Answered step by step

Verified Expert Solution

Question

1 Approved Answer

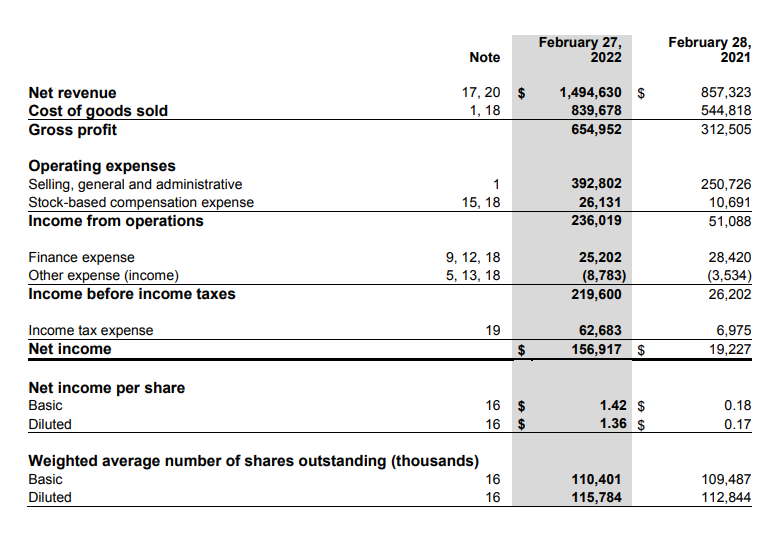

calculate Interest Coverage (EBIT/ Interest expense) with the given information Net revenue Cost of goods sold Gross profit Operating expenses February 27, February 28, Note

calculate Interest Coverage (EBIT/ Interest expense) with the given information

Net revenue Cost of goods sold Gross profit Operating expenses February 27, February 28, Note 2022 2021 17,20 $ 1,18 1,494,630 $ 857,323 839,678 544,818 654,952 312,505 Selling, general and administrative 392,802 250,726 Stock-based compensation expense 15, 18 26,131 10,691 Income from operations 236,019 51,088 Finance expense 9, 12, 18 25,202 28,420 Other expense (income) 5, 13, 18 (8,783) (3,534) Income before income taxes 219,600 26,202 Income tax expense 19 62,683 6,975 Net income $ 156,917 $ 19,227 Net income per share Basic 16 $ 1.42 $ 0.18 Diluted 16 $ 1.36 $ 0.17 Weighted average number of shares outstanding (thousands) Basic Diluted 166 16 16 110,401 115,784 109,487 112,844

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the Interest Coverage ratio we need to find the EBIT Earnings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e9a5d7809d_954111.pdf

180 KBs PDF File

663e9a5d7809d_954111.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started