Cons! ates' divisions. (You will need to use the weighted average cost of capital, which was preceding exercise.) e Construction Assos which was computed in the Exercise 13-29 ; Residual Income Wyalusing Industries has manufactured prefabricated houses for over 20 years constructed in sections to be assembled on customer lote Wunluaina awnnnded into me years. The houses 13.1 13.21 precur housin 19