Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate Fair Market Value, Income from Sub, and Investment based on Problem 6-3 REQUIRED: Prepare a consolidation workpaper for Pal Corporation and Subsidiary for the

Calculate Fair Market Value, Income from Sub, and Investment based on Problem 6-3

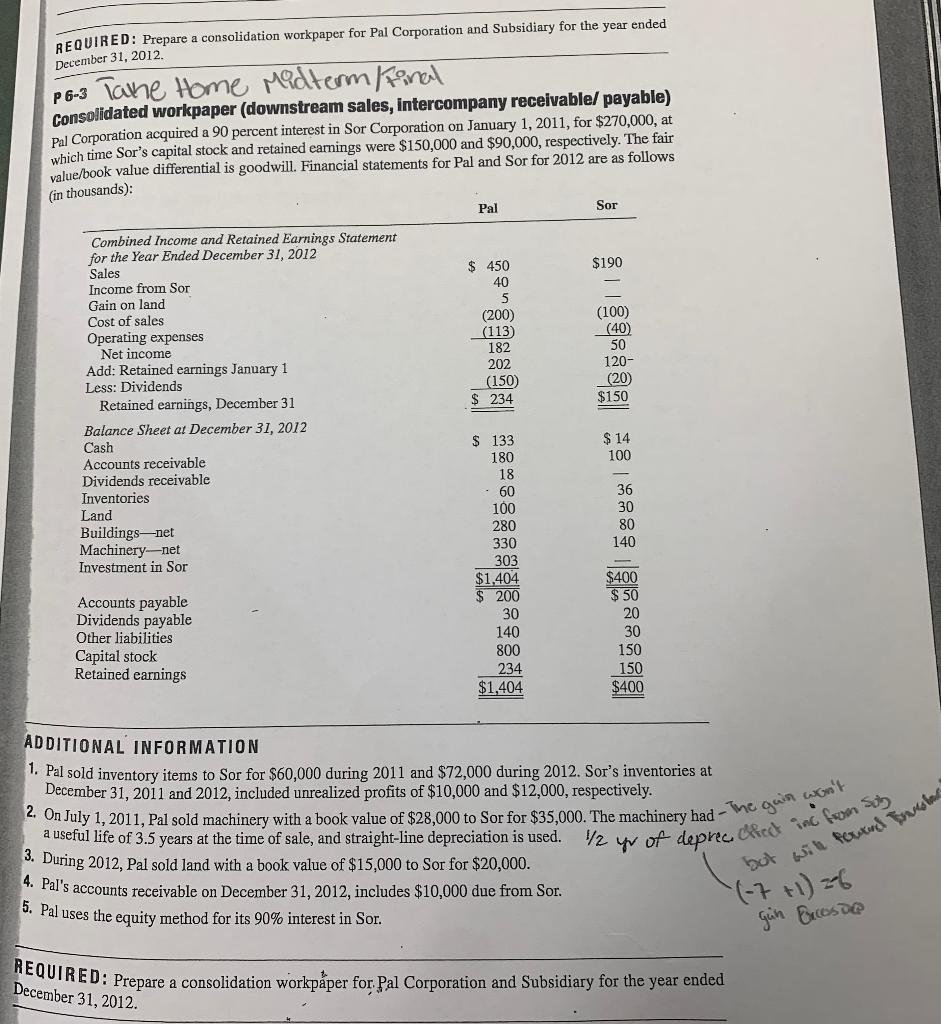

REQUIRED: Prepare a consolidation workpaper for Pal Corporation and Subsidiary for the year ended December 31,2012 p6-3 Take Home midterm/final consolidated workpaper (downstream sales, intercompany receivable/ payable) Pal Corporation acquired a 90 percent interest in Sor Corporation on January 1,2011 , for $270,000, at which time Sor's capital stock and retained earnings were $150,000 and $90,000, respectively. The fair valuelbook value differential is goodwill. Financial statements for Pal and Sor for 2012 are as follows (in thousands): ADDITIONAL INFORMATION 1. Pal sold inventory items to Sor for $60,000 during 2011 and $72,000 during 2012. Sor's inventories at a useful life of 3.5 years at the time of sale, and straight-line depreciation is used. 1/2 yr of deprec ctice 3. During 2012, Pal sold land with a book value of $15,000 to Sor for $20,000. December 31,2011 and 2012, included unrealized profits of $10,000 and $12,000, respectively. 2. On July 1,2011 , Pal sold machinery with a book value of $28,000 to Sor for $35,000. The machinery had 4. Pal's accounts receivable on December 31,2012 , includes $10,000 due from Sor. 5. Pal uses the equity method for its 90% interest in Sor. botwich(7+1)=6ginfrcosoe REQUIRED: Prepare a consolidation workpper for, Pal Corporation and Subsidiary for the year ended December 31, 2012. Calculate 63 Fair Market Value Income from Sub InvestmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started