Answered step by step

Verified Expert Solution

Question

1 Approved Answer

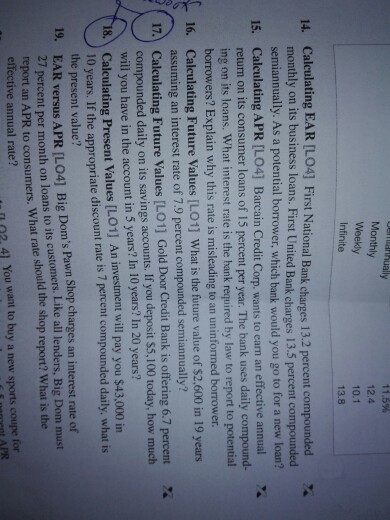

calculate future value and present value of exercise 17 and 18 Monthly Weekly Infinite 11.5% 12.4 10.1 13.8 Calculating EAR [L04] First National Bank charges

calculate future value

and present value of exercise 17 and 18

Monthly Weekly Infinite 11.5% 12.4 10.1 13.8 Calculating EAR [L04] First National Bank charges 13.2 percent compounded monthly on its business loans. First United Bank charges 13.5 percent compounded semiannually. As a potential borrower, which bank would you go to for a new loan? Calculating APR [L04] Barcan Credit Corp. wants to earn an effective annual return on its consumer loans of 15 percent per year. The bank uses daily compound- ing on its loans. What interest rate is the hank required by law to report to potential borrowers? Explain why this rate is misleading to an uninformed borrower Caleulating Future Values [L01] What is the future value of S2.600 in 19 years assuming an interest rate of 7.9 percent compounded semiannually? 14. % is. 16. Calculating Future Values [LO1] What is the fut 16. 17. Calculating Future Values [LO1] Gold Door Credit Bank is offering 6.7 percent 2 compounded daily on its savings accounts. If you deposit SS, 100 today, how much will you have in the account in 5 years? In 10 years? In 20 years? 8. Calculating Present Values [LO1] An investment will pay you $43,000 in 10 years. If the appropriate discount rate is 7 percent compounded daily, what is the present value? 7 percent per month on loans to its customers. Like all lenders, Big Dom report an APR to consumers. What rate should the shop report? What is the effective annual rate? 19. EAR versus R versus APR [LO4] Big Dom's Pawn Shop charges an interest rate of Like all lenders, Big Dom must n2, 41 You want to buy a new sports coupe for at APRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started