Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate FY 2022 Federal Income Taxes for Allen-Baxter Corporation. Remember, currently, the corporate income tax rate on taxable income for 2022 is a federal flat

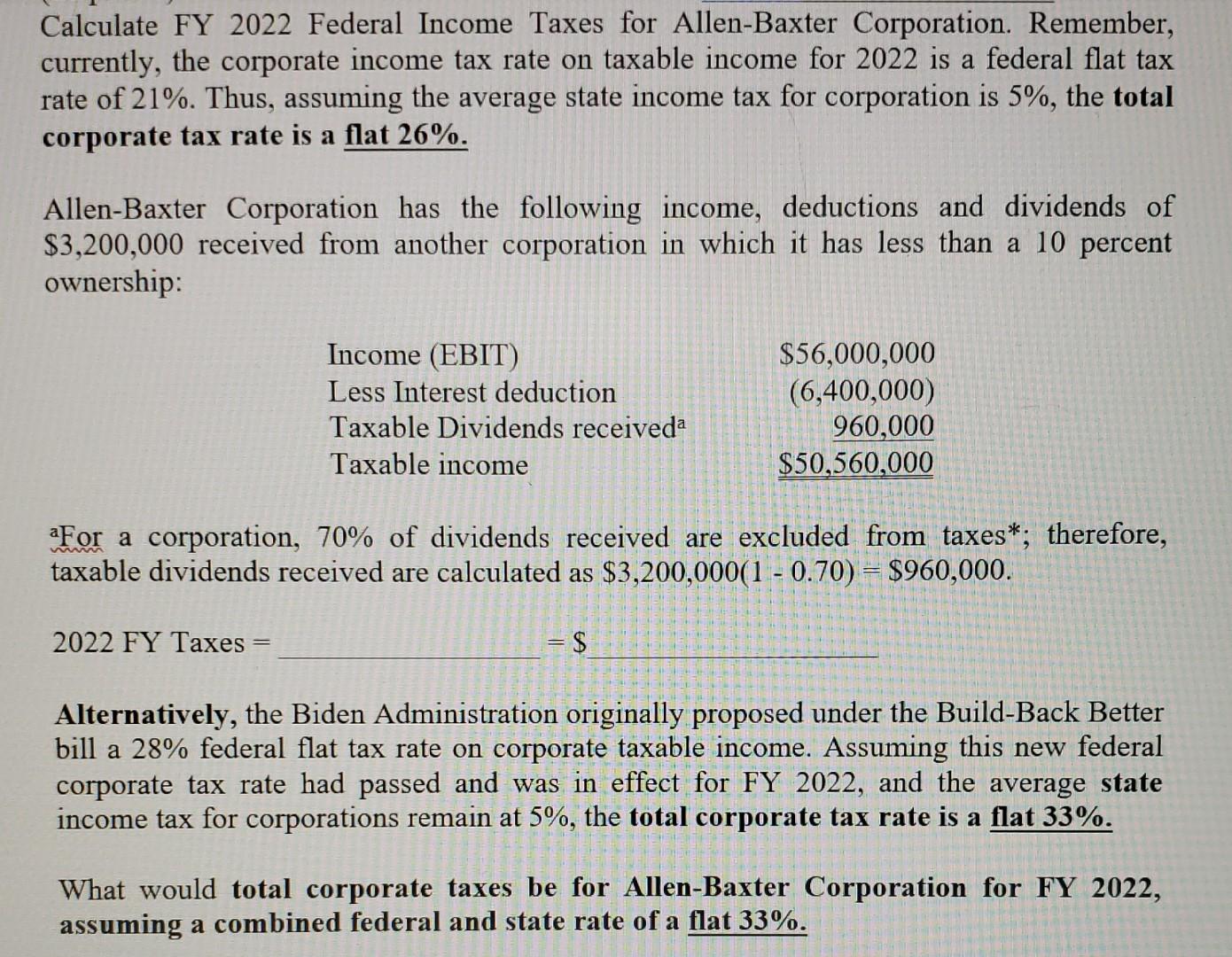

Calculate FY 2022 Federal Income Taxes for Allen-Baxter Corporation. Remember, currently, the corporate income tax rate on taxable income for 2022 is a federal flat tax rate of 21%. Thus, assuming the average state income tax for corporation is 5%, the total corporate tax rate is a flat 26%. Allen-Baxter Corporation has the following income, deductions and dividends of $3,200,000 received from another corporation in which it has less than a 10 percent ownership: Income (EBIT) Less Interest deduction Taxable Dividends receiveda Taxable income $56,000,000 (6,400,000) 960,000 $50,560,000 For a corporation, 70% of dividends received are excluded from taxes*; therefore, taxable dividends received are calculated as $3,200,000(1 - 0.70) = $960,000. - 2022 FY Taxes -$ Alternatively, the Biden Administration originally proposed under the Build-Back Better bill a 28% federal flat tax rate on corporate taxable income. Assuming this new federal corporate tax rate had passed and was in effect for FY 2022, and the average state income tax for corporations remain at 5%, the total corporate tax rate is a flat 33%. What would total corporate taxes be for Allen-Baxter Corporation for FY 2022, assuming a combined federal and state rate of a flat 33%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started